EUR/USD. Smart Money. The Dollar's Free Fall Is Accelerating

Technical analysis

2026-01-28 16:31:12

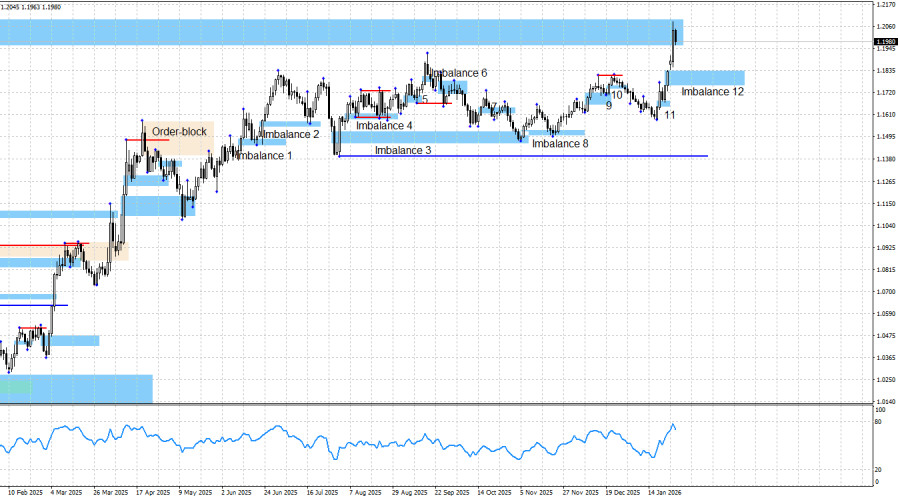

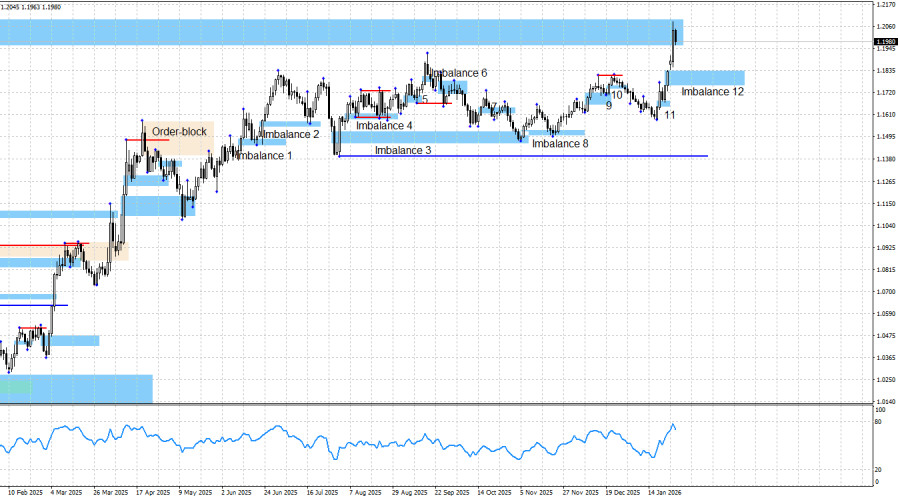

The EUR/USD pair continues its upward movement, just as I anticipated. In a bullish trend, traders should focus primarily on bullish patterns and buy signals. Last week, another bullish imbalance (No. 11) was formed, and almost immediately afterward a buy signal appeared in the form of a price reaction to this pattern. As a result, traders had yet another excellent opportunity to open positions that are now showing a profit of around 250 points. The weekly bearish imbalance has been reached, and a minor price reaction may follow from this level, which could work in traders' favor. In this case, there is a high probability of a pullback into imbalance No. 12, followed by a resumption of growth. I would like to remind you that the weekly imbalance served only as a price reference point. I do not expect the bullish trend to end based on this pattern.

Undoubtedly, Donald Trump deserves the credit for the dollar's latest decline. Traders paid no attention to economic reports throughout last week. The peak of this indifference was the publication of U.S. third-quarter GDP data, which came in stronger than expected. Donald Trump first imposed trade tariffs on EU countries and then lifted them, yet in both cases traders saw only negative signals. In my view, they interpreted the situation correctly, as such policy flip-flopping means only one thing: the decisions of the U.S. president (of the world's largest economy, no less) are worth very little. Today Trump may introduce tariffs, tomorrow he may cancel them. Today Trump may declare his readiness to seize Greenland by force, and tomorrow change his mind. Today he has grievances with Europe, tomorrow with China, the day after tomorrow with Canada, and then with South Korea. Markets cannot understand what to expect from Trump and therefore are pricing in the worst-case scenario known as "sell America."

The technical picture continues to signal bullish dominance. The bullish trend remains intact despite the sideways movement seen in recent months. A new bullish signal has formed within imbalance No. 11, allowing expectations of growth at least toward 1.1976 (the lower boundary of the weekly imbalance). This week, another bullish imbalance (No. 12) was formed, from which buy positions can also be opened going forward.

There was no notable news flow on Wednesday, but the FOMC meeting is scheduled for the evening. In my view, there is little reason to expect meaningful support for the dollar from the U.S. regulator, although the dollar may still strengthen slightly, given how sharply it has fallen over the past two weeks. Technical analysis supports this scenario, and in that case I will prepare for new buy positions within imbalance No. 12.

Bullish traders have had more than enough reasons for renewed advances for the past four to five months, and with each passing day those reasons only multiply. These include the inevitably dovish outlook for FOMC monetary policy, Donald Trump's overall policy (which has not changed recently), the confrontation between the U.S. and China (where only a temporary truce has been reached), protests by the American public against Trump under the slogan "No Kings," weakness in the labor market, gloomy prospects for the U.S. economy (recession), the government shutdown that lasted a month and a half, the possibility of a new shutdown that could begin as early as Sunday, and now also U.S. military aggression toward certain countries, criminal prosecution of Powell, the "Greenland confusion," and worsening relations with Canada and South Korea. Thus, in my opinion, further growth of the pair is entirely natural.

I still do not believe in a bearish trend. The news background remains extremely difficult to interpret in favor of the dollar, which is why I do not attempt to do so. The blue line marks the price level below which the bullish trend could be considered over. Bears would need to push the price down by about 570 pips to reach that level, and I consider this task impossible under the current news background and circumstances. The nearest upward target for the euro was the bearish imbalance of 1.1976–1.2092 on the weekly chart, which was formed back in June 2021. This pattern was fully filled this week. Above that, only two levels stand out: 1.2348 and 1.2564. These levels represent two peaks on the monthly chart, from which liquidity could potentially be taken.

News Calendar for the U.S. and the Eurozone:

United States – Initial Jobless Claims Change (13:30 UTC).

On January 29, the economic calendar contains only one minor event. The impact of the news background on market sentiment on Thursday will be negligible.

EUR/USD Forecast and Trading Advice:

In my view, the pair remains in the process of forming a bullish trend. Despite the fact that the news background continues to favor bulls, bears have carried out regular attacks over recent months. Nevertheless, I see no realistic reasons for the start of a bearish trend.

From imbalances 1, 2, 3, 4, 5, 8, and 9, traders had opportunities to buy the euro. In all cases, we observed price growth, and the bullish trend remained intact. Last week, a new bullish signal formed from imbalance No. 11, once again allowing traders to open buy positions targeting 1.1976. That target has been reached. This week, another bullish imbalance (No. 12) was formed, meaning that traders may soon receive new opportunities to enter long positions.

Смотрите также