BTC/USD Analysis. March 27th. Bitcoin lacks growth potential

Crypto-currencies

2025-03-27 07:31:30

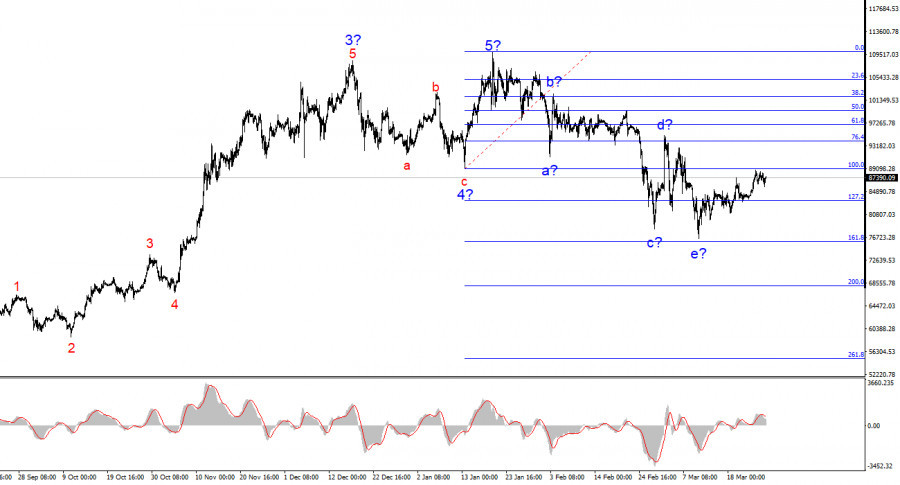

The wave structure on the 4-hour chart of BTC/USD is quite clear. After completing a bullish trend composed of five full waves, a corrective downward phase has begun, currently taking the form of a correction. Based on this, I did not expect, and still do not expect, Bitcoin to rise above $110,000–$115,000 in the coming months.

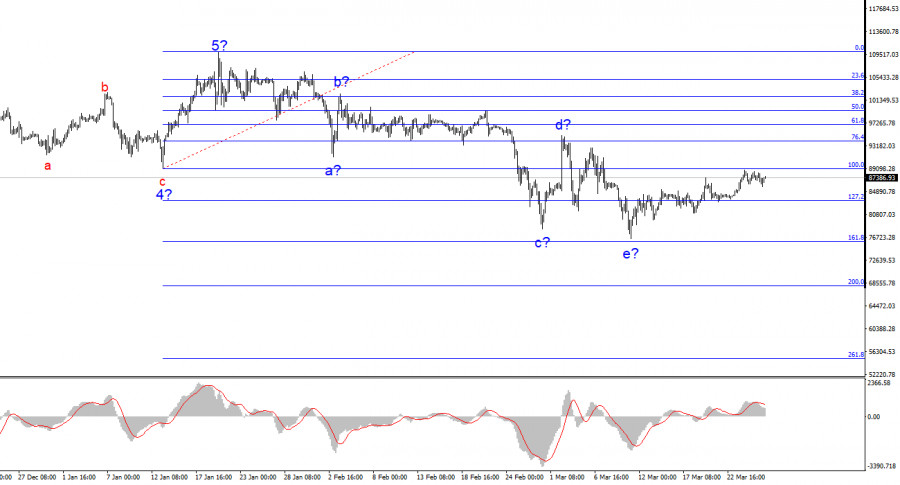

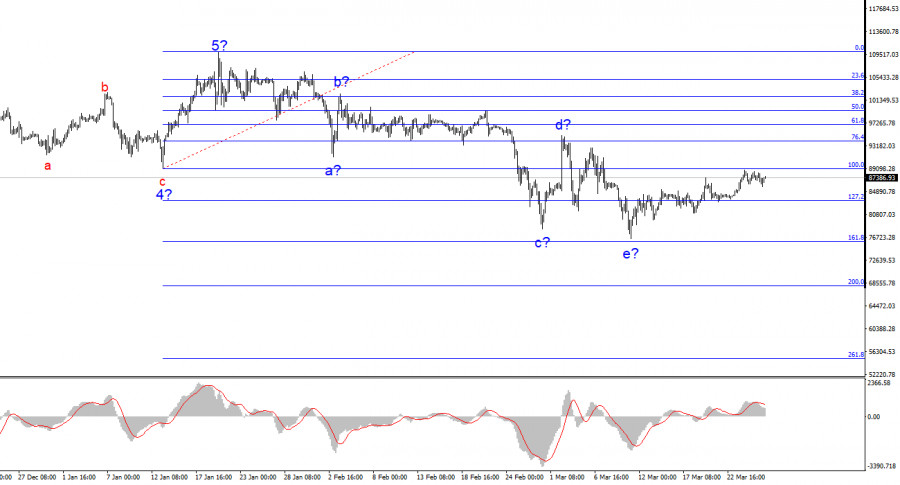

The news background had supported Bitcoin's growth thanks to continuous reports of new investments from institutional traders, governments of certain countries, and even pension funds. However, Trump and his policies have driven investors out of the market, and a trend cannot remain bullish indefinitely. The wave that began on January 20 does not resemble an impulsive wave. Therefore, we are likely dealing with a complex corrective structure that could unfold over several months. Within this initial wave, the structure is very complex, but the five-wave pattern a-b-c-d-e can be identified rather clearly. If the current wave structure is correct, then an upward corrective wave is now forming, which may classically consist of three waves.

The BTC/USD rate has managed to stabilize, and the wave structure now implies potential growth. But how strong could this rally realistically be? Many market participants begin to panic when Bitcoin drops $10,000 or $15,000. However, in my view, such a move is minor for a super-volatile asset like Bitcoin—this range can be covered in just a few days. From its all-time high, Bitcoin has already declined by $33,000. Even such a correction doesn't seem strong or deep enough to justify expecting a new bullish trend. Therefore, I anticipate the formation of a corrective wave or a series of waves, after which the broader corrective structure will likely continue to develop.

Currently, there is a lot of talk in the market about interest in Bitcoin from institutional investors and even the U.S. government. But let me remind you that interest in Bitcoin has been growing for years, and that has never stopped it from falling by tens of thousands of dollars during downtrends. I believe large players are using Bitcoin exactly as they should—to make a profit. Consequently, after an uptrend concludes, market participants begin taking profits. Prices fall, offering future opportunities to buy Bitcoin at lower levels. Nobody buys near all-time highs (except MicroStrategy).

Final conclusions

Based on the BTC/USD analysis, I conclude that the current growth phase has ended. Everything points toward a complex, multi-month correction ahead. This is why I've previously advised against buying cryptocurrencies—and now even more so. A drop in Bitcoin below the low of wave 4 indicates a transition to a bearish trend segment, likely corrective. Therefore, I believe the best course of action is to look for selling opportunities. A short-term corrective upward wave may develop soon, during which new selling opportunities can be considered, with targets around $68,000 and potentially down to $55,000.

On the higher wave scale, a five-wave bullish structure is visible. A corrective or full-fledged bearish trend structure is now forming.

Core Principles of My Analysis:

- Wave structures should be simple and clear. Complex formations are difficult to trade and often evolve unexpectedly.

- If you're unsure about the market situation, it's better to stay out.

- There is never 100% certainty about the direction. Always use protective Stop Loss orders.

- Wave analysis can be combined with other forms of analysis and trading strategies.

Смотрите также