Trading Recommendations for the Cryptocurrency Market on December 19

Crypto-currencies

2024-12-19 06:56:45

Bitcoin and Ethereum experienced significant declines yesterday, losing between 5% and 8% from their opening levels. This occurred immediately after Federal Reserve Chair Jerome Powell addressed the press, stating that the central bank would exercise greater caution in deciding on interest rate cuts next year. Smaller cryptocurrencies dropped even further: XRP, ADA Cardano, and LTC Litecoin fell nearly 10%.

At the post-FOMC press conference, Powell stated that the anticipated slower rate cuts reflect higher inflation figures in previous months and elevated inflation expectations for next year. "We are approaching a neutral rate, which is another reason for future cautious steps," Powell added.

When asked about the idea of the government establishing a strategic Bitcoin reserve under Donald Trump's presidency, Powell remarked that the Fed is not permitted to own Bitcoin under the Federal Reserve Act and has no plans to seek a legislative change. However, given the Trump administration's complete control of Congress, amending the law appears feasible. This potential change could serve as a future driver for cryptocurrency market growth.

Legislative changes could open new avenues for cryptocurrencies, allowing the Fed to participate in the market. Should the government establish a strategic Bitcoin reserve, this could be critical in legitimizing cryptocurrencies and boosting investor trust. Mechanisms that states use to manage strategic resource reserves could be adapted for Bitcoin, ensuring market stability and predictability.

As for the intraday strategy in the cryptocurrency market, I plan to continue relying on any significant dips in Bitcoin and Ethereum, anticipating the continuation of a medium-term bull market. The bullish trend remains intact.

As for short-term trading, the strategy and conditions are described below.

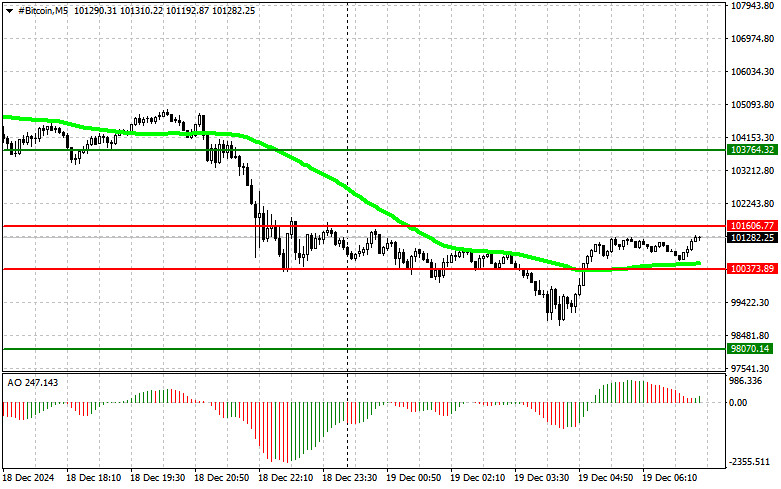

Bitcoin

Buy scenario

I will buy Bitcoin today when I reach the entry point near $101,600, with the goal of growing to $103,700. At $103,700, I plan to exit my buy positions and sell on the rebound. Before buying on a breakout, ensure the 50-day moving average is below the current price and the Awesome Oscillator is above zero.

Sell Scenario

I will sell Bitcoin today when I reach the entry point of around $100,300 to fall to the $98,000 level. At $98,000, I plan to exit sell positions and buy on the rebound. Before selling on a breakout, ensure the 50-day moving average is above the current price and the Awesome Oscillator is below zero.

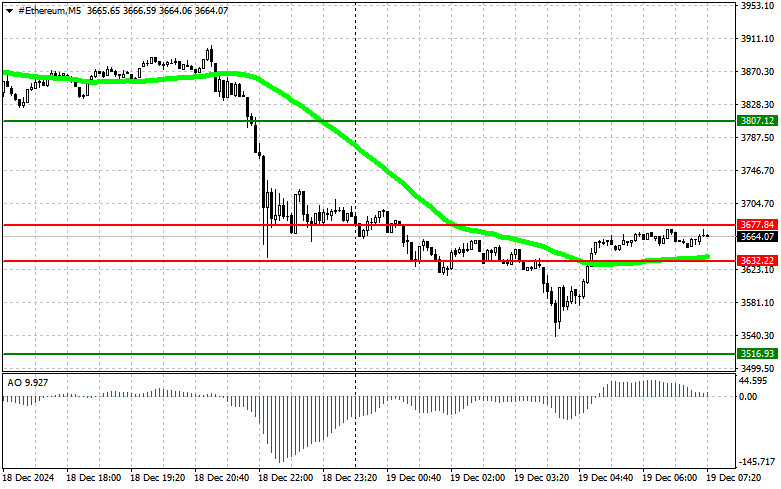

Ethereum

Buy scenario

I will buy Ether today when I reach the entry point at $3677 with a growth target of $3807. At $3,807, I plan to exit buy positions and sell on the rebound. Before buying on a breakout, ensure the 50-day moving average is below the current price and the Awesome Oscillator is above zero.

Sell Scenario

I will sell Ether today when I reach the entry point near $3632 with a downside target of $3516. At $3,516, I plan to exit sell positions and buy on the rebound. Before selling on a breakout, ensure the 50-day moving average is above the current price and the Awesome Oscillator is below zero.

Смотрите также