analytics1_1

Weekly Forecast Based on Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, NZD/USD, and GOLD as of June 30th

Weekly Forecast Based on Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, NZD/USD, and GOLD as of June 30th

Wave analysis

2025-06-30 08:57:27

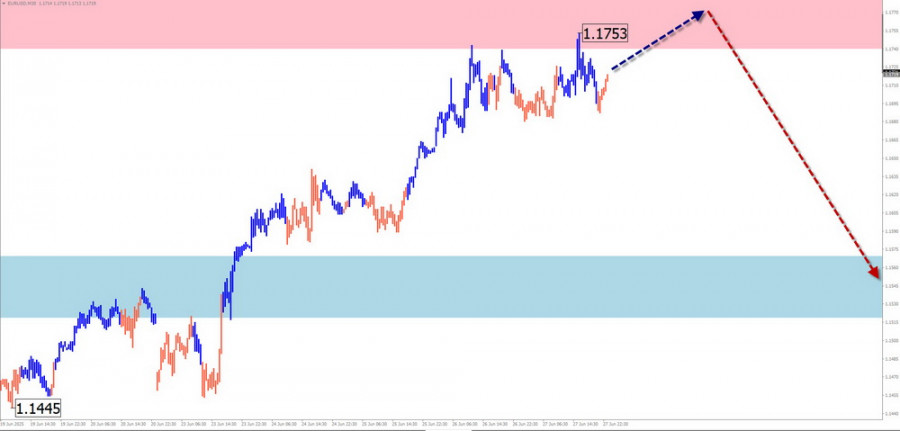

EUR/USD

Analysis:

Since February of this year, the price movement of the euro has followed an upward wave algorithm. Since mid-April, a hidden correction has been forming within the structure. Trendlines drawn through the extremes form a "horizontal pennant" figure, which remains incomplete. The price has reached the lower boundary of a strong potential reversal zone.

Forecast:

In the coming days, a continuation of the sideways flat movement is expected. Near the resistance zone, a reversal setup is likely. A new downward vector is expected to begin by week's end.

Potential Reversal Zones

- Resistance: 1.1740 / 1.1790

- Support: 1.1570 / 1.1520

Recommendations:

- Buying: Possible in reduced volume during individual sessions, with a target no higher than the resistance zone.

- Selling: Recommended once your trading system confirms reversal signals.

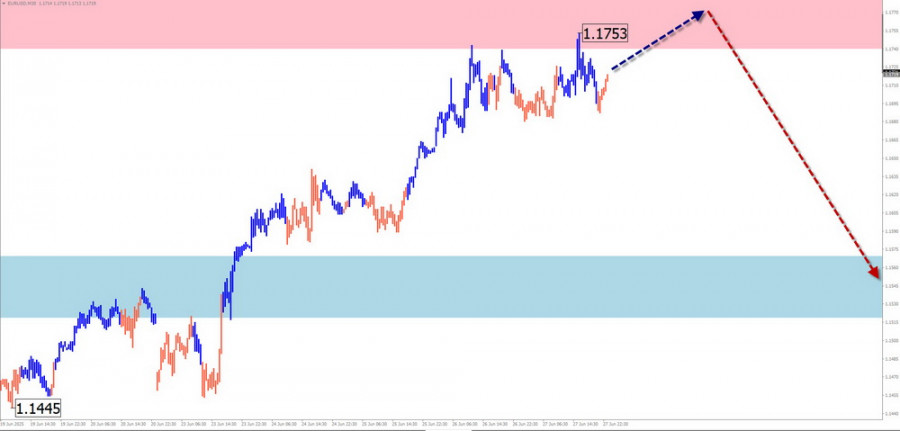

USD/JPY

Analysis:

Since December last year, USD/JPY has followed a dominant downward wave, which remains incomplete. In the past month, the final part (wave C) has begun to form. The wave is developing in a sideways formation.

Forecast:

Sideways movement is expected to continue throughout the week. A brief decline early in the week cannot be ruled out, but it is likely to stay within support boundaries. In the second half of the week, the probability of a trend reversal and price increase toward the resistance zone increases.

Potential Reversal Zones

- Resistance: 147.00 / 147.50

- Support: 143.70 / 143.20

Recommendations:

- Selling: High risk, may result in losses.

