Trading Recommendations for the Cryptocurrency Market on December 30

Crypto-currencies

2024-12-30 07:48:32

Bitcoin and Ethereum are experiencing a gradual decline as the year comes to a close, and it appears that any potential new highs may not occur until 2025. However, there is no need for panic; Bitcoin's $90,000 level is a key focus for investors at this time. Meanwhile, Ethereum remains stable, trading around the $3,500 mark.

The recent market decline has negatively impacted the Crypto Fear and Greed Index, which has dropped to 65 points—the lowest level since October 15. This low reading raises significant concerns among investors, indicating that many are selling off their assets to minimize losses. The downward trend in cryptocurrency prices, particularly for Bitcoin and Ethereum, is affecting overall investor sentiment and increasing pessimism about potential further declines.

Despite this situation, such market fluctuations are not uncommon. Historically, investors often respond emotionally to short-term changes in the market. Many experts still believe in the long-term potential of cryptocurrencies as valuable investment tools. However, it is essential to recognize the risks and avoid making panic-driven decisions based on fear.

As for the intraday strategy in the cryptocurrency market, I plan to continue capitalizing on significant dips in Bitcoin and Ethereum, aiming to benefit from the continuation of the bullish trend in the medium term, which remains intact.

As for short-term trading, the strategy and conditions are described below.

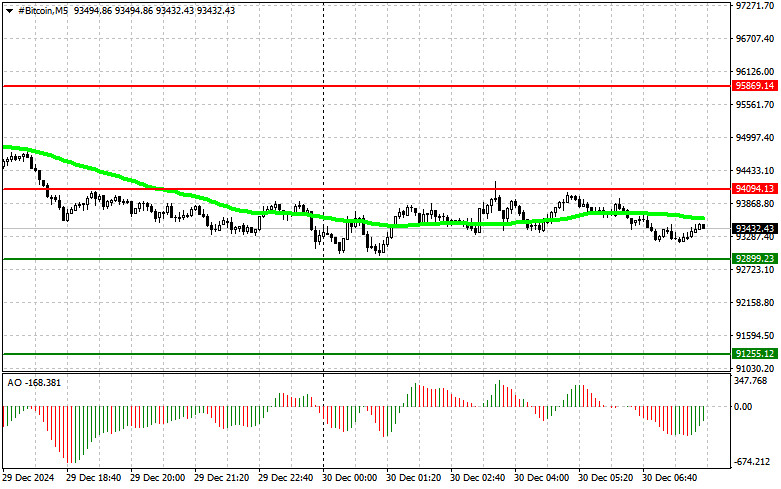

Bitcoin

Buy Scenario:

Upon reaching the entry point at $94,000, I will buy Bitcoin today, with a target of $95,860. At $95,860, I will exit buys and sell immediately on a pullback. Before buying on a breakout, ensure that the 50-day moving average is below the current price and that the Awesome Oscillator is in the positive zone.

Sell Scenario:

Upon reaching the entry point at $92,899, I will sell Bitcoin today with a target of $91,200. At $91,200, I will exit sales and buy immediately on a pullback. Before selling on a breakout, ensure that the 50-day moving average is above the current price and that the Awesome Oscillator is in the negative zone.

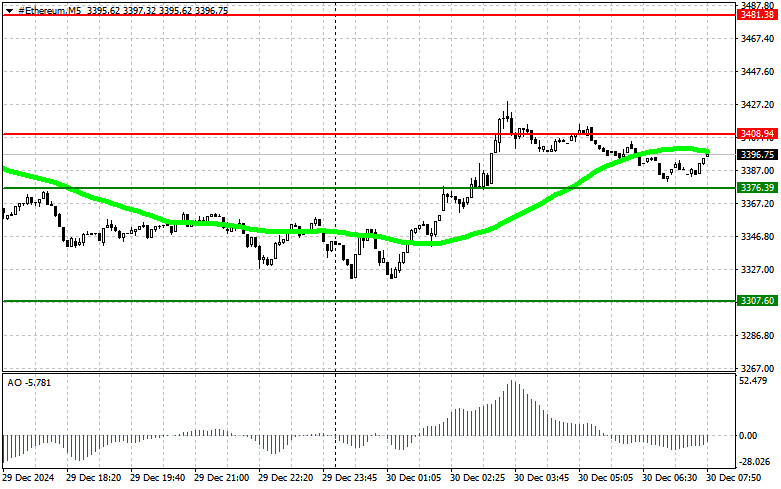

Ethereum

Buy Scenario:

Upon reaching the entry point at $3,408, I will buy Ethereum today with a target of $3,481. At $3,481, I will exit buys and sell immediately on a pullback. Before buying on a breakout, ensure that the 50-day moving average is below the current price and that the Awesome Oscillator is in the positive zone.

Sell Scenario:

Upon reaching the entry point at $3,376, I will sell Ethereum today with a target of $3,307. At $3,307, I will exit sales and buy immediately on a pullback. Before selling on a breakout, ensure that the 50-day moving average is above the current price and that the Awesome Oscillator is in the negative zone.

Смотрите также