Intraday Strategies for Beginner Traders on December 26

Forecast

2025-12-26 05:50:16

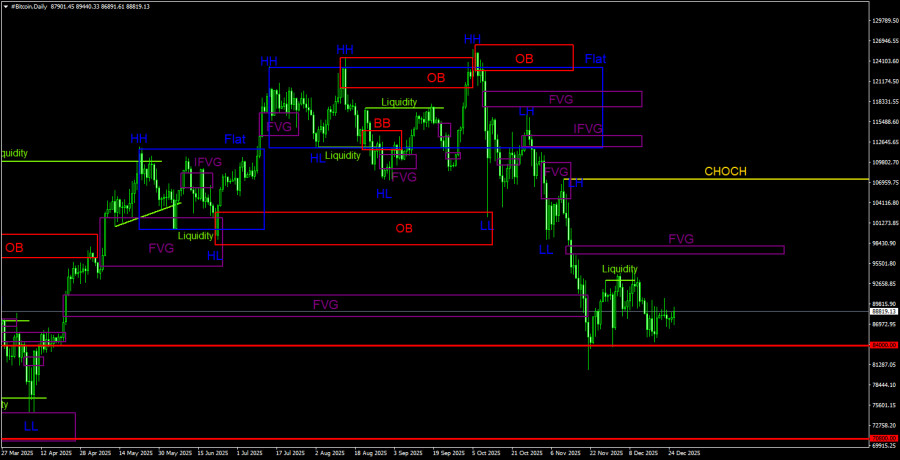

The euro and British pound have maintained their strength; however, trading for these instruments continues within a range. The USD/JPY pair has also stabilized, and by the end of the week, significant changes are unlikely.

On Wednesday, the pre-holiday lull in economic data led to slight instability in currency trading. Trading across many pairs was conducted within a limited corridor, although it displayed sharp shifts, attributed to a liquidity shortage. It is expected that after the New Year holidays, trading in the currency market will gradually intensify. With the return of market participants and the release of new statistical data, sharp, uncontrollable movements may subside, and price dynamics will become more predictable.

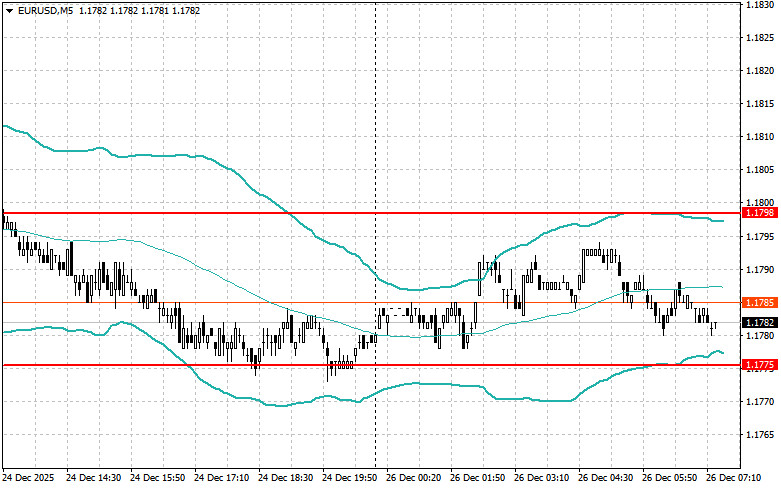

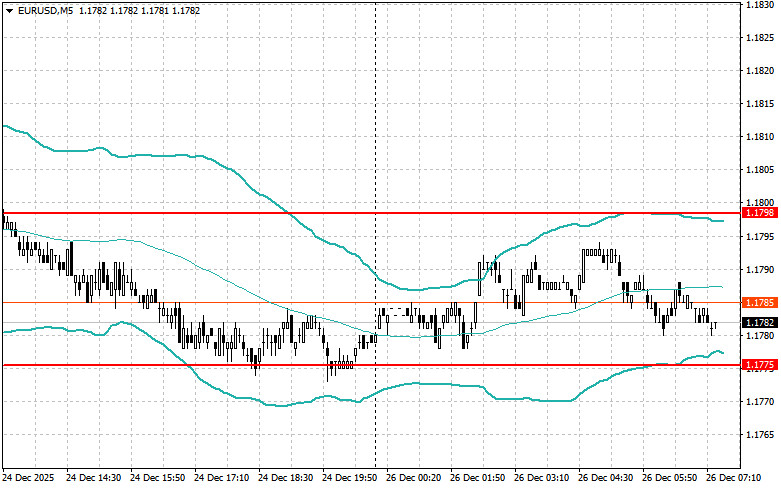

Today promises to be relatively calm, as buyers of EUR/USD are unlikely to make their presence felt after Christmas. Liquidity will remain low, making the market vulnerable to sudden spikes and drops, so traders should exercise particular caution. In the absence of significant drivers, attention will be focused on technical levels and local news.

