Donald Trump Prepares New Tariffs

Fundamental analysis

2025-09-15 00:01:33

In recent weeks, the market has entered a state of relative calm. This is clearly reflected in the US dollar, which, despite everything, is in no hurry to keep declining. I can't say we're seeing a classic sideways trend or a change in the wave pattern, but market activity has dropped, price swings are small, and there is no mass dollar selloff as before.

This could be explained by the uncertainty over what to expect from the FOMC over a one-year horizon (due to the complicated situation involving Donald Trump), and because the US president hasn't recently announced or implemented new tariffs. Trump's attention is now entirely focused on trying to stop the conflict in Ukraine. The White House leader still wants to be the world's chief peacemaker and is putting all his effort into ending the war. Unfortunately, Trump's idea of "effort" means threats, blackmail, and tariffs—not actual compromise or solutions satisfying both sides.

This week, Trump announced his readiness to introduce sweeping new tariffs against India and China in response to their purchases of energy from Russia. According to Trump, these measures will push Russian President Vladimir Putin toward negotiations. After the memorable (some say historic) Putin-Trump meeting in Alaska, talks stalled—and there's been no real progress.

As I've written before, the problem may not be so much Trump as it is the stances of Kyiv and Moscow. A lot of diverse information emerges about each side's conditions for resolution. Sometimes, two politicians from the same side voice completely different demands or hint at varied compromises at the talks. Overall, the situation seems as follows. Russia wants Ukraine to withdraw troops from territories not even occupied yet, demands demilitarization, "denazification," a change of government in Kyiv, a reduction of the Ukrainian army, and guarantees that Ukraine won't join NATO.

Kyiv wants to keep its current military strength, asks for international security guarantees, wants to join the EU, and, at best, is willing to freeze the conflict along the current front line but refuses to recognize all occupied territories as Russian.

As you can see, the sides are worlds apart in their requirements, and not even Trump can bridge such a gap.

Wave Picture for EUR/USD

Based on my analysis, EUR/USD continues to develop its upward trend segment. The wave structure still completely depends on the news flow regarding Trump's decisions, as well as the external and internal politics of the new Administration. The wave's target may reach the 1.25 area. Given the consistent news environment, I continue to consider long positions, targeting levels near 1.1875 (the 161.8% Fibonacci level) and above.

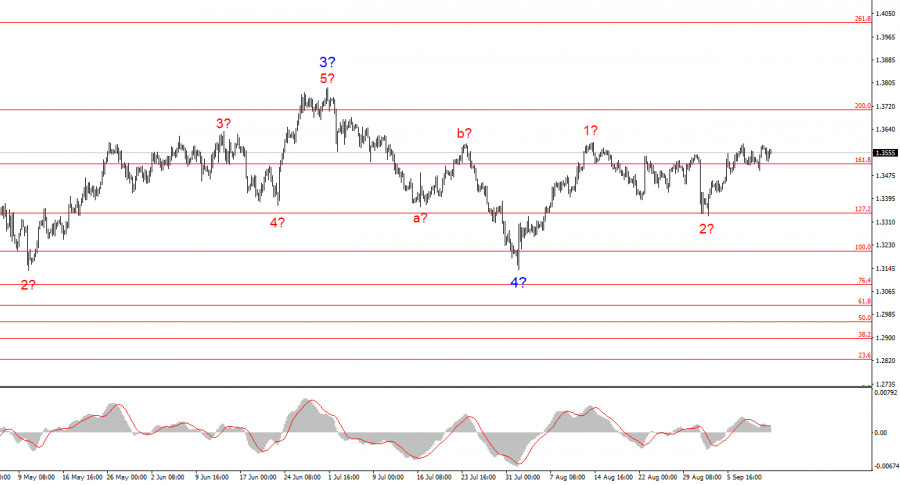

Wave Picture for GBP/USD

The wave structure for GBP/USD remains unchanged. We are dealing with an upward, impulsive trend segment. Under Trump, markets may see plenty of shocks and reversals, which could notably impact the wave pattern, but for now, the working scenario remains intact, and Trump's policy remains unchanged. The upward trend segment's targets are near the 261.8% Fibonacci level. Currently, I expect continued growth within wave 3 of 5, aiming for 1.4017.

My Key Analytical Principles:

- Wave structures should be simple and clear. Complex structures are harder to trade and tend to change.

- If you are not confident about the market situation, it's better to stay out.

- There is never 100% certainty in market direction. Do not neglect protective Stop Loss orders.

- Wave analysis can be combined with other forms of analysis and trading strategies.

Смотрите также