Trading Recommendations for the Cryptocurrency Market on August 20

Crypto-currencies

2025-08-20 08:02:00

Bitcoin's collapse to around $ 112,500 has sparked widespread discussion about whether the bull market unfolding this year has come to an end.

Institutional buying is steadily declining, new market participants are not appearing, and outflows from spot ETFs continue. All of this is quite a worrying short-term signal, sparking some panic among speculators.

Falling institutional demand deprives the market of the necessary support, while the lack of new participants exacerbates the problem, limiting growth and development opportunities. Outflows from spot ETFs, in turn, signal rising investor distrust in the current market state. This may be due to various factors, including macroeconomic uncertainty, regulatory risks, or simply profit-taking after a period of rapid growth — the latter seems the most likely explanation. Regardless of the reasons, continued outflows put additional pressure on prices and form a downward trend.

Against this backdrop, it is not surprising that the Fear and Greed Index fell to 44 — the lowest since June 22. At this level, it reflects prevailing neutral investor sentiment, which points to uncertainty regarding the market's next direction. Some time ago, greed dominated, pushing prices upward; now, the situation has changed, and investors are exercising caution. The decline in the Fear and Greed Index can be interpreted as a potential trend reversal signal. Although not a guarantee, such declines have often historically preceded periods of consolidation or even correction in the market. Investors should closely monitor further index dynamics to assess the strength of the current trend and the likelihood of change.

The neutral zone where the index is now indicates that the market is searching for new drivers for growth or, conversely, new reasons for a decline. In the coming days and weeks, key factors shaping investor sentiment will be macroeconomic data and geopolitical developments.

As for intraday strategy in the cryptocurrency market, I will continue to rely on large pullbacks in Bitcoin and Ethereum, expecting the medium-term bull market — which is still intact — to continue.

For short-term trading, the strategy and conditions are outlined below.

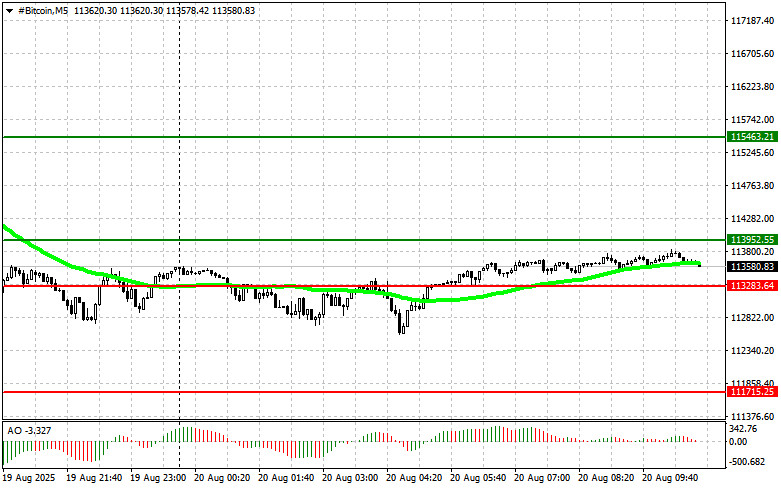

Bitcoin

Buy Scenario

Scenario #1: Today, I plan to buy Bitcoin at the entry point around $113,900 with a target at $115,400. Around $115,400, I intend to exit long positions and immediately sell on the rebound. Before breakout buying, make sure the 50-day moving average is below the current price and the Awesome Oscillator is above zero.

Scenario #2: Buying Bitcoin is also possible from the lower boundary at $113,200 if there is no market reaction to its breakout, with targets at $113,900 and $115,400.

Sell Scenario

Scenario #1: Today, I plan to sell Bitcoin at the entry point around $113,200 with a target at $111,700. Around $111,700, I intend to exit short positions and immediately buy on the rebound. Before breakout selling, make sure the 50-day moving average is above the current price and the Awesome Oscillator is below zero.

Scenario #2: Selling Bitcoin is also possible from the upper boundary at $113,900 if there is no market reaction to its breakout, with targets at $113,200 and $111,700.

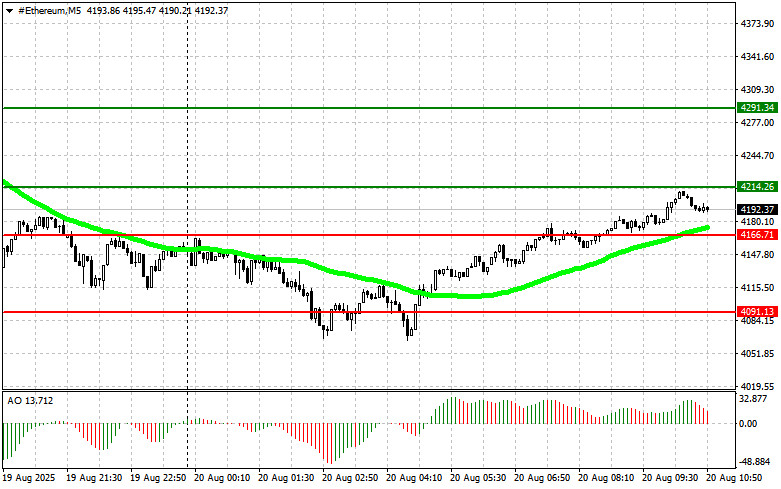

Ethereum

Buy Scenario

Scenario #1: Today, I plan to buy Ethereum at the entry point around $4,214 with a target at $4,291. Around $4291, I intend to exit long positions and immediately sell on the rebound. Before breakout buying, make sure the 50-day moving average is below the current price and the Awesome Oscillator is above zero.

Scenario #2: Buying Ethereum is also possible from the lower boundary at $4,166 if there is no market reaction to its breakout, with targets at $4,214 and $4,291.

Sell Scenario

Scenario #1: Today, I plan to sell Ethereum at the entry point around $4,166 with a target at $4,091. Around $4091, I intend to exit short positions and immediately buy on the rebound. Before breakout selling, make sure the 50-day moving average is above the current price and the Awesome Oscillator is below zero.

Scenario #2: Selling Ethereum is also possible from the upper boundary at $4,214 if there is no market reaction to its breakout, with targets at $4,166 and $4,091.

Смотрите также