Trading Recommendations for the Cryptocurrency Market on November 11

Crypto-currencies

2024-11-11 08:26:37

On Sunday evening, Bitcoin surpassed $81,000, continuing its record rally for the sixth consecutive day. Since Donald Trump's victory, the cryptocurrency market has yet to show a single day of correction.

According to recent data, BTC has risen by 5.6% over the last 24 hours, with trading volumes reaching nearly $100 billion. Weekend bumps are typically considered bullish in the cryptocurrency market, as trading volumes decrease when many institutional investors and professional traders are less active.

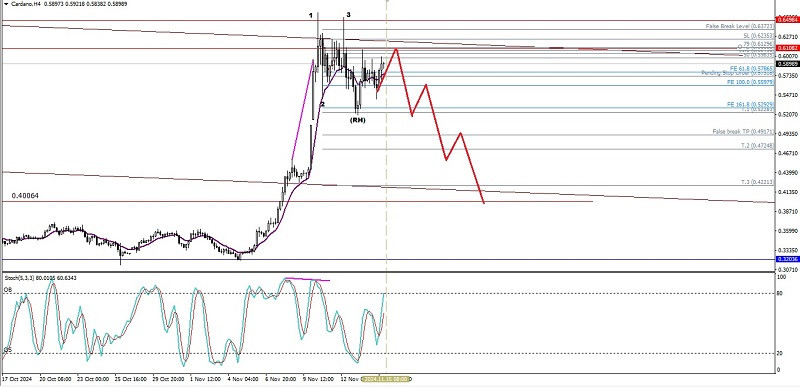

Dogecoin (DOGE) and Shiba Inu (SHIB) led the altcoins, increasing their prices by as much as 30%. Other major cryptocurrencies took a breather after Friday's rally. Ethereum (ETH), BNB, and XRP rose by less than 4%, while Cardano's ADA posted a 35% increase. The broader CoinDesk 20 Index (CD20), tracking the largest tokens by market capitalization, rose by 4.5% over the last 24 hours.

As I mentioned, the cryptocurrency market's rally began following the election of pro-crypto Republican Donald Trump as the US President. Additionally, last Thursday, the Federal Reserve reduced interest rates.

US Bitcoin-based exchange-traded funds (ETFs) recorded net inflows of over $1.3 billion late last week, surpassing the March record of $1.1 billion.

As for the intraday strategy on the cryptocurrency market, I plan to leverage significant pullbacks in Bitcoin and Ethereum, aiming for sustained growth in the ongoing bull market over the medium term.

For short-term trading, the strategy and conditions are detailed below.

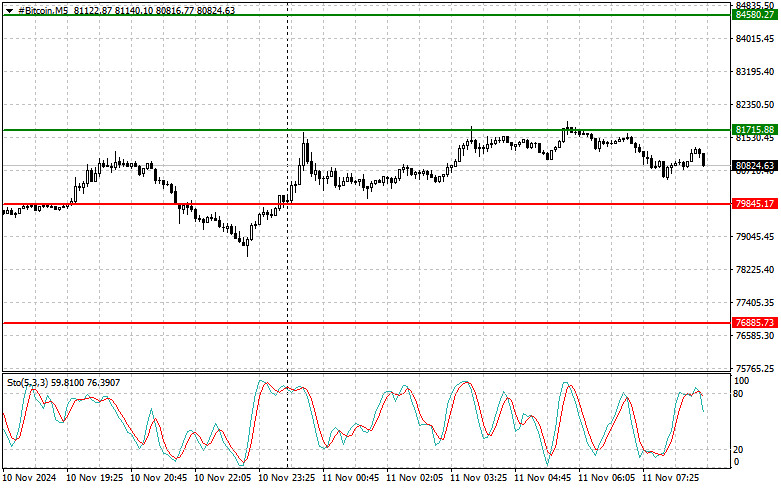

Bitcoin

Buy scenario

I will buy Bitcoin today when the entry point is around $81,715, with a growth target of $84,580. At $84,580, I will exit from buying and sell immediately on the rebound. Before buying on a breakout, it is best to ensure that the Stochastic indicator is near the lower boundary, around the 20 level.

Sell Scenario

I will sell Bitcoin today when I reach the entry point near $79,845, with the aim of falling to $76,885. At $76,885, I will exit from selling and buy immediately on the rebound. Before selling on a breakout, ensure the Stochastic indicator is at the upper boundary, near the 80 level.

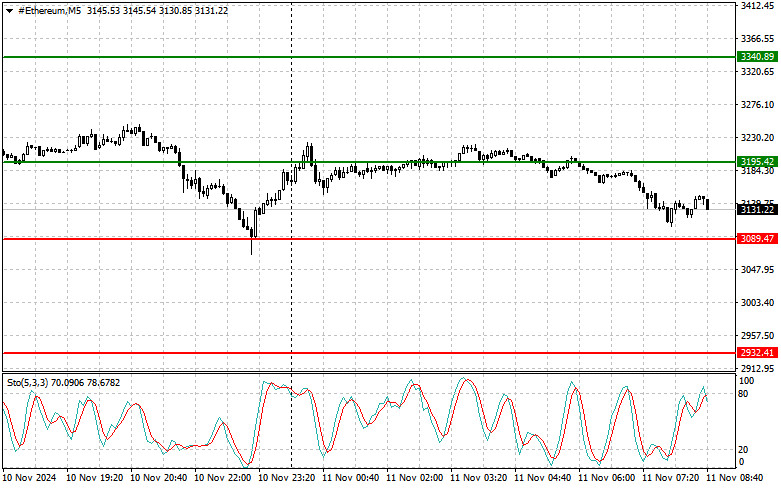

Ethereum

Buy scenario

I will buy Ether today when I reach the entry point at $3195 with a growth target of $3340. At $3340, I will exit from buying and sell immediately on the rebound. Before buying on a breakout, ensure the Stochastic indicator is near the lower boundary, around the 20 level.

Sell Scenario

I will sell Ether today when I reach the entry point near $3089 with a downside target of $2932. At the $2932 area, I will exit selling and buy immediately on the rebound. Before selling on a breakout, make sure that the Stochastic indicator is at the upper boundary, near the 80 level.

Смотрите также