analytics1_1

How to Trade the GBP/USD Currency Pair on December 19? Simple Tips and Trade Analysis for Beginners

How to Trade the GBP/USD Currency Pair on December 19? Simple Tips and Trade Analysis for Beginners

Trading plan

2025-12-19 04:00:12

Trade Analysis for Thursday:

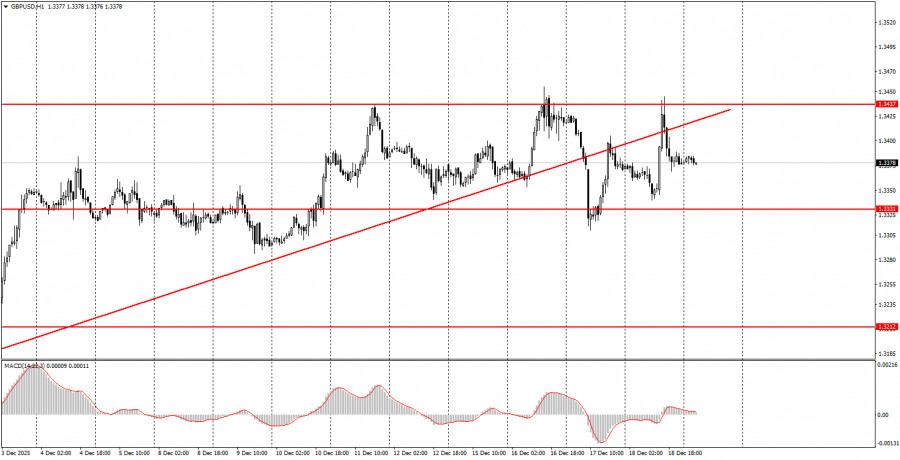

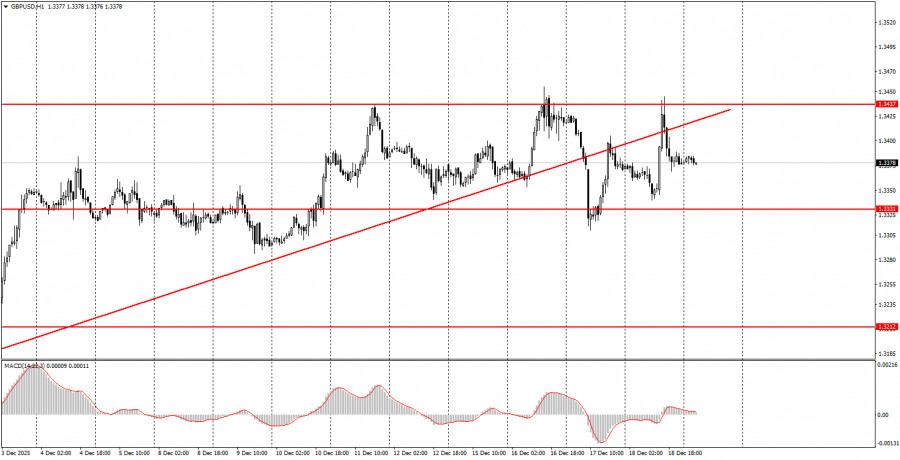

1H Chart of the GBP/USD Pair

The GBP/USD pair traded mixed on Thursday, reflecting a mixed fundamental backdrop. It was a complex day, especially for novice traders. The difficulty lay in interpreting all the information received. For instance, the Bank of England lowered the key interest rate, prompting many to expect a decline in the British currency. However, the market had already anticipated monetary policy easing since Wednesday, when the UK inflation report was published. Inflation sharply declined, opening the door for the BoE to lower the key rate. Therefore, it can be said that this decision was priced in beforehand.

At the same time, U.S. inflation also fell sharply in November, surprising the market but opening the door for the Federal Reserve to further lower the key rate. Hence, the sharp decline in the dollar throughout the day was expected, yet the GBP/USD pair unexpectedly found itself within the sideways channel of 1.3331-1.3437 and could not break out of it. By the end of the day, neither the dollar nor the pound showed growth, although the US currency could have fallen by 100-150 pips. We remind novice traders once again that after significant global events, it is often best to wait for the market to settle.