- Buying: May be the primary strategy in the coming days; use smaller volume sizes for safety.

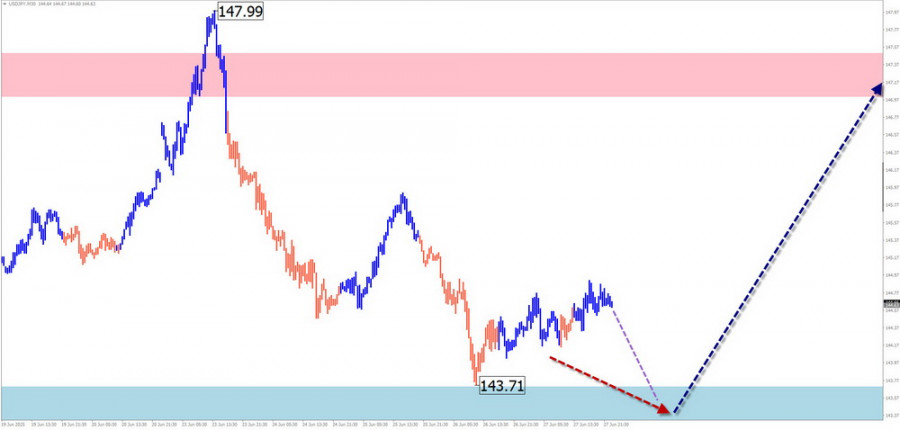

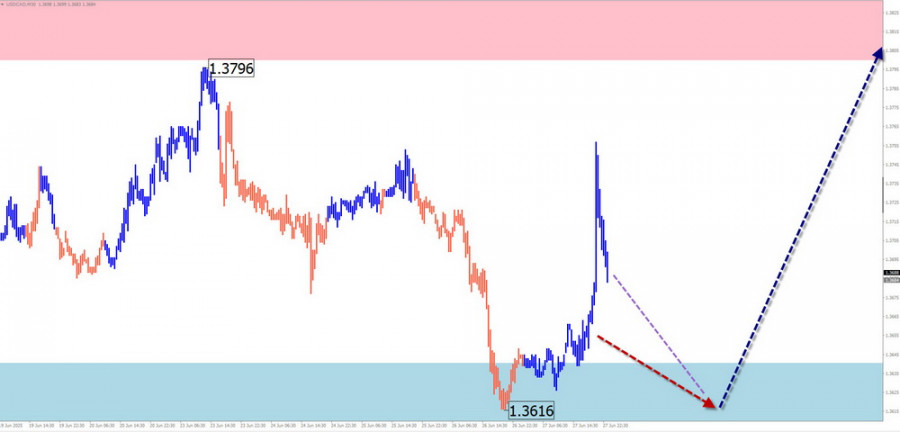

GBP/JPY

Analysis:

Since April, GBP/JPY has been moving within an upward wave. Prices are approaching the lower boundary of a major potential reversal zone on the weekly timeframe. The structure analysis indicates it is still incomplete.

Forecast:

The upward trend is expected to continue during the week, potentially reaching the resistance zone. Sideways movement or a brief decline within the support level is possible in the near term. Increased activity is anticipated toward the end of the week.

Potential Reversal Zones

- Resistance: 200.00 / 200.50

- Support: 197.50 / 197.00

Recommendations:

- Buying: May be used with fractional volume sizes during individual sessions; target limited to resistance.

- Selling: Premature until confirmed reversal signals appear near resistance.

USD/CAD

Analysis:

The downward wave that formed on the USD/CAD chart this year has been followed by a corrective move since late May. The pair is largely confined to a sideways price channel. The current wave structure remains incomplete, lacking its final segment.

Forecast:

The pair may decline further in the coming days, reaching the support zone. A reversal and upward movement from support may follow. The resistance zone reflects the upper boundary of the pair's expected weekly volatility.

Potential Reversal Zones

- Resistance: 1.3800 / 1.3850

- Support: 1.3640 / 1.3590

Recommendations:

- Selling: Possible intraday in small volumes, not beyond the support zone.

- Buying: Consider only after confirmed reversal signals appear near support.

