analytics1_1

GBP/USD: Simple Trading Tips for Beginner Traders for February 2nd. Review of Yesterday's Forex Trades

GBP/USD: Simple Trading Tips for Beginner Traders for February 2nd. Review of Yesterday's Forex Trades

Forecast

2026-02-02 10:56:36

Trade Review and Trading Tips for the British Pound

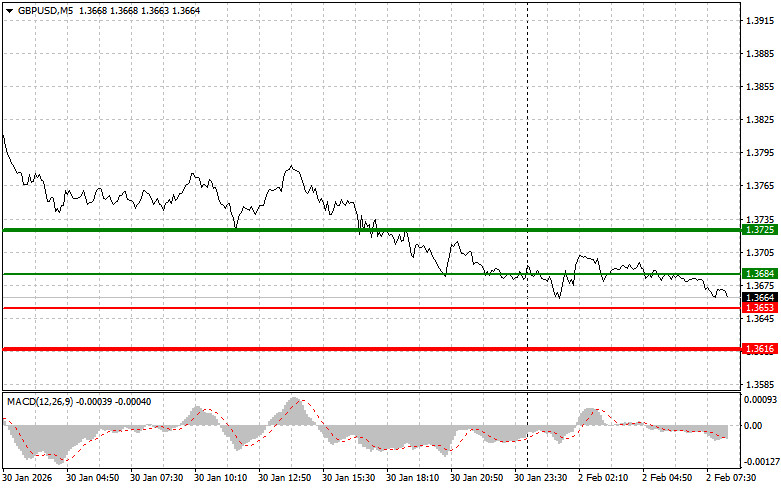

The price test of 1.3771 occurred when the MACD indicator had already moved significantly upward from the zero line, which limited the pair's upward potential. For this reason, I did not buy the pound.

As the statistics showed, the U.S. Producer Price Index (PPI) remained unchanged at a high level, while many economists had expected it to decline. This PPI surprise convinced investors that the Federal Reserve's chosen path is correct, and that the regulator will continue fighting high inflation despite its slight easing at the end of last year.

This morning, data on the UK House Price Index from Nationwide Building Society will be released, along with the Manufacturing PMI. In addition, a public speech by Sarah Breeden, a member of the Bank of England's Financial Policy Committee, is scheduled.

The Nationwide house price index will provide an up-to-date picture of conditions in the UK housing market. A decline in prices may signal a slowdown in activity caused by higher interest rates and more expensive mortgage lending. The manufacturing PMI will help assess the condition of the industrial sector of the economy. Weak readings could bring renewed pressure on the British pound, as they would indicate a slowdown in economic recovery and reduced demand for goods.

The speech by Sarah Breeden, a member of the Bank of England's Financial Policy Committee, will attract significant attention. Market participants will closely analyze her comments on the current economic situation, inflation prospects, and future monetary policy. Her statements could have a substantial impact on the British pound's exchange rate and overall market sentiment.

As for the intraday strategy, I will focus primarily on implementing Scenarios No. 1 and No. 2.

Buy Scenarios

Scenario No. 1:

Today, I plan to buy the pound if the price reaches the entry area around 1.3684 (thin green line on the chart), with a target move toward 1.3725 (thicker green line on the chart). Around 1.3725, I plan to exit long positions and open short positions in the opposite direction, targeting a 30–35 point move from that level. A rise in the pound today can be expected only after very strong economic data.

Important! Before buying, make sure the MACD indicator is above the zero line and just beginning to rise from it.

Scenario No. 2:

I also plan to buy the pound today if there are two consecutive tests of the 1.3653 level, at a moment when the MACD indicator is in the oversold area. This would limit the pair's downward potential and lead to an upward market reversal. Growth toward the opposite levels 1.3684 and 1.3725 can be expected.

Sell Scenarios

Scenario No. 1:

Today, I plan to sell the pound after the 1.3653 level is broken (red line on the chart), which would lead to a rapid decline in the pair. The key target for sellers will be 1.3616, where I plan to exit short positions and also open buy trades in the opposite direction, targeting a 20–25 point rebound from that level. Pound sellers are likely to act at any opportunity.

Important! Before selling, make sure the MACD indicator is below the zero line and just beginning to decline from it.

Scenario No. 2:

I also plan to sell the pound today in the case of two consecutive tests of the 1.3684 level, when the MACD indicator is in the overbought area. This would limit the pair's upward potential and lead to a downward market reversal. A decline toward the opposite levels 1.3653 and 1.3616 can be expected.

What's on the Chart:

- Thin green line – entry price for buying the trading instrument

- Thick green line – estimated price where Take Profit can be set or profits can be manually locked in, as further growth above this level is unlikely

- Thin red line – entry price for selling the trading instrument

- Thick red line – estimated price where Take Profit can be set or profits can be manually locked in, as further decline below this level is unlikely

- MACD indicator – when entering the market, it is important to focus on overbought and oversold zones

Important:

Beginner Forex traders should make market entry decisions with great caution. Before the release of major fundamental reports, it is best to stay out of the market to avoid sharp price fluctuations. If you decide to trade during news releases, always use stop-loss orders to minimize losses. Without stop-loss orders, you can lose your entire deposit very quickly—especially if you do not use proper money management and trade large volumes.

And remember: successful trading requires a clear trading plan, such as the one presented above. Making spontaneous trading decisions based on the current market situation is inherently a losing strategy for an intraday trader.

Смотрите также