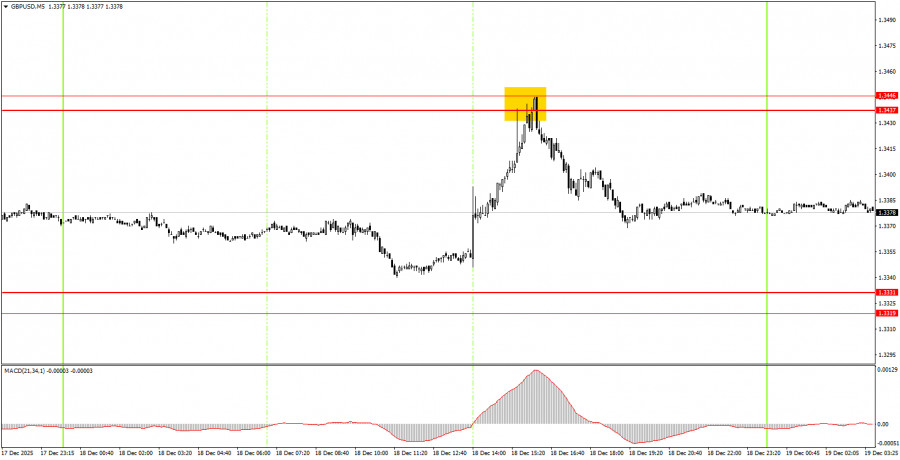

5M Chart of the GBP/USD Pair

On the 5-minute time frame, one sell trading signal was formed during the day in the area of 1.3437-1.3446, but we did not highlight these levels for trading yesterday. These are the updated levels based on the new sideways channel. Overall, opening trades during or immediately after the results of the European Central Bank and BoE meetings was quite risky. Alongside this, the U.S. inflation report was also released.

How to Trade on Friday:

On the hourly time frame, the GBP/USD pair could enter a downward correction, as the trendline has been broken. However, a flat market has formed over the past 1.5 weeks. As mentioned earlier, there are no global factors driving medium-term dollar growth, so we expect movement only to the upside. We also anticipate a resumption of the global upward trend in 2025, which could lead the pair to the 1.4000 mark in the coming months.

On Friday, novice traders may consider opening new long positions if the price bounces from the 1.3319-1.3331 area or breaks above the 1.3437-1.3446 region. A bounce from the 1.3437-1.3446 range or a consolidation below 1.3319-1.3331 would make shorts relevant.

On the 5-minute time frame, trading can currently be considered at levels 1.2913, 1.2980-1.2993, 1.3043, 1.3096-1.3107, 1.3203-1.3212, 1.3259-1.3267, 1.3319-1.3331, 1.3437-1.3446, 1.3529-1.3543, and 1.3574-1.3590. On Friday, a retail sales report is scheduled for release in the UK, while in the U.S., the University of Michigan consumer sentiment index will be released. Neither report is the most significant, and the British pound is currently flat.

Key Rules of the Trading System:

- The strength of a signal is assessed by the time it takes to form the signal (bounce or breakout). The less time it takes, the stronger the signal.

- If two or more trades were opened near any level based on false signals, all subsequent signals from that level should be ignored.

- In a flat, any pair can create numerous false signals or none at all. In any case, it's better to stop trading at the first signs of a flat.

- Trades are opened during the period between the start of the European session and the middle of the American session, after which all trades must be closed manually.

- On the hourly timeframe, when trading based on signals from the MACD indicator, it is preferable to trade only when good volatility is present, and a trend is confirmed by a trend line or channel.

- If two levels are positioned too closely to each other (5 to 20 points), they should be viewed as a support or resistance area.

- After moving 20 pips in the right direction, set the Stop Loss to breakeven.

Chart Explanation:

- Support and Resistance Levels: Levels that serve as targets for opening buys or sells. Take Profit levels can be placed near them.

- Red Lines: Channels or trend lines that reflect the current trend and indicate the preferred direction for trading.

- MACD Indicator (14, 22, 3): A histogram and signal line, a supplementary indicator that can also be used as a source of signals.

Important Note: Significant speeches and reports (always included in the news calendar) can greatly influence the movement of the currency pair. Therefore, during their release, it is advisable to trade cautiously or exit the market to avoid sharp reversals against the preceding movement.

Remember: For beginners trading in the Forex market, it is important to understand that not every trade can be profitable. Developing a clear strategy and practicing money management are keys to long-term trading success.

Смотрите также