Trading Recommendations for the Cryptocurrency Market on September 18

Crypto-currencies

2025-09-18 06:59:16

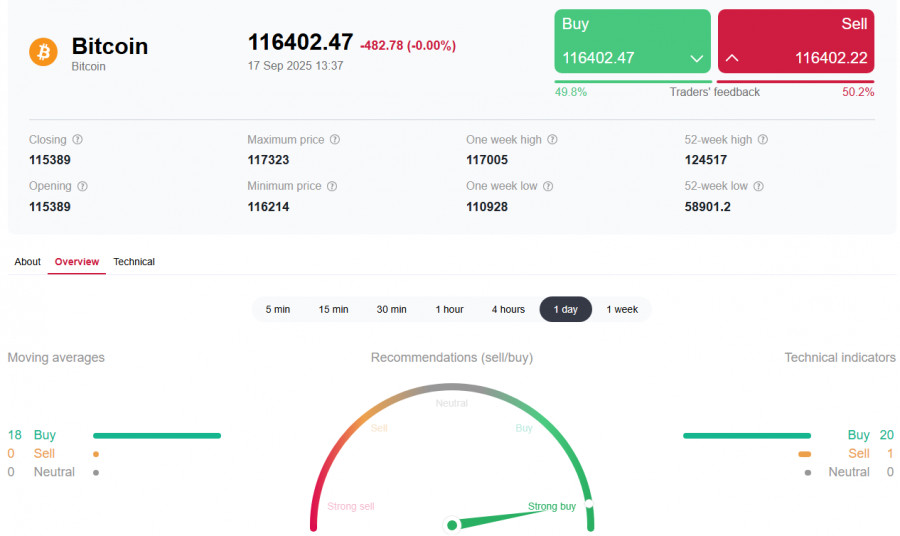

During the Asian session, Bitcoin stopped just one step away from the 118,000 mark, although only yesterday, after the Federal Reserve's rate decision, BTC had updated the level of 114,800.

Several factors drive this sharp rally: the continued inflow of institutional investors, rising interest from retail traders, and the Fed's ongoing monetary easing. Institutional players, who had previously shown caution, are likely to keep building positions in Bitcoin now that the Fed has confirmed its dovish stance, viewing BTC as a hedge against inflation and instability in traditional financial markets.

Before the Fed's decision, the average daily BTC purchases by public companies stood at 1,428 BTC, the lowest since May this year. But after yesterday's meeting, this could change. Renewed demand may push BTC above 118,000, a key level separating the market from the path toward its all-time high near 124,500. However, if the price fails to hold above that barrier soon, a move down toward 100,000 will be almost guaranteed. With plenty of time before the Fed's October meeting, the market still has room to revisit 100K ahead of the next rate cut.

For the intraday strategy, I will continue to rely on buying major dips in BTC and ETH, expecting the bullish market trend to extend in the medium term.

For short-term trading, here are the scenarios:

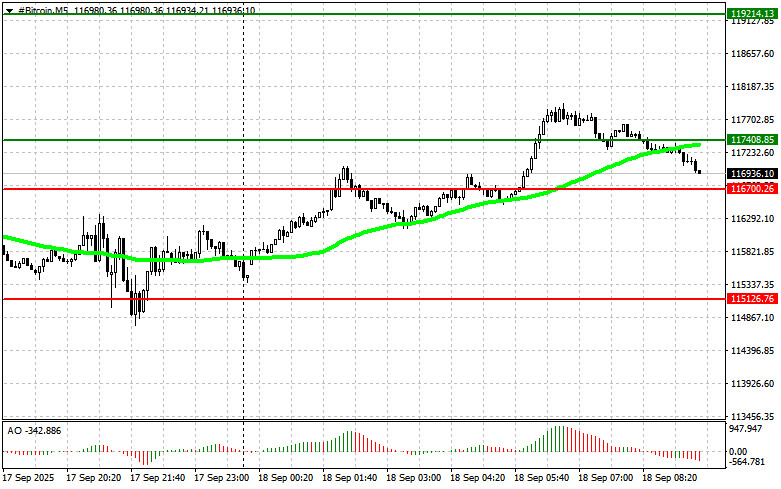

Bitcoin

Buy Scenario

- Scenario #1: I plan to buy Bitcoin today at an entry point near 117,400, targeting 119,200. Around 119,200, I will exit long positions and immediately sell on the rebound. Before buying on a breakout, make sure the 50-day moving average is below the current price and the Awesome Oscillator is above zero.

- Scenario #2: Buying is also possible from the lower boundary at 116,700 if there is no market reaction to its breakout, with upside targets at 117,400 and 119,200.

Sell Scenario

- Scenario #1: I plan to sell Bitcoin today at an entry point near 116,700, targeting 115,100. Around 115,100, I will exit shorts and immediately buy on the rebound. Before selling on a breakout, make sure the 50-day moving average is above the current price and the Awesome Oscillator is below zero.

- Scenario #2: Selling is also possible from the upper boundary at 117,400 if there is no market reaction to its breakout, with downside targets at 116,700 and 115,100.

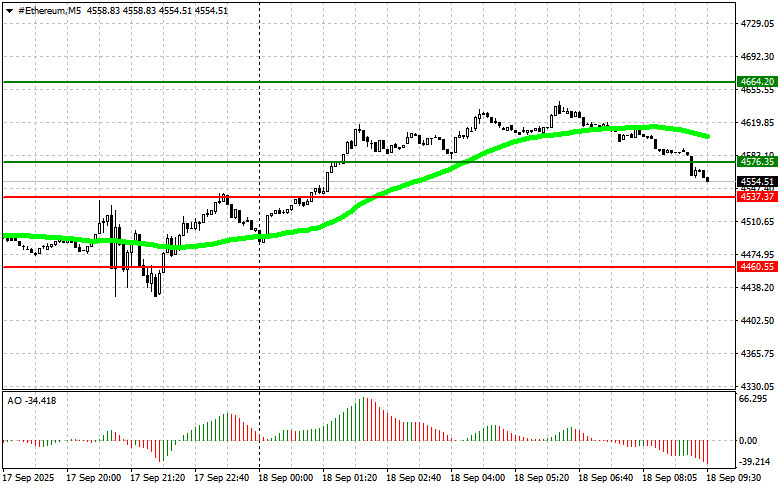

Ethereum

Buy Scenario

- Scenario #1: I plan to buy Ethereum today at an entry point near 4,576, targeting 4,664. Around 4,664, I will exit long positions and immediately sell on the rebound. Before buying on a breakout, make sure the 50-day moving average is below the current price and the Awesome Oscillator is above zero.

- Scenario #2: Buying is also possible from the lower boundary at 4,537 if there is no market reaction to its breakout, with upside targets at 4,576 and 4,664.

Sell Scenario

- Scenario #1: I plan to sell Ethereum today at an entry point near 4,537, targeting 4,460. Around 4,460, I will exit shorts and immediately buy on the rebound. Before selling on a breakout, make sure the 50-day moving average is above the current price and the Awesome Oscillator is below zero.

- Scenario #2: Selling is also possible from the upper boundary at 4,576 if there is no market reaction to its breakout, with downside targets at 4,537 and 4,460.

Смотрите также