Trading Recommendations for the Cryptocurrency Market on September 16

Crypto-currencies

2025-09-16 06:50:50

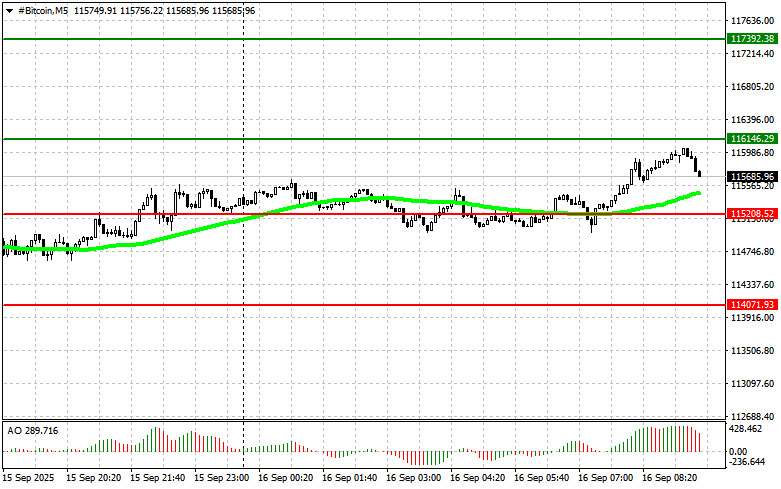

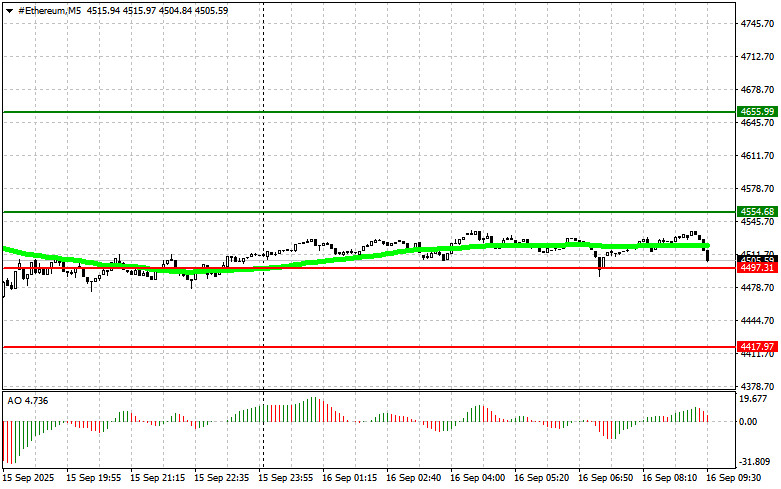

Yesterday, Bitcoin slipped down to the $114,600 area and spent most of the day there. Today, however, active buying with the opening of the European session is an encouraging sign. The key question is whether BTC can stay above $116,000 rather than fall further as it did yesterday—we'll know soon. If Bitcoin does hold this level, the road to $117,000 and $119,000 opens up. Ethereum remained at the same levels as yesterday.

Meanwhile, some crypto market experts—including Arthur Hayes—expect that once the Fed launches QE, BTC could reach $200,000 by the end of 2025. Under favorable conditions, Bitcoin could rise to $250,000, and by the end of 2028, it could reach $1,000,000. These ambitious forecasts are based on several key factors. First, the expected resumption of quantitative easing (QE) by the Fed is likely to inject more liquidity into financial markets, stimulating investment in riskier assets, including cryptocurrencies. This scenario assumes that low interest rates and continued monetary stimulus will support Bitcoin over the long term.

Second, growing institutional interest in Bitcoin—reflected by rising trading volumes on regulated platforms and the advent of new investment vehicles like ETFs—lays the groundwork for further price appreciation. Institutional investors, with their large resources, can boost liquidity and reduce volatility, making Bitcoin more attractive to a broader audience.

However, it's important to remember that the crypto market remains highly volatile and sensitive to regulatory shifts, technological innovation, and macroeconomic factors. Therefore, such price forecasts should be treated with caution, keeping risks in mind while investing in cryptocurrencies.

For intraday crypto strategies, I'll continue looking to buy into major dips in Bitcoin and Ethereum, aiming to capitalize on the still-intact medium-term bull market. For short-term trading, today's strategy is outlined below.

Bitcoin

Buy Scenario

- Scenario #1: I plan to buy Bitcoin today at an entry point around $116,100, targeting a rise to $117,400. Around $117,400, I'll exit longs and sell on the bounce. Before entering a breakout long, confirm the 50-day moving average is below the current price and the Awesome Oscillator is above zero.

- Scenario #2: Buy Bitcoin from the lower boundary at $115,200 if there's no major downside reaction, aiming for a rebound to $116,100 and $117,400.

Sell Scenario

- Scenario #1: I plan to sell Bitcoin at $115,200, targeting a fall to $114,000. Around $110,900, I'll exit shorts and buy on the bounce. Before entering a breakout short, confirm the 50-day moving average is above the current price and the Awesome Oscillator is below zero.

- Scenario #2: Sell Bitcoin from the upper boundary at $116,100 if there's no bullish breakout, targeting moves down to $115,200 and $114,000.

Ethereum

Buy Scenario

- Scenario #1: I plan to buy Ethereum today at around $4,554, targeting a rise to $4,655. Around $4,655, I'll exit longs and sell on the bounce. Before entering a breakout long, confirm the 50-day moving average is below the current price and the Awesome Oscillator is above zero.

- Scenario #2: Buy Ethereum from the lower boundary at $4,497 if there's no negative reaction to a breakdown, targeting reversals to $4,554 and $4,655.

Sell Scenario

- Scenario #1: I plan to sell Ethereum at $4,497, targeting a drop to $4,417. Around $4,417, I'll exit shorts and buy on the bounce. Before entering a breakout short, confirm the 50-day moving average is above the current price and the Awesome Oscillator is below zero.

- Scenario #2: Sell Ethereum from the upper boundary at $4,554 if there is no strong follow-up to the breakout, targeting moves to $4,497 and $4,417.

Смотрите также