Painful experience of crypto market

Crypto-currencies

2025-02-03 09:54:50

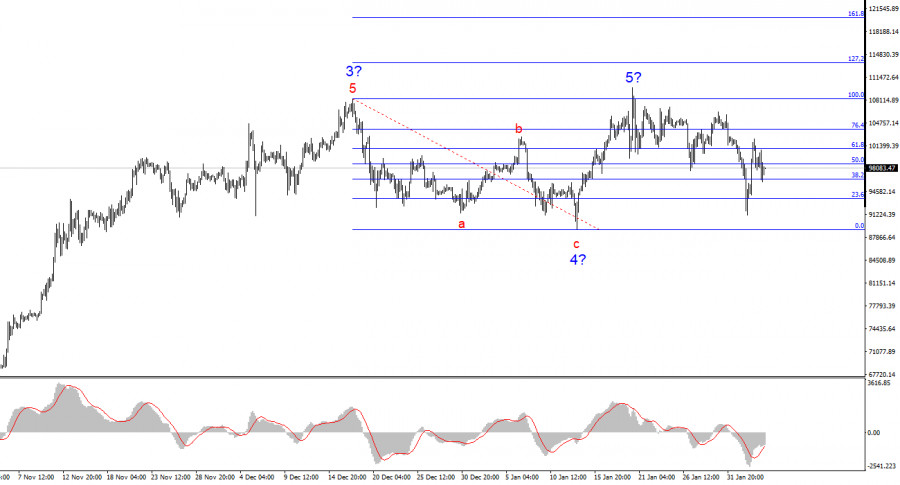

Bitcoin and Ethereum have been subjected to panic sell-offs. It was especially painful to watch Ethereum, which in one day showed a -26% plunge at its lowest point. There has been a small recovery of the trading instrument since then, but even after this, the chances of significant growth in the short term, and especially a recovery to last week's levels, remain very low.

Cryptocurrencies opened with a sharp decline on Monday. Against the backdrop of a new trade war initiated by Trump and expectations of a tense day in the US stock market, the total capitalization of the cryptocurrency market shrank by 10% overnight. Over the past 24 hours, there were a huge number of liquidations: traders lost $2.2 billion, which is comparable to the losses seen during the FTX collapse and the COVID-19 pandemic. Many experts believe the market will recover quickly, but for now, it will likely decline even further rather than return to last week's highs.

Clearly, after the sharp drop, there has been an increase in interest from institutional investors, who view the current decline as an opportunity to enter the market at lower prices. This could help restore the capitalization of the cryptocurrency sector in the medium and long-term periods. Financial support from major players could also become a stabilizing factor that helps mitigate the effects of recent volatility. It is important to monitor new data and macroeconomic indicators in the coming days that may influence the market.

According to the latest data, during the past trading week, the net inflow into spot BTC-ETFs was +$559.5 million, compared to an inflow of +$1.757.7 billion in the previous week. The net outflow from spot ETH-ETFs was -$45.3 million, compared to an outflow of $139.4 million the previous week. Despite the decrease in the BTC-ETF inflow compared to the previous week, investors are still interested in interest in Bitcoin. This sentiment may be related to changes in the investment strategies of major players. In a situation where uncertainty in global financial markets is increasing, investors may seek safer assets, leading to significant fluctuations in fund inflows and outflows. As for ETH ETFs, the observed net outflow could indicate growing distrust in Ethereum as an asset given the current market conditions. As today's events showed, these concerns were not unfounded.

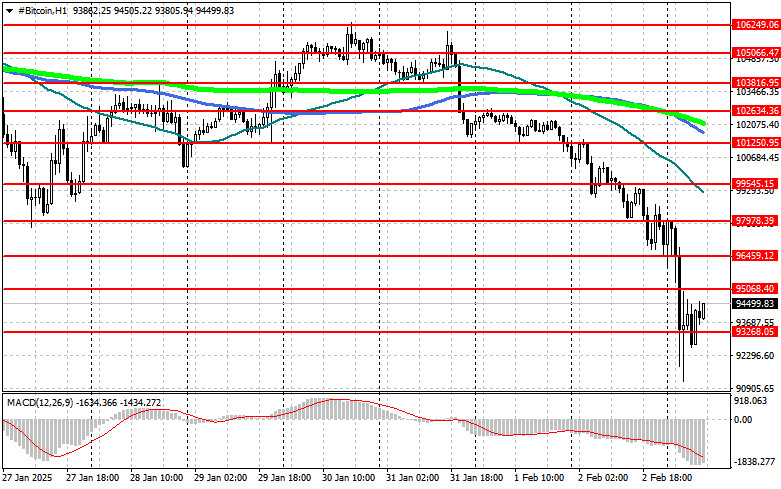

As for the technical picture of Bitcoin, buyers are now targeting a return to the $95,000 level, which opens the direct path to $96,400, and from there, it's close to the $97,900 level. The furthest target will be the high around $99,500. If surpassed, this would signal a return to a medium-term bullish market. In case of Bitcoin's decline, buyers are expected to enter at $93,200. A return of the trading instrument to this area could quickly drop BTC to the $91,900 zone, with the $90,600 level being very close. The furthest bearish target would be the $89,100 area.

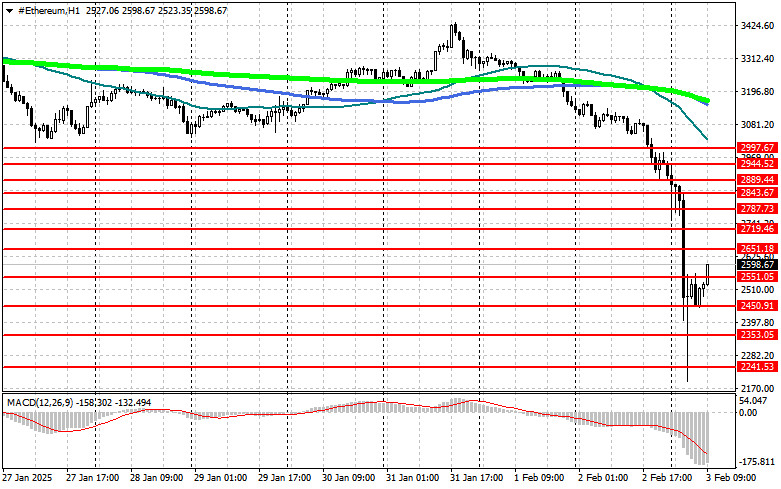

As for Ethereum's technical picture, a clear consolidation above the $2,650 level opens the direct path to $2,719. From there, it's not far to the $2,787 level. The furthest target will be the one-year high around $2,843. Surpassing this would signal a return to a medium-term bullish market. In the case of a correction in Ethereum, buyers are expected at the $2,550 level. A return of the trading instrument below this area could quickly drop ETH to the $2,450 zone, with the $2,353 level being the furthest target.

Смотрите также