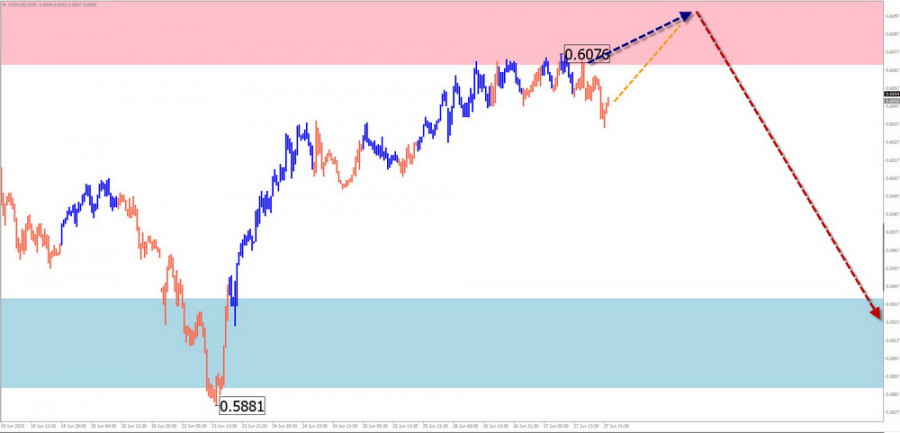

NZD/USD

Brief Analysis:

NZD/USD remains in a dominant bullish wave that began in April. Wave extremes form a "horizontal pennant" on the chart. The bearish phase since May 26 remains a part of internal correction. The bullish leg from June 23 has reversal potential.

Weekly Forecast:

The pair is likely to continue its upward movement for a few more days. A sideways trend and reversal conditions are expected near the resistance zone. Downward movement becomes more probable in the second half of the week.

Potential Reversal Zones

- Resistance: 0.6070 / 0.6120

- Support: 0.5940 / 0.5890

Recommendations:

- Selling: Low potential and potentially risky.

- Buying: Can be considered if reversal signals appear near the support zone.

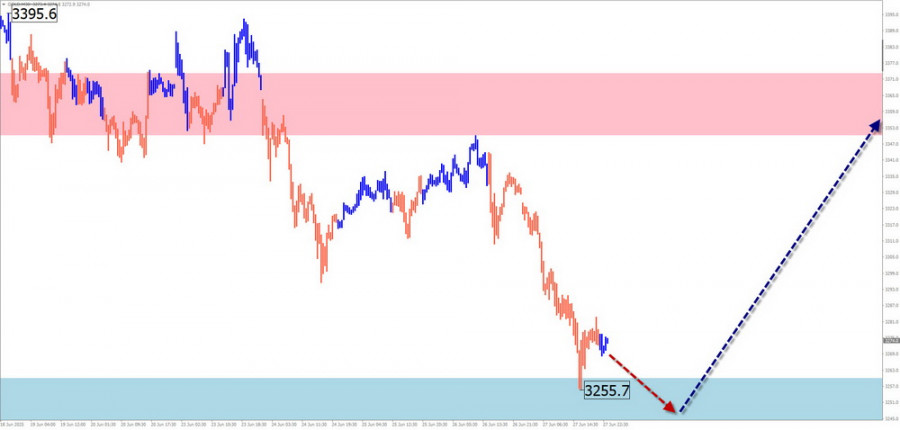

GOLD

Analysis:

Since April, gold has mostly moved sideways. The current descending phase serves as a correction to the previous bullish trend and forms a "horizontal pennant." The price is testing the upper boundary of the two-month range.

Forecast:

Pressure on the support zone may ease in the coming days. A reversal and renewed price rise could follow. Most of the price activity is expected closer to the weekend.

Potential Reversal Zones

- Resistance: 3350.0 / 3370.0

- Support: 3260.0 / 3240.0

Recommendations:

- Selling: Low potential, could be unprofitable.

- Buying: Can be considered as the primary strategy after reversal signals appear near support according to your trading system.

Notes:In simplified wave analysis (SWA), all waves consist of three segments (A-B-C). Each timeframe analyzes the last, incomplete wave. Dotted lines show expected movement paths.

Important:The wave algorithm does not account for the time duration of price movements!

Смотрите также