analytics1_1

GBP/USD: Simple Trading Tips for Beginner Traders for January 7th. Review of Yesterday's Forex Trades

GBP/USD: Simple Trading Tips for Beginner Traders for January 7th. Review of Yesterday's Forex Trades

Forecast

2026-01-07 09:42:51

Trade Review and Tips for Trading the British Pound

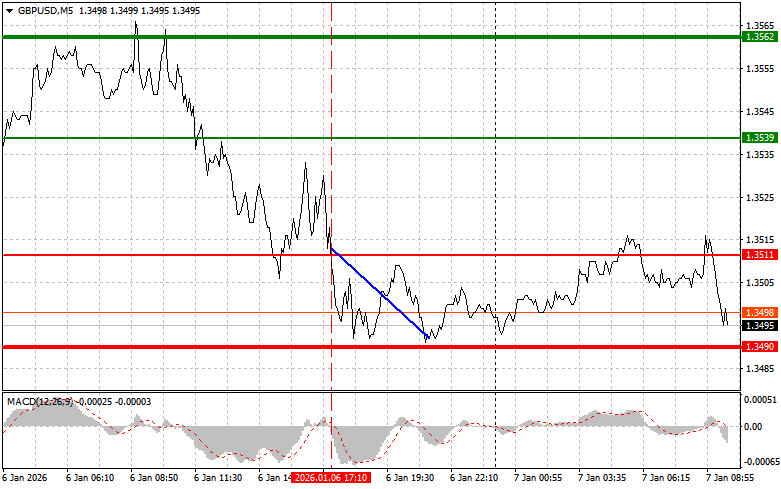

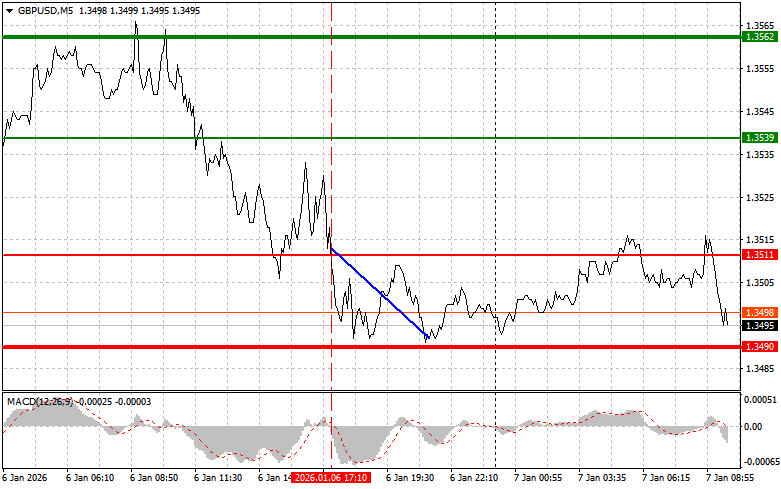

The test of the 1.3511 price level occurred at the moment when the MACD indicator was just beginning to move downward from the zero line, which confirmed a correct entry point for selling the pound. As a result, the pair declined toward the target level of 1.3490.

The pound managed to hold its ground against the dollar after news that the U.S. services PMI came in below economists' expectations. This fact, which may seem contradictory from the standpoint of classical economic logic, nevertheless reflects the complex nature of current economic realities and market expectations. Contrary to expectations, the weakening of U.S. services-sector data did not lead to an immediate weakening of the dollar against the pound. There are several reasons for this. First, the British economy itself is facing serious challenges, including high inflation and recession risks. The declining attractiveness of the dollar is offset by similar problems in the UK. Second, the policy of the Bank of England plays an important role. Expectations of a further pause in the interest rate–cutting cycle in the UK, aimed at fighting inflation, are supporting the pound.

Today, traders' focus will shift to the UK construction PMI figures. This indicator, which reflects the pulse of construction activity, will provide valuable information about the state of the British economy amid ongoing uncertainty. Low PMI readings may signal a decline in demand for construction materials and services, affecting employment and investment in the sector. In turn, this could put pressure on the pound sterling and increase the risk of an economic slowdown. Conversely, high PMI readings would indicate sustained growth in the construction industry, which would be a positive signal for the UK economy as a whole. This would likely lead to a strengthening of the pound and increased investor confidence.

