Trading Recommendations for the Cryptocurrency Market on August 29

Crypto-currencies

2025-08-29 05:37:44

Bitcoin fell back below the $112,000 level, failing once again to consolidate above $113,000 properly. Ether also saw a significant correction during today's Asian trading, indicating its limited upside potential and an apparent lack of new major buyers and fresh capital from spot ETFs.

This muted enthusiasm may be due to investor caution after recent volatility. Further analysis shows that Ether trading volumes remain relatively low compared to periods of peak growth, confirming the lack of momentum to continue the uptrend. Institutional investors, in particular, are taking a wait-and-see approach, assessing the outlook for infrastructure and regulatory development. Technical analysis presents a mixed picture: short-term indicators suggest potential consolidation, while long-term charts continue to show growth potential driven by DeFi development and Ethereum network upgrades.

In the near term, Ethereum will need to overcome several significant resistance levels before a sustained uptrend can be confirmed. The likelihood of further consolidation or even a correction remains high until convincing signs of renewed inflows appear. Investors' attention will be focused on upcoming Ethereum protocol updates and regulatory decisions, which could significantly influence market sentiment.

As for Bitcoin, it too still holds long-term growth potential, although a larger correction seems inevitable. According to forecasts by several firms, by 2035 BTC could be worth $1,300,000—assuming an average annual growth rate of just 28.3%.

Regarding the intraday strategy in the cryptocurrency market, I will continue to act based on any significant pullbacks in Bitcoin and Ether, while relying on the continued development of the mid-term bull market, which remains intact.

For short-term trading, my strategy and conditions are described below.

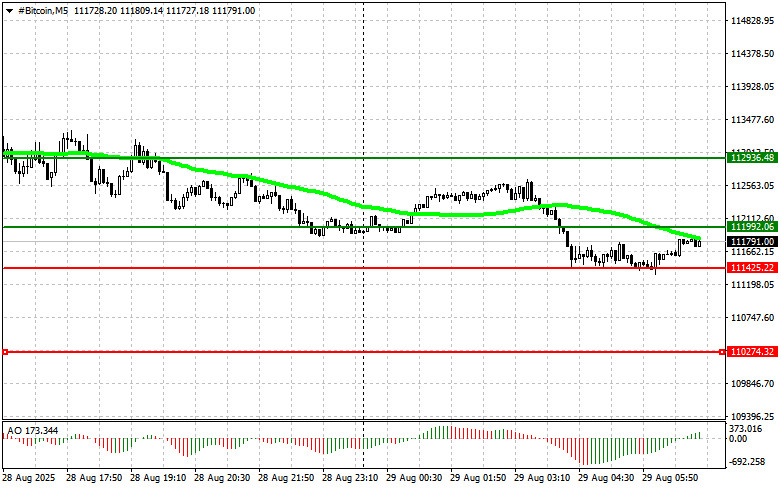

Bitcoin

Buy Scenario

- Scenario 1: I will buy Bitcoin today if it reaches an entry point around $112,000, targeting a rise to $112,900. Around $112,900, I will close the buy and sell immediately on a bounce. Before buying on a breakout, ensure the 50-day moving average is below the current price and the Awesome Oscillator is above zero.

- Scenario 2: You can buy Bitcoin from the lower boundary at $111,400 if there is no market reaction to its breakout in the opposite direction, targeting $112,000 and $112,900.

Sell Scenario

- Scenario 1: I will sell Bitcoin today if it reaches an entry point around $111,400, targeting a drop to $110,200. Around $110,200, I will close the sell and buy immediately on a bounce. Before selling on a breakout, ensure the 50-day moving average is above the current price and the Awesome Oscillator is below zero.

- Scenario 2: You can sell Bitcoin from the upper boundary at $112,000 if there is no market reaction to its breakout in the opposite direction, targeting $111,400 and $110,200.

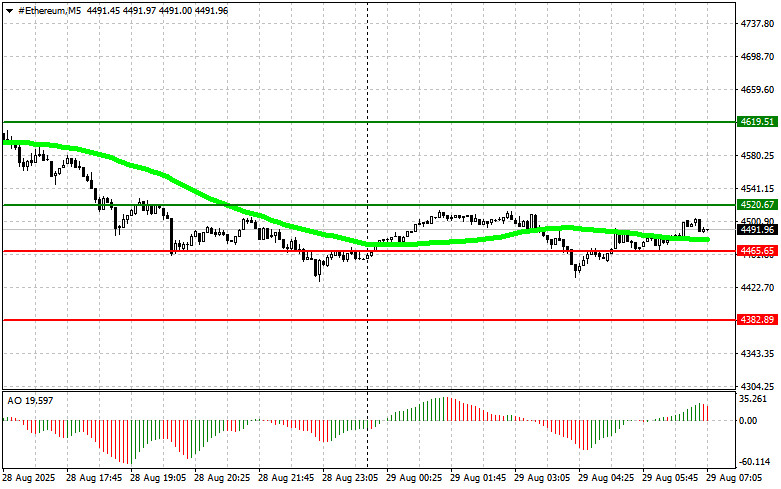

Ethereum

Buy Scenario

- Scenario 1: I will buy Ether today if it reaches an entry point around $4,520, targeting a rise to $4,619. Around $4,619, I will close the buy and sell immediately on a bounce. Before buying on a breakout, ensure the 50-day moving average is below the current price and the Awesome Oscillator is above zero.

- Scenario 2: You can buy Ether from the lower boundary at $4,465 if there is no market reaction to its breakout in the opposite direction, targeting $4,520 and $4,619.

Sell Scenario

- Scenario 1: I will sell Ether today if it reaches an entry point around $4,465, targeting a drop to $4,382. Around $4,382, I will close the sell and buy immediately on a bounce. Before selling on a breakout, ensure the 50-day moving average is above the current price and the Awesome Oscillator is below zero.

- Scenario 2: You can sell Ether from the upper boundary at $4,520 if there is no market reaction to its breakout in the opposite direction, targeting $4,465 and $4,382.

Смотрите также