EUR/USD Analysis on June 2, 2025

Wave analysis

2025-06-02 17:07:54

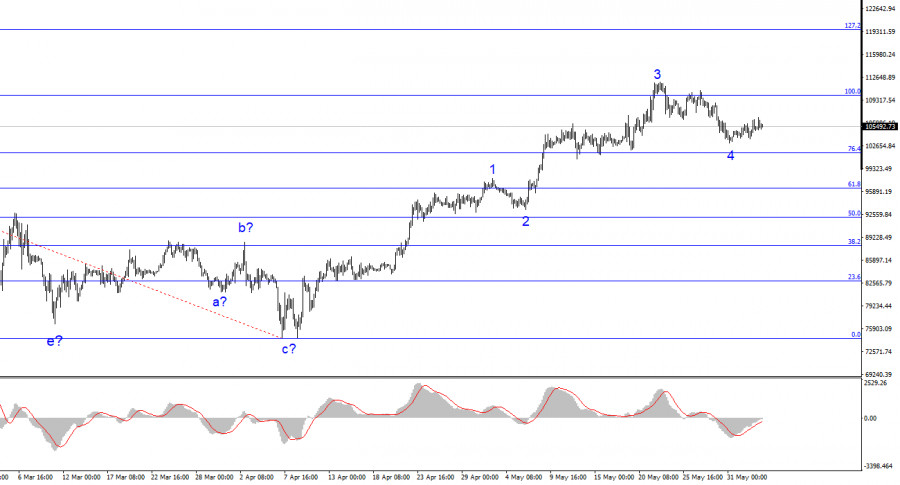

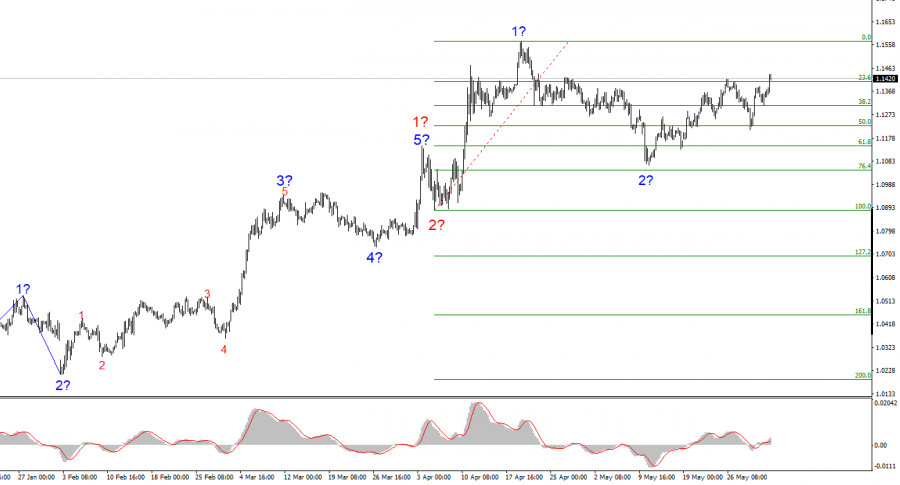

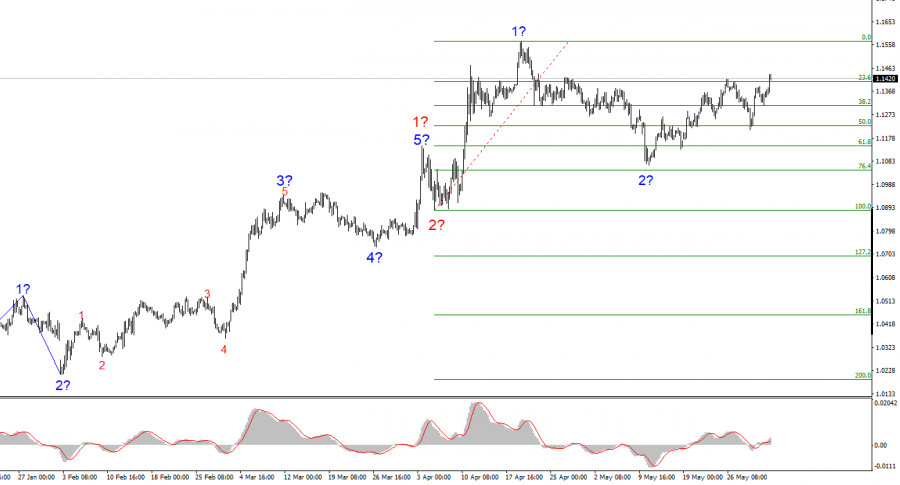

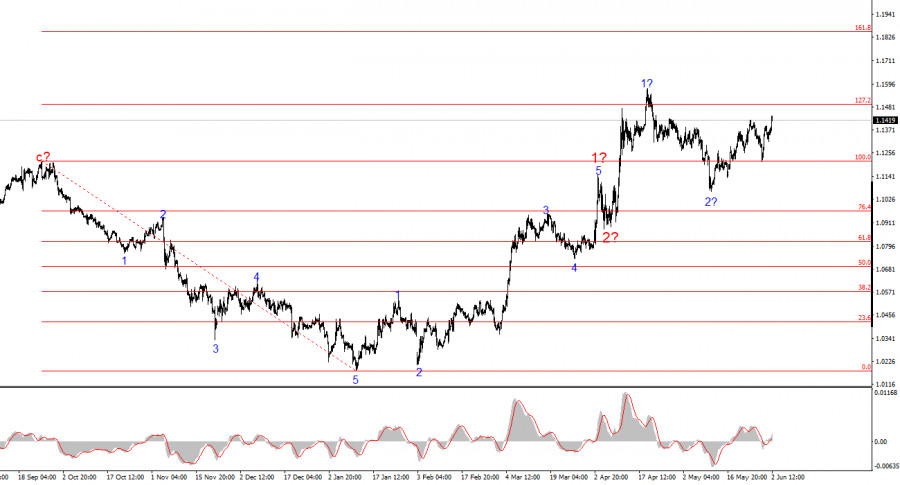

The wave structure on the 4-hour chart for EUR/USD has transformed into a bullish formation and continues to hold that shape. I believe there is no doubt that this transformation occurred solely due to the new U.S. trade policy. Before February 28, when the sharp decline of the U.S. dollar began, the wave structure appeared as a convincing downward trend segment. A corrective wave 2 was forming. However, Trump's weekly announcements about various tariffs did their job. Demand for the U.S. dollar began to plummet, and the entire trend segment that began on January 13 has now taken on an impulsive bullish form.

Currently, wave 2 within wave 3 is presumably complete. If this assumption is correct, price growth should continue over the coming weeks and months. However, the U.S. dollar will likely remain under pressure unless Donald Trump completely reverses his trade policy — a scenario that seems highly unlikely given recent events. At the moment, there are no reasons to expect strong growth for the U.S. currency.

The EUR/USD exchange rate rose by 70 basis points on Monday even before the U.S. session started. There was plenty of news encouraging new dollar sell-offs. This "new saga" began last Thursday when the Federal Appeals Court overturned the decision of the International Trade Court that had annulled almost all tariffs imposed by Donald Trump. Thus, hopes for a sharp de-escalation of the trade conflict lasted no more than one day. Thursday clearly demonstrated that even explicit laws outlining presidential powers are not being enforced consistently. Interestingly, the Appeals Court has yet to explain its rationale. On what basis did it overturn the