Wave analysis of BTC/USD on February 5. Bitcoin on verge of collapse?

Crypto-currencies

2025-02-05 06:45:17

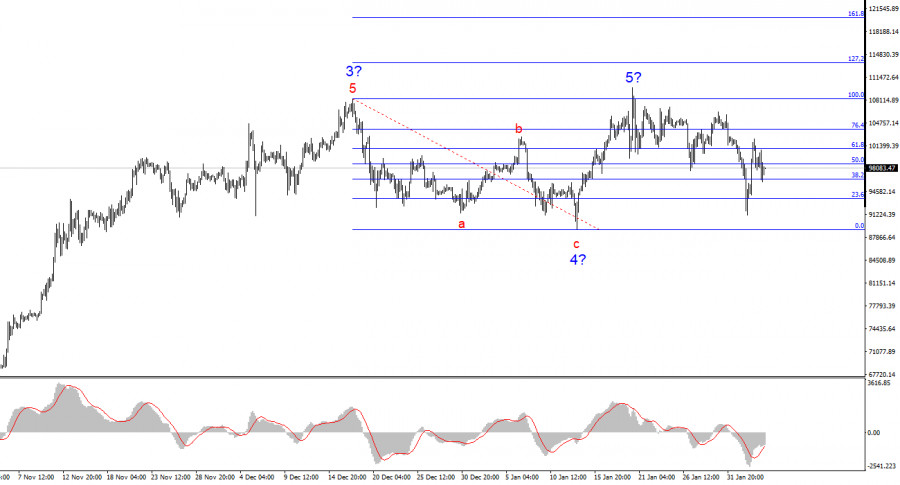

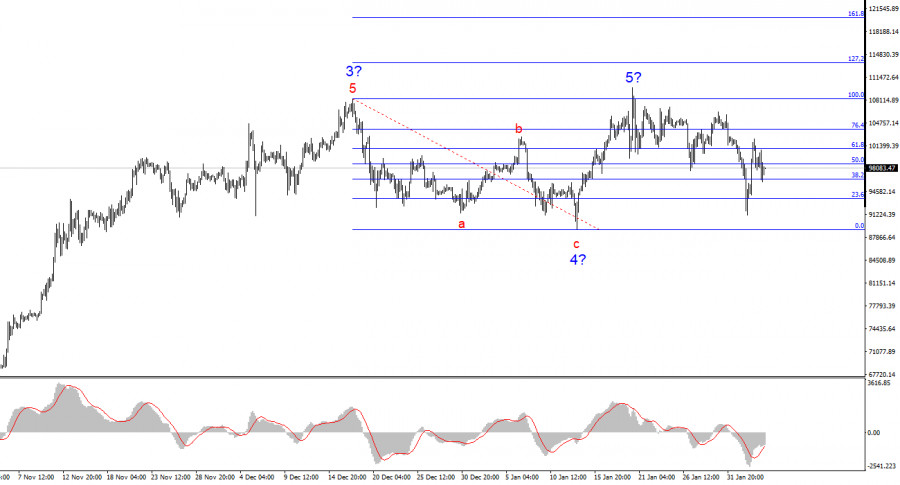

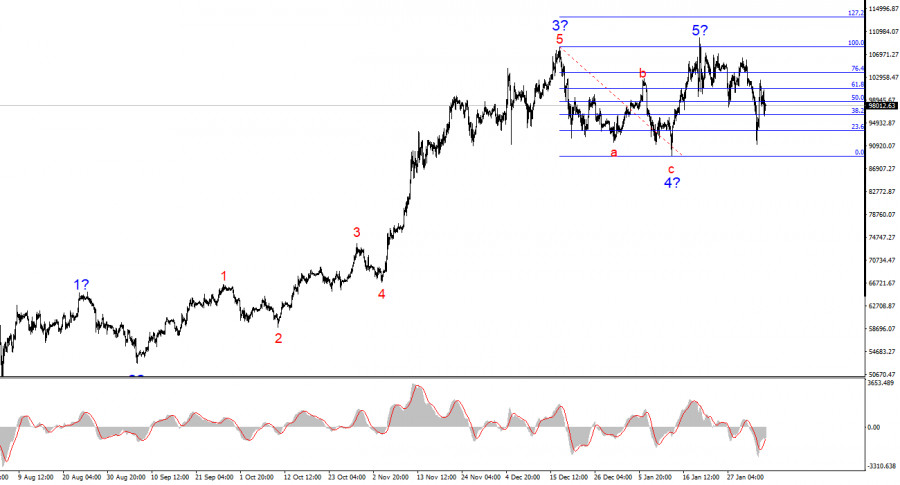

The wave structure on the 4-hour chart of BTC/USD appears clear and well-defined. After an extended and complex a-b-c-d-e corrective pattern, which developed between March 14 and August 5, a new impulsive wave has begun to form. This wave has already taken a five-wave structure. Judging by the size of the first wave, the fifth wave may turn out to be shortened. Based on this, I do not expect Bitcoin to rise above $110,000–115,000 in the coming months.

Additionally, wave 4 has taken on a three-wave structure, which further confirms the validity of the current wave analysis. Since the formation of the anticipated wave 5 has begun, entry points for buying should be considered. However, as I mentioned earlier, this wave may soon be completed—or may already be over.

The news background has supported Bitcoin's growth, primarily due to continuous inflows of institutional investments, government-backed purchases, and interest from pension funds. However, Trump and his policies could drive investors out of the market, and the trend cannot remain bullish indefinitely.

Looking at the current structure of wave 2 within wave 5, I doubt that it is actually wave 2 of 5. I am more inclined to believe that the upward trend is nearing completion.

What does the US wealth fund have to do with Bitcoin?

On Tuesday, BTC/USD plunged by $5,200. Bitcoin continues to swing back and forth, but overall, it is gradually sliding downward.

I do not subscribe to the belief that every global or US event impacts the cryptocurrency market—or Bitcoin in particular. In my view, investor sentiment remains the key driving force behind Bitcoin's movements. The easiest way to analyze this sentiment is through wave analysis or other technical indicators.

