Trading tips for crypto market on July 30 (North American session)

Crypto-currencies

2025-07-30 11:12:40

Bitcoin remains firmly above $118,000, clearly targeting a potential breakout above $120,000. Ethereum has seen a slight correction but continues to trade within a channel, signaling further upside potential.

Today's Federal Reserve meeting could boost the cryptocurrency market. Any hint from FOMC members about a potential rate cut in September could act as a catalyst for a broader rally. Such comments would be interpreted as a sign of easing economic pressure, which would, in turn, spark demand for riskier assets, including digital currencies.

In addition to the Fed meeting, a report on cryptocurrencies set to be released today could also serve as a catalyst for Bitcoin's growth. Although a White House spokesperson said the focus of the first official crypto report will be on the regulatory framework rather than a strategic crypto reserve, such an event could still be interpreted positively by the market.

Investors are eagerly awaiting details on how the US government plans to handle digital assets going forward. Recently introduced, clear, and balanced rules have helped attract institutional investors, who previously hesitated due to legal uncertainty. The report may touch on taxation, consumer protection, and anti-money laundering efforts. It's important that regulation strikes a balance — addressing risks while recognizing the potential benefits of crypto.

Intraday strategy I plan to continue buying major dips in Bitcoin and Ethereum, banking on the continuation of the medium-term bull trend, which remains intact. For short-term trades, here is the strategy.

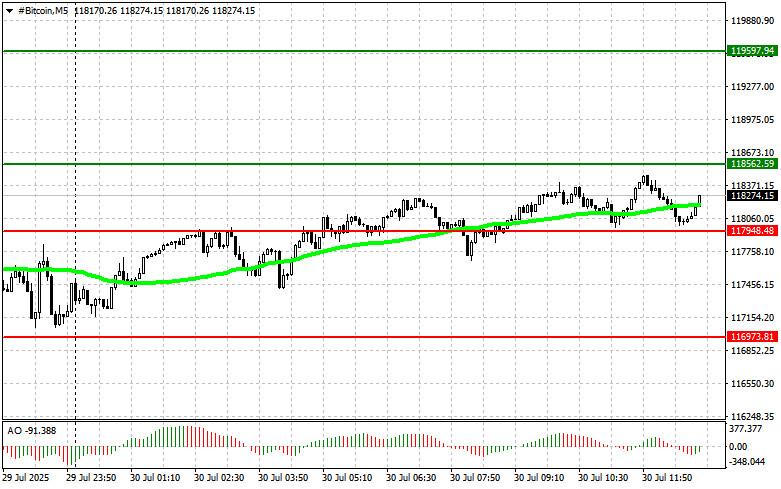

Bitcoin

Buy scenarios

Scenario 1: I will buy Bitcoin today upon reaching the entry point near $118,600, targeting a rise to $119,500. I will exit longs and sell on the bounce near $119,500. Before buying a breakout, I'll confirm that the 50-day moving average is below the current price, and the Awesome Oscillator is above zero.

Scenario 2: A buy scenario is also possible from the lower border at $118,000, provided there's no bearish reaction to its break. Targets remain $118,600 and $119,500.

Sell scenarios

Scenario 1: I will sell Bitcoin upon reaching $118,000, targeting a drop to $117,400. I will exit shorts and go long on the bounce near $117,400. Before selling a breakout, I'll confirm that the 50-day moving average is above the current price, and the Awesome Oscillator is below zero.

Scenario 2: A short is also possible from the upper border at $118,600, if there's no bullish reaction to its break. Targets are $118,000 and $117,400.

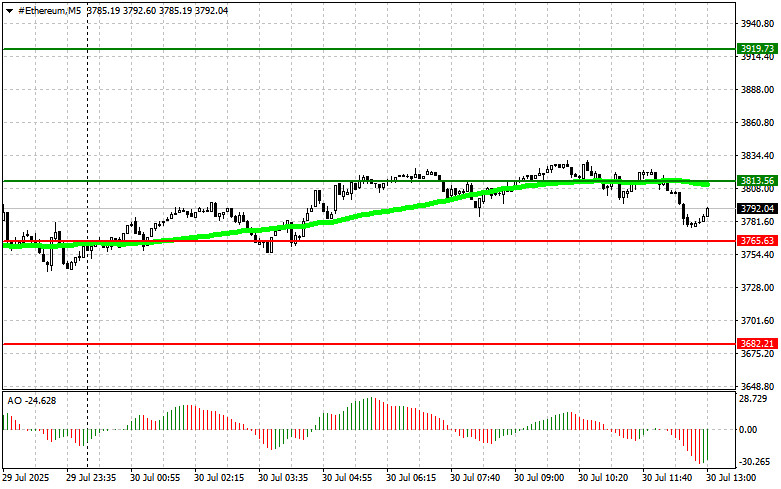

Ethereum

Buy scenarios

Scenario 1: I will buy Ethereum today upon reaching the entry point near $3,813, targeting a rise to $3,919. I will exit longs and sell on the bounce near $3,919. Before buying a breakout, I'll confirm that the 50-day moving average is below the current price, and the Awesome Oscillator is above zero.

Scenario 2: We could open long positions from the lower border at $3,765, provided there's no bearish reaction to its break. Targets remain $3,813 and $3,919.

Sell scenarios

Scenario 1: I will sell Ethereum today upon reaching $3,765, targeting a drop to $3,682. I will exit shorts and buy on the bounce near $3,682. Before selling a breakout, I'll confirm that the 50-day moving average is above the current price, and the Awesome Oscillator is below zero.

Scenario 2: Short positions could be opened from the upper border at $3,813, if there's no bullish reaction to its break. Targets are $3,765 and $3,682.

Смотрите также