Trade Court's decision, which was based solely on current legislation? How can two different courts interpret the same law differently? Trump's team didn't even have time to reframe its position or present new evidence and arguments. One court canceled the tariffs, and the second one canceled the cancellation.

Therefore, it's no surprise that demand for the U.S. dollar is falling again. This morning, Germany and the Eurozone also released manufacturing PMI reports, none of which impressed. Germany's index fell from 48.4 to 48.3 points, and although the Eurozone's index rose slightly, the market had been expecting a rise anyway.

General Conclusions

Based on the conducted analysis of EUR/USD, I conclude that the pair continues constructing an upward trend segment. In the near future, the wave pattern will entirely depend on the news background, particularly related to Trump's decisions and U.S. foreign policy. The construction of wave 3 of the upward trend segment has begun, and its targets could extend to the 1.2500 area. Therefore, I am considering buying with targets above 1.1572, corresponding to 423.6% Fibonacci levels. It's important to remember that a de-escalation of the trade war could reverse the uptrend, but at the moment, there are no signs of reversal or de-escalation.

On the higher wave scale, the wave pattern has shifted to a bullish outlook. We are likely facing a long-term series of rising waves, though news from Donald Trump could once again turn everything upside down.

Key Principles of My Analysis:

- Wave structures should be simple and clear. Complex structures are difficult to trade and often subject to frequent changes.

- If there is uncertainty about the market situation, it is better to stay out.

- Absolute certainty about the direction of movement never exists. Always use protective Stop Loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.

Смотрите также