I'd like to remind you that, currently, in the lead-up to the New Year, a wait-and-see position prevails. Many market participants have already closed their annual positions and prefer not to take risks, fearing unpredictable fluctuations. Trading volumes have significantly decreased, creating additional difficulties for those trying to trade actively.

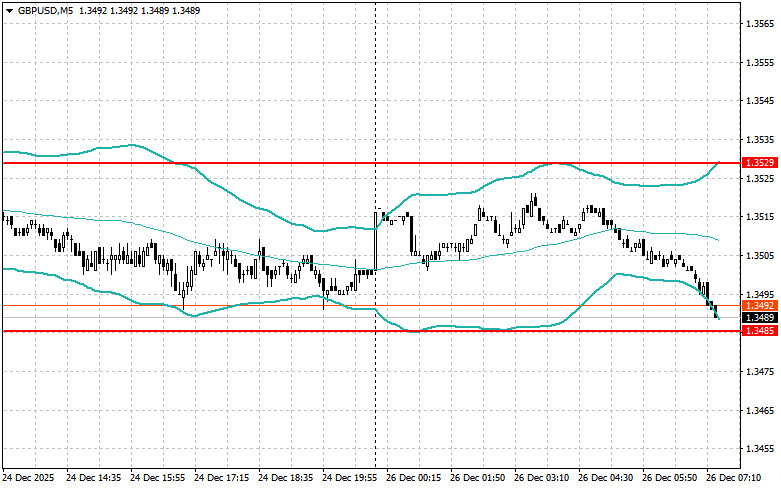

There are no news releases from the UK today, so a similar situation awaits the British pound.

If the data corresponds with economists' expectations, it is better to act based on the Mean Reversion strategy. If the data comes in significantly above or below expectations, the Momentum strategy is the best approach.

Momentum Strategy (Breakout):

For the EUR/USD Pair

- Buy on breakout above 1.1807, targeting 1.1840 and 1.1882.

- Sell on a breakout below 1.1781, targeting 1.1760 and 1.1730.

For the GBP/USD Pair

- Buy on breakout above 1.3502, targeting 1.3531 and 1.3561.

- Sell on a breakout below 1.3471, targeting 1.3442 and 1.3411.

For the USD/JPY Pair

- Buy on breakout above 155.30, targeting 156.68 and 157.05.

- Sell on a breakout below 155.99, targeting 155.67 and 155.32.

For the EUR/USD Pair

- Look for selling opportunities after a failed breakout above 1.1798, upon a return below this level.

- Look for buying opportunities after a failed breakout below 1.1775 upon returning to this level.

For the GBP/USD Pair

- Look for selling opportunities after a failed breakout above 1.3529, upon a return below this level.

- Look for buying opportunities after a failed breakout below 1.3485 upon returning to this level.

For the AUD/USD Pair

- Look for selling opportunities after a failed breakout above 0.6727, upon a return below this level.

- Look for buying opportunities after a failed breakout below 0.6697 upon returning to this level.

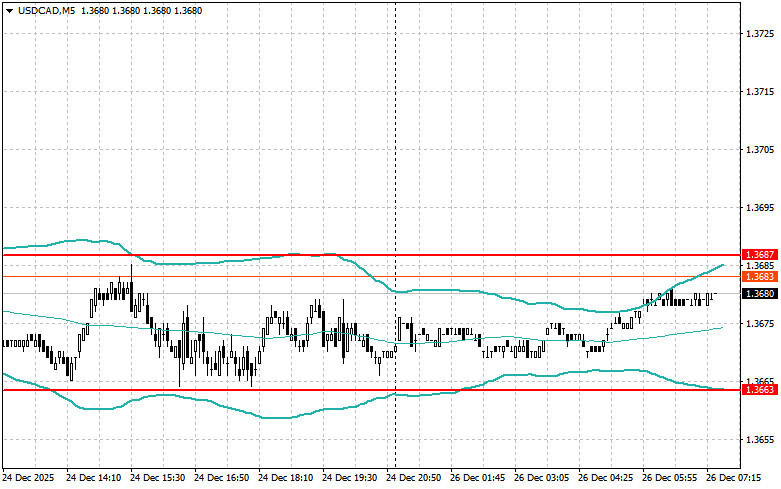

For the USD/CAD Pair

- Look for selling opportunities after a failed breakout above 1.3687, upon a return below this level.

- Look for buying opportunities after a failed breakout below 1.3663 upon returning to this level.

Смотрите также