Trading Recommendations for the Cryptocurrency Market on March 27

Crypto-currencies

2025-03-27 07:06:54

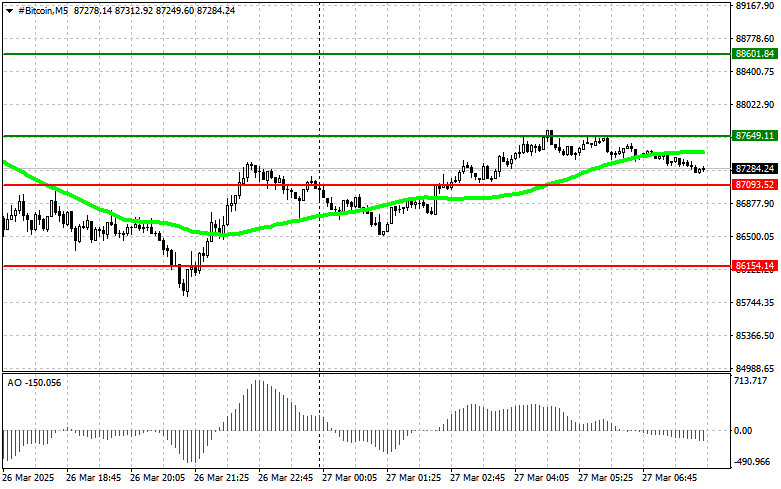

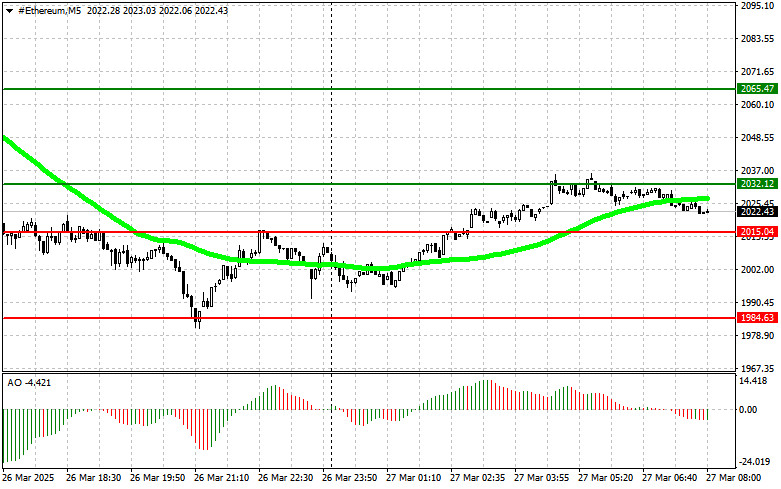

Bitcoin and Ethereum are facing challenges in maintaining their upward momentum. However, this appears to be more of a reaction to Donald Trump's latest political statements—which have led to a decline in demand for risk assets—rather than anything serious enough to reintroduce panic or bearish sentiment into the market. Yesterday, Bitcoin rebounded after dropping to $86,100 and is now trading around $87,200. Ethereum has also recovered after hitting a low of nearly $1,984 and is currently trading at $2,022.

In the meantime, Ethereum has fairly good prospects for growth. This is primarily tied to the Pectra upgrade, which has now been deployed on the Hoodi testnet as part of Ethereum's methodical update approach. This step is potentially the final scheduled test before the mainnet rollout expected in Q2 of this year. For context, Hoodi is a newly launched testnet by the Ethereum developers (on March 17) created specifically to finalize Pectra testing after previous attempts on the Holesky and Sepolia testnets encountered issues and failed.

The developers reported that Hoodi successfully executed the Pectra fork and completed its work approximately 30 minutes after activation, bringing Ethereum one step closer to mainnet implementation. If the update is rolled out, demand for ETH may increase significantly. The Pectra upgrade is expected to deliver major improvements in scalability, security, and functionality, which could boost interest from both institutional and retail investors. Notably, Pectra includes several Ethereum Improvement Proposals (EIPs) aimed at optimizing the Ethereum Virtual Machine (EVM), reducing gas fees, and enhancing overall network efficiency. These changes are likely to make Ethereum a more attractive platform for developers and users of decentralized applications (dApps).

As for intraday strategy in the crypto market, I will continue to rely on major dips in Bitcoin and Ethereum, anticipating the continuation of the bull market's development in the medium term, which remains intact.

For short-term trading, the strategy and conditions are outlined below.

Bitcoin

Buy Scenario

Scenario #1: Buy BTC today at the $87,700 entry point with a target of $88,600. Exit longs at $88,600 and sell immediately on the rebound. Important: Before buying a breakout, confirm that the 50-day moving average is below the current price and the Awesome Oscillator is in positive territory.

Scenario #2: Buy BTC from the lower boundary at $87,000 if there is no market reaction to a breakout below, with targets at $87,700 and $88,600.

Sell Scenario

Scenario #1: Sell BTC today at the $87,000 entry point with a target of $86,100. Exit shorts at $86,100 and buy immediately on the rebound. Important: Before selling a breakout, confirm that the 50-day moving average is above the current price and the Awesome Oscillator is in negative territory.

Scenario #2: Sell BTC from the upper boundary at $87,700 if there is no market reaction to a breakout above, targeting $87,000 and $86,100.

Ethereum

Buy Scenario

Scenario #1: Buy ETH today at the $2,032 entry point with a target of $2,065. Exit longs at $2,065 and sell immediately on the rebound. Important: Before buying a breakout, confirm that the 50-day moving average is below the current price and the Awesome Oscillator is in positive territory.

Scenario #2: Buy ETH from the lower boundary at $2,015 if there is no market reaction to a breakout below, with targets at $2,032 and $2,065.

Sell Scenario

Scenario #1: Sell ETH today at the $2,015 entry point with a target of $1,984. Exit shorts at $1,984 and buy immediately on the rebound. Important: Before selling a breakout, confirm that the 50-day moving average is above the current price and the Awesome Oscillator is in negative territory.

Scenario #2: Sell ETH from the upper boundary at $2,032 if there is no market reaction to a breakout above, targeting $2,015 and $1,984.

Смотрите также