Trading Recommendations for the Cryptocurrency Market on June 5

Crypto-currencies

2025-06-05 07:20:53

Bitcoin is struggling to reach $106,000 less frequently and is dropping toward $104,000 more often, which is a rather concerning short-term signal. Sooner or later, this pattern could lead to a larger correction for BTC, possibly resulting in a strong sell-off. On the other hand, Ethereum remains within its sideways channel and does not currently cause much concern.

Meanwhile, U.S. Senator Bill Hagerty stated in an interview yesterday that the GENIUS Act on stablecoins will bring the U.S. payment system into the 21st century. According to him, the current regulatory framework for financial innovation is outdated and no longer meets the demands of a rapidly evolving digital economy. The GENIUS Act aims to create clear and transparent rules for stablecoins, encouraging investment and innovation in the sector. A key element of the bill is the requirement for stablecoin reserves, intended to ensure their stability and protect investors from potential risks. Moreover, the GENIUS Act proposes the creation of a federal regulator to oversee the stablecoin market, which would prevent fragmentation and contradictions across different states.

Proponents argue that the bill will create favorable conditions for developing next-generation payment systems — faster, cheaper, and more accessible to all Americans. This could increase U.S. competitiveness in the global financial market and strengthen its leading position in innovation. However, critics express concerns about the potential risks associated with stablecoins and call for a more cautious approach to regulating this area.

As for the intraday strategy on the cryptocurrency market, I plan to remain active and will take advantage of any major pullbacks in Bitcoin and Ethereum. I believe that the overall bull market is still underway and will continue to develop in the medium term.

As for short-term trading, the strategy and conditions are described below.

Bitcoin

Buy Scenario

Scenario #1: Today, I plan to buy Bitcoin at the entry point around $104,700, targeting a rise to $105,300. I will exit long positions near $105,300 and immediately sell on a pullback.

Important: Before buying on a breakout, ensure the 50-day moving average is below the current price and the Awesome Oscillator is in positive territory.

Scenario #2: Bitcoin can also be bought from the lower boundary of $104,200 if there is no market reaction to its breakout, aiming for $104,700 and $105,300.

Sell Scenario

Scenario #1: I plan to sell Bitcoin today at the entry point around $104,200, targeting a drop to $103,600. I will exit short positions near $103,600 and immediately buy on a pullback.

Important: Before selling on a breakout, ensure the 50-day moving average is above the current price and the Awesome Oscillator is in negative territory.

Scenario #2: Bitcoin can also be sold from the upper boundary of $104,700 if there is no market reaction to its breakout, targeting $104,200 and $103,600.

Ethereum

Buy Scenario

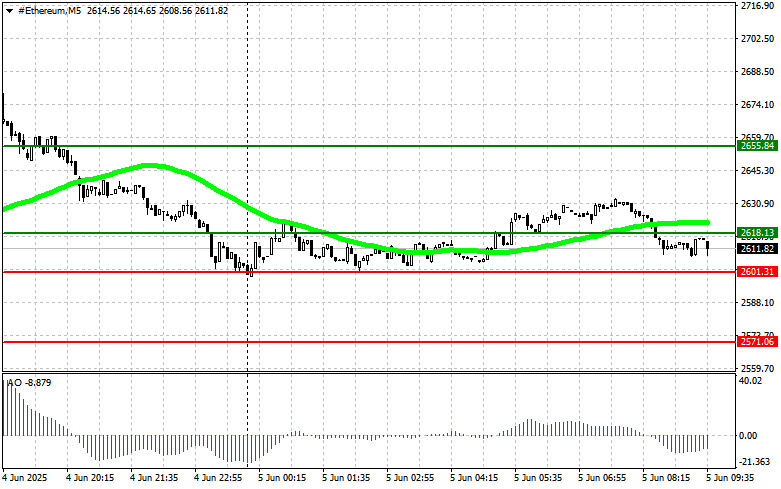

Scenario #1: Today, I plan to buy Ethereum at the entry point around $2,618, targeting a rise to $2,655. I will exit long positions near $2,655 and immediately sell on a pullback.

Important: Before buying on a breakout, ensure the 50-day moving average is below the current price and the Awesome Oscillator is in positive territory.

Scenario #2: Ethereum can also be bought from the lower boundary of $2,601 if there is no market reaction to its breakout, aiming for $2,618 and $2,655.

Sell Scenario

Scenario #1: I plan to sell Ethereum at the entry point around $2,601 today, targeting a drop to $2,571. I will exit short positions near $2,571 and immediately buy on a pullback.

Important: Before selling on a breakout, ensure the 50-day moving average is above the current price and the Awesome Oscillator is in negative territory.

Scenario #2: If the market does not react to Ethereum's breakout, it can also be sold from the upper boundary of $2,618, targeting $2,601 and $2,571.

Смотрите также