At this moment, I do not see signs that the market is preparing for another major upward move. Bitcoin has been in an uptrend for two years, but cycles still exist—and cryptocurrency is not gold. In my opinion, "digital gold" is on the verge of a serious collapse.

Furthermore, Trump's new US Wealth Fund is unlikely to help Bitcoin in any way. Imagine you have capital to invest—would you buy an asset at its historical peak? Donald Trump, who has been a businessman his entire life, certainly does not plan to buy Bitcoin at $100,000 for the US fund.

Instead, Bitcoin's price must first be pushed lower before large-scale accumulation can begin. When it comes to manipulations in the crypto market (which, unlike the forex market, is largely unregulated), even children understand how it works. Everyone remembers the times when a single tweet from Elon Musk could send Bitcoin soaring or crashing by $10,000.

Conclusions

Based on my BTC/USD wave analysis, I conclude that Bitcoin's bullish run is nearing its end. This may be an unpopular opinion, but the fifth wave could turn out to be shortened. If this assumption is correct, we could soon witness a crash or a complicated correction. Therefore, I do not recommend buying Bitcoin at the moment.

In the near future, Bitcoin could drop below the low of wave 4, which would confirm a transition into a bearish trend structure.

On higher wave timeframes, we can observe a completed five-wave bullish formation. This suggests that a corrective downward structure or a bearish market phase may soon begin.

Key principles of my analysis:

1. Wave structures should be simple and clear. Complex patterns are difficult to trade and often change.

2. If you are uncertain about the market trend, it's better to stay out.

3. There is no 100% certainty in price direction. Always use Stop Loss orders to protect your positions.

4. Wave analysis can be combined with other analytical methods and trading strategies for a more comprehensive approach.

Смотрите также