EUR/USD Overview. Weekly Preview. The Market Will Struggle Again

Fundamental analysis

2025-11-25 02:24:38

The EUR/USD currency pair traded very calmly on Monday. In the first half of the day, the euro gained slightly, but overall volatility remained low, and the pair showed no interesting movements. Thus, the market situation on the first trading day of the week remained unchanged. Could it change during the week? Looking ahead, the answer is: there is little chance of that. The flat trend on the daily timeframe persists, suggesting volatility is unlikely to increase significantly over the next four days, and movements are not expected to become much more logical. Moreover, the macroeconomic and fundamental backdrop this week will be quite sparse, and the market has been known to ignore even significant events and reports in recent weeks and months.

On Monday morning, the German business climate index was published, the only report of the day. It can be said right away that the euro's morning growth was not related to this index. At least because the indicator's actual value was below expectations. In any case, this report cannot be considered important. What awaits us further in the week?

Today, Germany will publish the third estimate of GDP for the third quarter, and even international event calendars do not mark this as an important event. In other words, it is unlikely that the third estimate will differ significantly from the second or first, and it is also unlikely to differ from expert forecasts. The German economy is either not growing quarter over quarter or growing very slowly. There will not be many reasons for optimism for the euro today.

On Wednesday, the event calendar in Europe is completely empty, aside from the upcoming speeches from European Central Bank President Christine Lagarde and ECB Chief Economist Philip Lane. However, it is worth noting once again that when the central bank was actively easing monetary policy or considering changes to it, the speeches of Lagarde and Lane (as well as other ECB representatives) were important, as they could contain hints for traders about future rate decisions. However, now the ECB has 100% likely completed the easing process, so what can we expect from central bank officials?

On Thursday, Germany will publish the consumer confidence index, which is also an entirely secondary indicator. On Friday, Germany will release retail sales, the unemployment rate, and the consumer price index. These are indeed important indicators, but they pertain to just one country in the Eurozone. Thus, a slight reaction to these reports may be possible, but even inflation currently attracts little interest, as the ECB has managed to stabilize it around 2%.

Thus, we can conclude that Europe is unlikely to be a major source of important information or news this week. The hope lies solely on the U.S., but there, the calendar is clearly not saturated with macroeconomic releases and fundamental events.

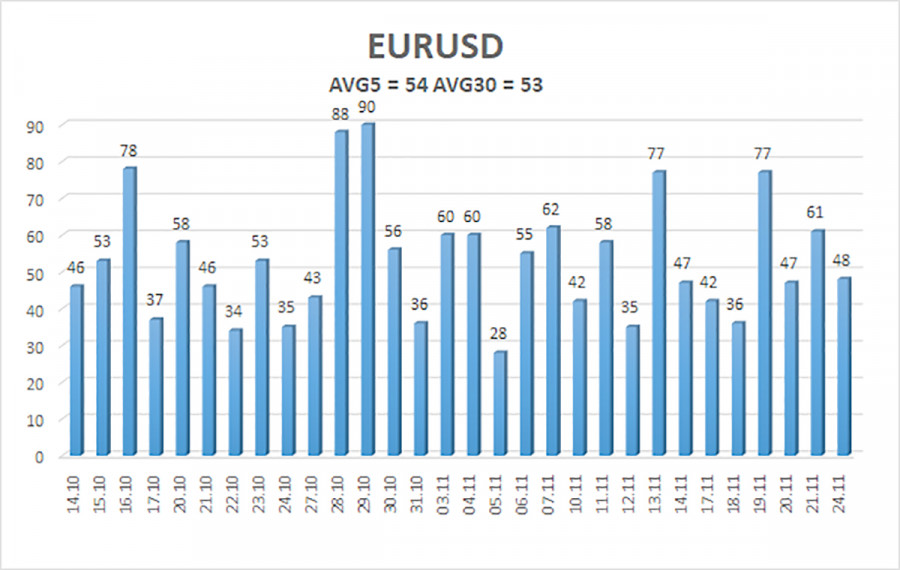

The average volatility of the EUR/USD currency pair over the last five trading days as of November 25 is 54 pips and is characterized as "medium-low." We expect the pair to trade between 1.1471 and 1.1581 on Tuesday. The upper channel of the linear regression is downward, signaling a downward trend, but in reality, the flat trend on the daily timeframe persists. The CCI indicator has entered the oversold region twice in October, which could provoke a new wave of upward trend in 2025. The indicator may enter the oversold area for the third time shortly.

Nearest Support Levels:

S1 – 1.1505

S2 – 1.1475

S3 – 1.1444

Nearest Resistance Levels:

R1 – 1.1536

R2 – 1.1566

R3 – 1.1597

Trading Recommendations:

The EUR/USD pair remains below its moving average, but an upward trend persists across all higher timeframes, while the daily timeframe has been flat for several months now. The global fundamental backdrop continues to exert a strong influence on the U.S. dollar. Recently, the dollar has been rising, but the reasons for this movement may be purely technical. When the price is below the moving average, small short positions can be considered with a target of 1.1475 on purely technical grounds. Long positions above the moving average remain relevant with a target of 1.1800 (the upper line of the flat on the daily timeframe).

Explanations for Illustrations:

- Linear regression channels help determine the current trend. If both are directed in the same way, then the trend is currently strong;

- The moving average line (settings 20,0, smoothed) determines the short-term trend and the direction in which trading should currently be conducted;

- Murray levels are targeted levels for movements and corrections;

- Volatility levels (red lines) denote the probable price channel within which the pair will trade in the coming day, based on current volatility metrics;

- The CCI indicator entering the oversold area (below -250) or the overbought area (above +250) indicates that a trend reversal is approaching in the opposite direction.

Смотрите также