Trading Recommendations for the Cryptocurrency Market on November 10

Crypto-currencies

2025-11-10 06:55:28

Bitcoin, similar to last weekend, has shown a fairly decent recovery and is currently trading above $106,000. Ethereum has also recovered well, but it is still too early to speak of a return to a bullish market.

Just as traders were beginning to recover from the sharp market crash observed on October 10 and 11, which caused billions of dollars in losses, news emerged that the U.S. Commodity Futures Trading Commission plans to launch cryptocurrency trading with leverage on American-regulated exchanges. It is worth recalling that excessive leverage and borrowing were major factors in Bitcoin's crash from $121,000 to $100,000 within hours in early October.

This move has provoked mixed reactions within the investment community. On one hand, providing access to crypto futures with leverage on regulated platforms could attract more institutional investors seeking ways to increase their profits in a volatile market. On the other hand, the increase in leverage significantly raises risks for retail traders, especially beginners who do not fully understand the intricacies of margin trading.

The question of acceptable leverage size also remains open. Excessive leverage can lead to cascading liquidations and even sharper market fluctuations, as we recently witnessed. Regulators will need to carefully consider mechanisms to protect investors and monitor risks to prevent a repeat of the October crash. Otherwise, the good intentions of expanding access to the crypto market could result in disaster for many traders.

Regarding intraday strategies in the cryptocurrency market, I will continue to act based on any major dips in Bitcoin and Ethereum, anticipating the continued development of a bullish market in the medium term, which has not disappeared.

As for short-term trading, the strategy and conditions are described below.

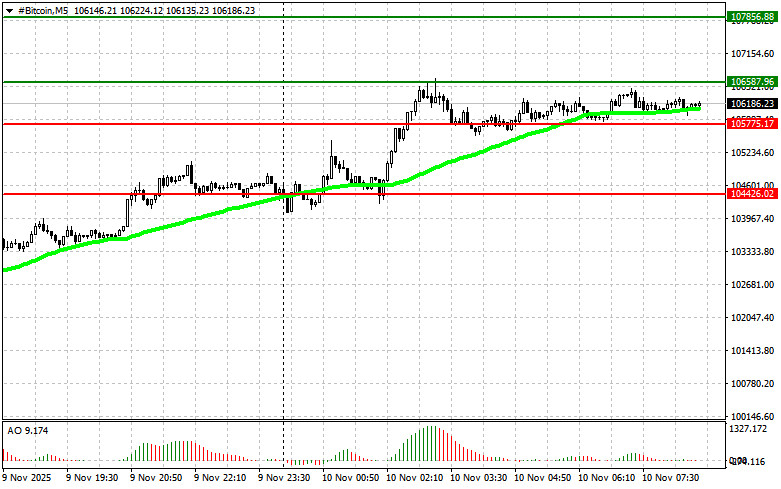

Bitcoin

Buy Scenario

- Scenario 1: I will buy Bitcoin today upon reaching an entry point around $106,500 with a target for growth to $107,800. I will exit my purchases around $107,800 and sell on the bounce. Before making a breakout purchase, ensure that the 50-day moving average is below the current price and that the Awesome indicator is above zero.

- Scenario 2: I can buy Bitcoin from the lower boundary of $105,700 if there is no market reaction to its breakout back toward levels of $106,500 and $107,800.

Sell Scenario

- Scenario 1: I will sell Bitcoin today upon reaching an entry point around $105,700 with a target for a drop to $104,400. I will exit my sales around $104,400 and buy on the bounce. Before making a breakout sale, ensure that the 50-day moving average is above the current price and that the Awesome indicator is below zero.

- Scenario 2: I can sell Bitcoin from the upper boundary of $106,500 if there is no market reaction to its breakout back toward levels of $105,700 and $104,400.

Ethereum

Buy Scenario

- Scenario 1: I will buy Ethereum today upon reaching an entry point around $3,627 with a target for growth to $3,706. I will exit my purchases around $3,706 and sell on the bounce. Before making a breakout purchase, ensure that the 50-day moving average is below the current price and that the Awesome indicator is above zero.

- Scenario 2: I can buy Ethereum from the lower boundary of $3,580 if there is no market reaction to its breakout back toward levels of $3,627 and $3,706.

Sell Scenario

- Scenario 1: I will sell Ethereum today upon reaching an entry point around $3,580 with a target for a drop to $3,504. I will exit my sales around $3,504 and buy on the bounce. Before making a breakout sale, ensure that the 50-day moving average is above the current price and that the Awesome indicator is below zero.

- Scenario 2: I can sell Ethereum from the upper boundary of $3,627 if there is no market reaction to its breakout back toward levels of $3,580 and $3,504.

Смотрите также