EUR/USD. Weekly preview. ISM indices, Non-farms, and the

Fundamental analysis

2026-01-04 22:52:38

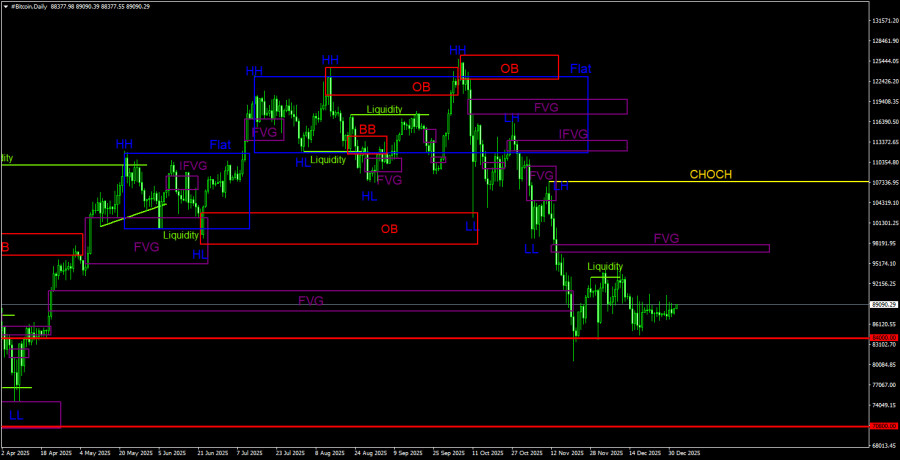

The economic calendar for the coming week is packed with important events. The New Year period is behind us, and now important macroeconomic reports traditionally published at the beginning of each month await us. It is quite likely that by the end of the coming week, the EUR/USD pair will nevertheless leave the area of the 17th figure within which it has traded for the previous three weeks. The only question is which way the scales will tilt — toward sellers or buyers of the pair.

So, on Monday, the most important macroeconomic indicator in the U.S. — the ISM manufacturing index — will be published. In November, this indicator fell to 48.2, the lowest level since July this year. The downward dynamic has been recorded for the second month in a row. Key subindexes disappointed as well. In particular, the new orders index fell from 49.4 to 47.4 (this component has been falling for three months in a row, indicating weak demand), and the employment index — to 44.0 (after a decline to 46.0 in the previous month). In other words, the ISM manufacturing index reflected weak demand and shrinking employment.

According to preliminary forecasts, in December the indicator will show a minimal increase (from 48.2 to 48.4), but it will remain in contraction territory. The dollar will receive support only if, contrary to forecasts, the index exceeds the 50-point threshold. However, the probability of that scenario is extremely small. The opposite result is more likely. Most indirect signals (weak orders, falling employment, price pressure, weak exports) indicate that the ISM manufacturing index will be below its November level in December. In addition, regional manufacturing indices (FRB New York, FRB Philadelphia, FRB Richmond) in December moved into negative territory, reflecting continued contraction in U.S. industrial activity.

The ISM services PMI will be published two days later — on Wednesday, January 7. The indicator is expected to decline slightly — from 52.6 to 52.2 — while remaining in expansion territory. A more significant drop (toward the 50 threshold) or a sudden fall into contraction would exert severe pressure on the U.S. currency.

In addition to the ISM indices, EUR/USD traders will focus on the U.S. labor market. ADP and JOLTS reports will be released on Wednesday, and December Nonfarm Payrolls will be released on Friday.

According to preliminary forecasts, the ADP report will show a 50,000 increase in private-sector employment, after a 30,000 decline the previous month. Although this indicator does not always correlate with official data, it can trigger volatility in EUR/USD, especially if it prints negative again.

Also on Wednesday, we will learn the November JOLTS value (vacancies on the last business day of the month before last). In October, this indicator stood at 7.67 million, its highest level since May 2025. According to forecasts, the upward trend will continue in November — the indicator should be at 7.73 million. Although this is a lagging indicator, it can complement the overall picture of the U.S. labor market if it turns out to be in the "red zone."

However, the decisive role will be played by Non-farm Payrolls, which will be published on Friday, January 9. This release will be the first relatively "clean" U.S. labor market report after the recent shutdown. As is known, during the prolonged federal government suspension, the publication of official statistics was disrupted. In particular, the October employment report was not published separately and was combined with the November report. Some parameters of the release were distorted due to the lack of data collection during the shutdown. Therefore, the December NFP report is significant for EUR/USD traders in assessing the current state of the U.S. labor market.

According to preliminary forecasts, unemployment in December will fall slightly — from 4.6% (a multi-year high) to 4.5%. Nonfarm payrolls should increase by 55,000, after a 64,000 rise in November. Average hourly earnings growth is expected to remain at the previous month's level (3.5%).

Overall, this is a relatively weak result. Even if the report matches forecasts, the dollar will be under background pressure. But if unemployment rises again and the payroll increase is below the 55,000 mark, the greenback will weaken significantly across the market, amid strengthening "dovish" expectations about future Fed actions. I remind you that market participants currently view the chances of a March rate cut as 50/50 (according to CME FedWatch). Weak NFP data could tip the scales toward the "dovish" scenario.

It is also worth noting that on Monday, a market reaction to the Venezuelan events is expected. Briefly: on Saturday, the U.S. carried out a large military operation in Venezuela, as a result of which President Nicolas Maduro was captured and delivered to the United States.

In the short term (on Monday), the dollar may strengthen as a safe-haven asset amid a spike in geopolitical tension and uncertainty. However, over the medium term (i.e., during the week), everything will depend on how quickly and in what way global markets assess the consequences of the events in Venezuela. Much will also depend on states' reactions, the stability of oil supplies, and investors' risk appetite assessment. If the tension stabilizes (i.e., no further escalation steps by the U.S. or other countries follow), EUR/USD will return to its ordinary fundamental drivers.

From a technical point of view, on the daily chart, the pair is on the middle line of the Bollinger Bands, below the Tenkan-sen line, and above the Kumo cloud and the Kijun-sen line. All this suggests uncertainty, despite the prevailing bearish sentiment for the pair. Despite the southbound impulse, EUR/USD sellers failed to breach the lower boundary of the 1.1710–1.1800 range within which the pair has traded for the third consecutive week. Accordingly, the bears did not even approach the main support level at 1.1690 (the upper boundary of the Kumo cloud on D1). If the southbound impulse "traditionally" fades at the base of the 17th figure, it is reasonable to consider longs with a first target at 1.1760 (Tenkan-sen line on D1).

Смотрите также