Crypto market cheers tolerance of SEC

Crypto-currencies

2025-01-22 09:02:35

Just a day after Gary Gensler officially stepped down as Chair of the US Securities and Exchange Commission (SEC), the federal agency's approach to cryptocurrencies is already undergoing dramatic changes.

On Tuesday, Acting Chair Mark Uyeda announced the creation of a crypto task group, tasked with developing a comprehensive and clear regulatory framework for crypto assets. The task group will be led by Commissioner Hester Peirce, a long-time advocate for the crypto industry, and will work closely with industry participants to craft the rules. Additionally, the task force will collaborate with Congress, providing technical assistance in drafting cryptocurrency regulations.

Both the tone and content of the SEC's Tuesday statement signal a radical shift in the agency's stance on cryptocurrency regulation under the new Trump administration. "Until now, the SEC has largely relied on enforcement actions to regulate cryptocurrencies retroactively, often introducing new and untested legal interpretations along the way," the statement noted. "Clarity on who must register and how has been sorely lacking, resulting in confusion about legal requirements. This has fostered an environment hostile to innovation and conducive to fraud."

Collaboration with CFTC

The Commission's new crypto task group is also expected to coordinate efforts with the Commodity Futures Trading Commission (CFTC). Under former SEC Chair Gensler and former CFTC Chair Rostin Behnam, the two agencies had been competing for the position of primary regulator for the cryptocurrency industry.

"We look forward to working hand-in-hand with the public to create a regulatory environment that protects investors, fosters capital formation, market integrity, and supports innovation," Peirce said in a statement.

Market reaction and institutional interest

Against this backdrop, it's no surprise that major market players are becoming more active. Yesterday, the Bank of America CEO announced that the US banking industry is ready to embrace cryptocurrencies for payments if regulators permit it.

In a recent interview, the Bank of America CEO stated that cryptocurrencies could significantly transform the financial technology landscape. He noted that banks should adapt to these changes and consider integrating digital currencies into their payment systems.

As customer and business interest in cryptocurrencies grows, financial institutions must prepare for this new stage of development. However, clear and understandable regulatory frameworks are essential for the full adoption of cryptocurrencies in the banking system. Without these, many banks will remain cautious due to risks associated with online transactions and the volatility of the crypto market.

Regulators must devise strategies that ensure the safety and protection of both consumers and financial institutions.

Bullish outlook for crypto

Despite existing barriers, the Bank of America CEO's stance highlights the banking industry's openness to innovation. Given technological advancements and shifting consumer preferences, the future of finance may be more digital than ever.

The entry of major players like the US banking sector into the cryptocurrency market could also spark a new rally.

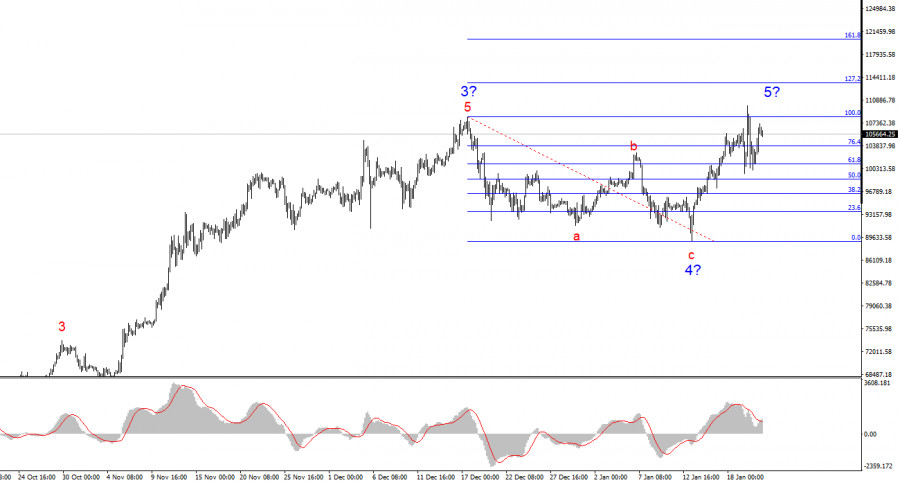

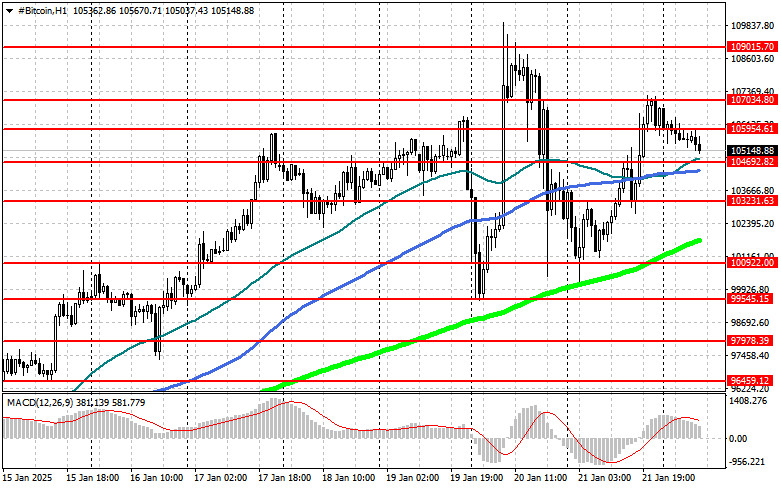

Technical analysis of Bitcoin

Bitcoin buyers are currently targeting a breakout above $105,900, which would pave the way to $107,000 and then $109,100. The ultimate target is the peak near $110,900, which would mark a return to the medium-term bullish market.

In case of a correction, buyers are expected to enter the market at $104,600. A drop below this level could quickly push BTC toward $103,200, with further potential declines to $100,900 and $99,500 as the ultimate target.

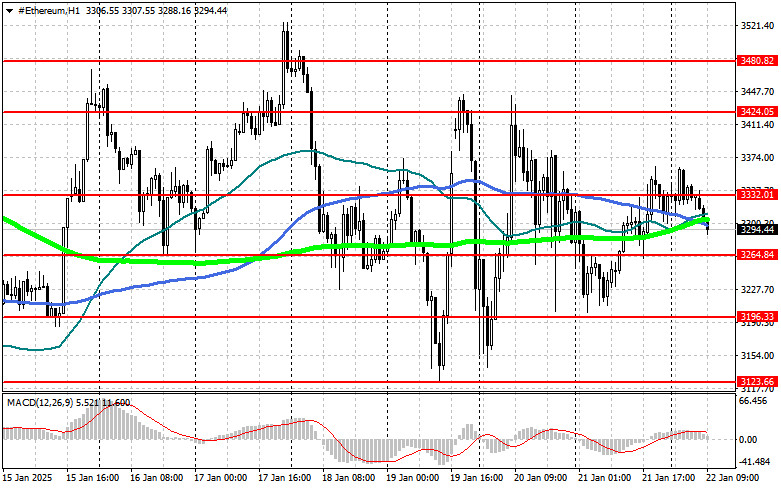

Technical analysis of Ethereum

For Ethereum, a solid hold above $3,264 opens the path to $3,332, followed by $3,424. The ultimate target is the yearly high near $3,480, signaling a return to the medium-term bullish trend.

In case of a correction, buyers are anticipated around $3,196. Falling below this level could lead ETH to $3,123, with further potential declines to $3,056 and $2,993 as the ultimate target.

Смотрите также