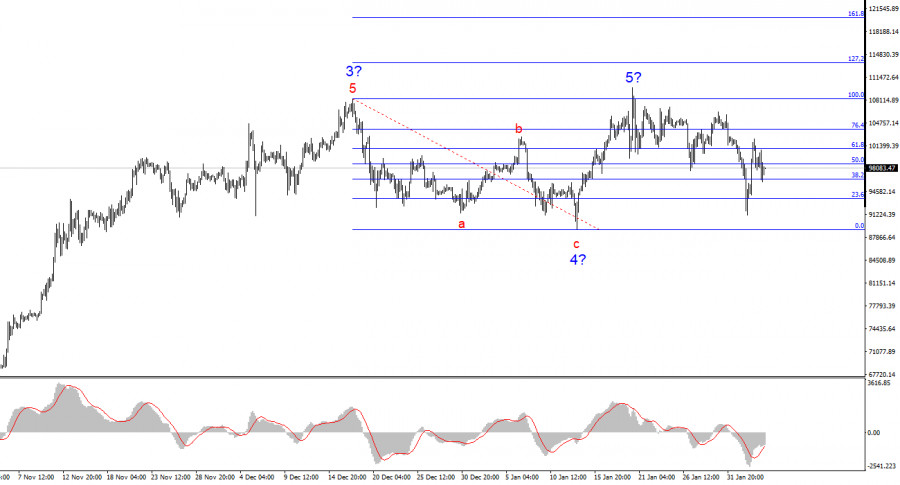

EUR/USD Forecast for February 5, 2025

Technical analysis

2025-02-05 03:03:55

Yesterday's data on factory orders and job openings in the U.S. allowed the euro to not only close the gap from Monday but also to support strong resistance levels, suggesting potential medium-term growth. Factory orders in December declined by 0.9% (forecast: -0.7%), while the number of job openings dropped from 8.156 million to 7.600 million, against expectations of 8.010 million. These figures raise concerns ahead of Friday's crucial labor market data.

If the upcoming data proves weak, the price could rise above the intersection of trendlines on the weekly chart, and continue its ascent toward the range of 1.0696 to 1.0778—historically significant highs indicated on the chart. The 1.0696 level aligns with the 50% retracement of the entire downward movement since September of last year.

On the daily chart, the price has moved above the balance indicator line, and the Marlin oscillator has returned to positive territory. The first target for growth in this alternative scenario is 1.0458, followed by 1.0520.

However, the primary bearish scenario has not been invalidated. For a bullish confirmation, the current week must close above the trendlines, meaning above current prices. This outcome depends on the market's reaction to Friday's labor data. There remains a high likelihood of the price falling back below 1.0320, which is under the MACD line on the daily chart.

On the four-hour chart, the Marlin oscillator is rising in positive territory, but the balance line and the MACD line at 1.0428 pose obstacles to reaching the 1.0458 target. This suggests a potential price reversal, leading to a drop below 1.0350, either from current levels or from 1.0428. Overall, the price is entering a period of uncertainty that may persist until Friday evening.

Смотрите также