As for the intraday strategy, I will mainly rely on the implementation of Scenarios No. 1 and No. 2.

Buy Scenarios

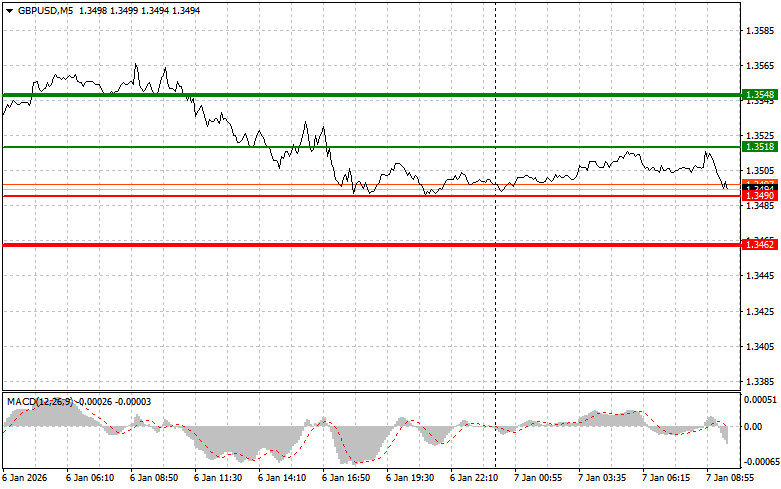

Scenario No. 1: Today, I plan to buy the pound when the price reaches the entry area around 1.3518 (green line on the chart), targeting growth toward the 1.3548 level (the thicker green line on the chart). Around 1.3548, I intend to exit long positions and open sell positions in the opposite direction, targeting a move of 30–35 points from that level. Strong pound growth today can be expected after positive data.Important: Before buying, make sure the MACD indicator is above the zero line and just starting to rise from it.

Scenario No. 2: I also plan to buy the pound today if there are two consecutive tests of the 1.3490 price level while the MACD indicator is in the oversold zone. This would limit the pair's downward potential and lead to an upward market reversal. Growth toward the opposite levels of 1.3518 and 1.3548 can be expected.

Sell Scenarios

Scenario No. 1: I plan to sell the pound today after a break below the 1.3490 level (red line on the chart), which would lead to a rapid decline in the pair. The key target for sellers will be the 1.3462 level, where I plan to exit short positions and immediately open long positions in the opposite direction, targeting a move of 20–25 points from that level. Pound sellers may become active after weak data.Important: Before selling, make sure the MACD indicator is below the zero line and just beginning to decline from it.

Scenario No. 2: I also plan to sell the pound today if there are two consecutive tests of the 1.3518 price level while the MACD indicator is in the overbought zone. This would limit the pair's upward potential and lead to a downward market reversal. A decline toward the opposite levels of 1.3490 and 1.3462 can be expected.

What's on the Chart

- Thin green line – entry price at which the trading instrument can be bought

- Thick green line – projected price where Take Profit orders can be placed or profits can be locked in manually, as further growth above this level is unlikely

- Thin red line – entry price at which the trading instrument can be sold

- Thick red line – projected price where Take Profit orders can be placed or profits can be locked in manually, as further decline below this level is unlikely

- MACD indicator – when entering the market, it is important to consider overbought and oversold zones

Important:

Beginner Forex traders should be extremely cautious when making market entry decisions. Before the release of major fundamental reports, it is best to stay out of the market to avoid being caught in sharp price fluctuations. If you decide to trade during news releases, always place stop-loss orders to minimize losses. Without stop-loss orders, you can lose your entire deposit very quickly—especially if you do not use proper money management and trade large volumes.

And remember: successful trading requires a clear trading plan, such as the one presented above. Making spontaneous trading decisions based on the current market situation is inherently a losing strategy for an intraday trader.

Смотрите также