EUR/USD Overview on January 7, 2026

Fundamental analysis

2026-01-07 04:37:50

During Tuesday, the EUR/USD currency pair corrected slightly downward and maintained a bearish bias. Overall, the dollar is holding on to positions it "earned through backbreaking labor." At the beginning of the week (or rather, over the weekend), the dollar frankly got lucky. The source of this luck was Donald Trump, who throughout 2025 did nothing but undermine the U.S. currency. This time, however, Trump decided to carry out a military operation in Venezuela aimed at capturing the country's president, Nicolas Maduro. This was successfully accomplished by U.S. forces in just a few hours. And the dollar, which still retains remnants of its former greatness, rose slightly out of old habit.

Trump himself stated that America wants to control Venezuela and is interested in Venezuelan oil. However, not in the sense of "taking everything for ourselves," but supposedly out of concern for the poor Venezuelan people. Naturally, no one in the market believed this interpretation, and many are now asking what the point of this operation really was.

Regardless of what Delcy Rodriguez, Donald Trump, and other officials may now claim, one simple truth should be understood: the Venezuelan people may not accept Trump's "generous" proposal. The leader of the White House decided to "lay his hand" on Venezuela's vast oil reserves, and the new president of the country, Delcy Rodriguez, is supposed to help him do so. First, it is completely unclear whether Rodriguez herself will agree to such a splendid scenario. If she does not, will Trump carry out another military operation—this time to abduct Rodriguez? Second, the new authorities in Caracas may agree to any deal with Trump, but that does not mean the Venezuelan people will support it.

For those who do not know, in Venezuela not every second resident has a weapon (as in the U.S.), but virtually every single one. If the decisions of the newly installed president do not suit the people, the country could be engulfed in a wave of bloodshed. A coup or revolution could begin. Who will put out this fire? We seriously doubt it will be Trump. At present, the entire operation in Venezuela does not even look like an attempt to seize Venezuelan oil or to stop the flow of drugs into the United States. The Americans captured Maduro—but what comes next? Did this automatically destroy all drug cartels in Venezuela? Or will the new authorities eliminate them within a couple of months? It should be remembered that in countries like Venezuela, drug cartels wield more political influence than the government itself. They possess money, weapons, and power. Therefore, in our view, nothing will change.

What Trump has gained, however, is the opportunity to "rattle weapons" in front of Colombia, Cuba, and even the European Union. The Venezuelan operation appears to have been needed so that all other countries with which Trump has disputes become more compliant. For example, Trump wants to gain control over Greenland. Perhaps after Venezuela, the passive European Union will simply hand it over to the United States—say, on a 50-year lease. We are confident that Trump will not start any wars, and the geopolitical conflict with Venezuela ended very quickly and, essentially, led to nothing.

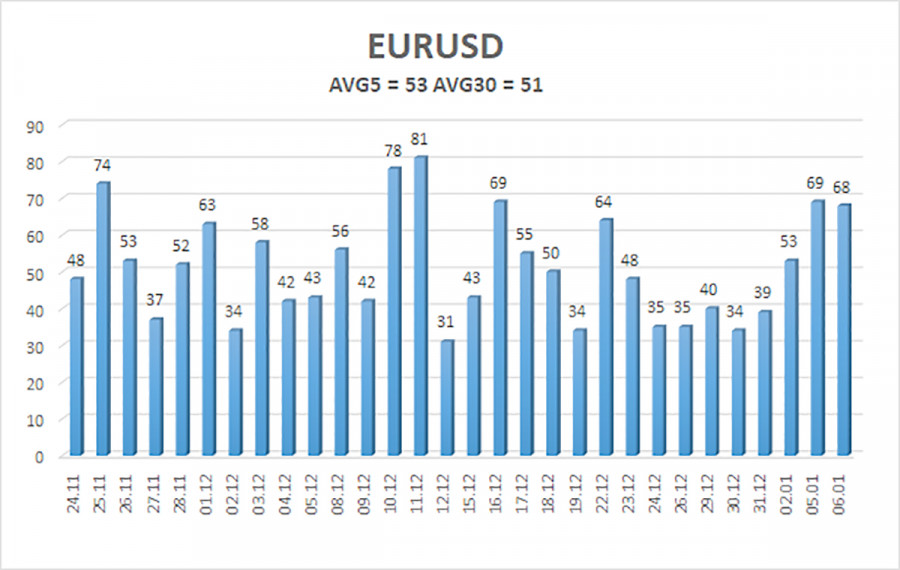

The average volatility of the EUR/USD currency pair over the last five trading days as of January 7 is 53 points and is characterized as "medium-low." We expect the pair to move between the levels of 1.1635 and 1.1741 on Wednesday. The higher linear regression channel is directed upward, but in reality a flat market on the daily timeframe is still ongoing. The CCI indicator entered the overbought zone in early December, but we have already seen a small pullback. Last week, a bullish divergence was formed, indicating a resumption of the upward trend.

Nearest support levels:

S1 – 1.1658S2 – 1.1597S3 – 1.1536

Nearest resistance levels:

R1 – 1.1719R2 – 1.1780R3 – 1.1841

Trading Recommendations:

The EUR/USD pair remains below the moving average, but on all higher timeframes the upward trend persists, while on the daily timeframe a flat market has been ongoing for the sixth consecutive month. The global fundamental background still plays a huge role for the market, and it remains negative for the dollar. Over the past six months, the dollar has occasionally shown weak growth, but exclusively within a sideways channel. It has no fundamental basis for long-term strengthening. While the price remains below the moving average, small short positions may be considered on purely technical grounds with targets at 1.1658 and 1.1636. Above the moving average, long positions remain relevant with a target of 1.1830 (the upper boundary of the daily flat), which has effectively already been tested. Now the flat needs to end.

Explanations to the Illustrations:

- Linear regression channels help determine the current trend. If both are directed in the same direction, the trend is currently strong.

- The moving average line (settings: 20,0, smoothed) defines the short-term trend and the direction in which trading should currently be conducted.

- Murray levels are target levels for price movements and corrections.

- Volatility levels (red lines) represent the probable price channel in which the pair is likely to trade over the next 24 hours, based on current volatility indicators.

- The CCI indicator entering the oversold zone (below ?250) or the overbought zone (above +250) signals that a trend reversal in the opposite direction may be approaching.

Смотрите также