Trading Recommendations for the Cryptocurrency Market on September 30

Crypto-currencies

2025-09-30 07:07:22

Bitcoin continued its rally during U.S. trading yesterday and gained further during today's Asian session, reaching the 114,800 mark. Ethereum also posted significant gains, consolidating above $4,000.

Yesterday, the SEC required issuers of spot ETFs for LTC, XRP, SOL, ADA, and DOGE to withdraw their 19b-4 filings, following the approval of general listing standards that replace the need for individual submissions. Clearly, this change will significantly accelerate the approval process for new crypto ETFs, making the old approach obsolete. As I noted earlier, the SEC's decision marks a turning point in recognizing cryptocurrencies as a legitimate asset class. The withdrawal of individual applications frees up resources for both the regulator and issuers, allowing them to focus on creating more efficient and secure products. Moreover, standardized listing rules increase transparency and predictability in the process, reducing uncertainty for investors and supporting further development of the crypto industry.

The SEC's decision serves as a strong signal that cryptocurrencies are no longer a marginal phenomenon but are becoming an integral part of the financial future. Simplifying the ETF listing process is only one step in this direction, but it highlights the regulator's readiness to embrace cooperation and innovation—key to unlocking the full potential of crypto technologies.

As for intraday strategy in the cryptocurrency market, I will continue to rely on significant pullbacks in Bitcoin and Ethereum as opportunities, expecting the medium-term bull market, which remains intact, to develop further.

Below are the short-term trading strategies and conditions.

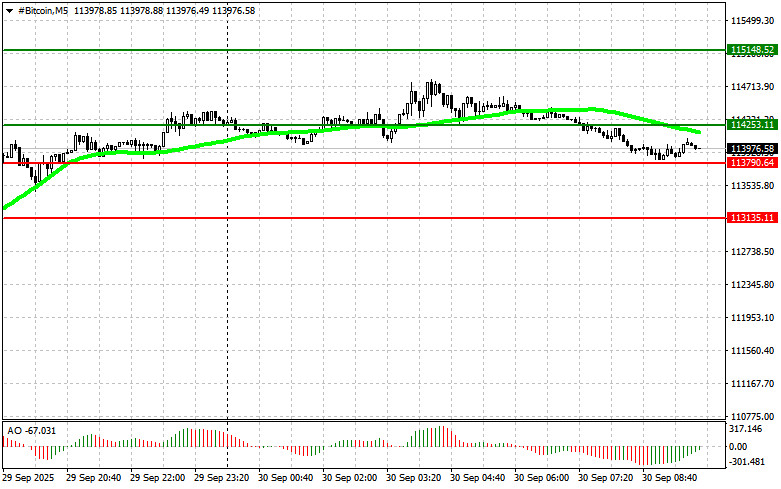

Bitcoin

Buy Scenario

- Scenario 1: I plan to buy Bitcoin today at the entry point around $114,200 with a target of $115,100. Around $115,100, I will exit my long position and sell immediately on a rebound. Before buying on a breakout, it is important to confirm that the 50-day moving average is below the current price and the Awesome Oscillator is above zero.

- Scenario 2: Bitcoin can also be bought from the lower boundary at $113,700 if there is no market reaction to its breakout, with a target of $114,200 and $115,100.

Sell Scenario

- Scenario 1: I plan to sell Bitcoin today at the entry point around $113,700 with a target of $113,100. Around $113,100, I will exit shorts and buy immediately on a rebound. Before selling on a breakout, it is important to confirm that the 50-day moving average is above the current price and the Awesome Oscillator is below zero.

- Scenario 2: Bitcoin can also be sold from the upper boundary at $114,200 if there is no market reaction to its breakout, targeting $113,700 and $113,100.

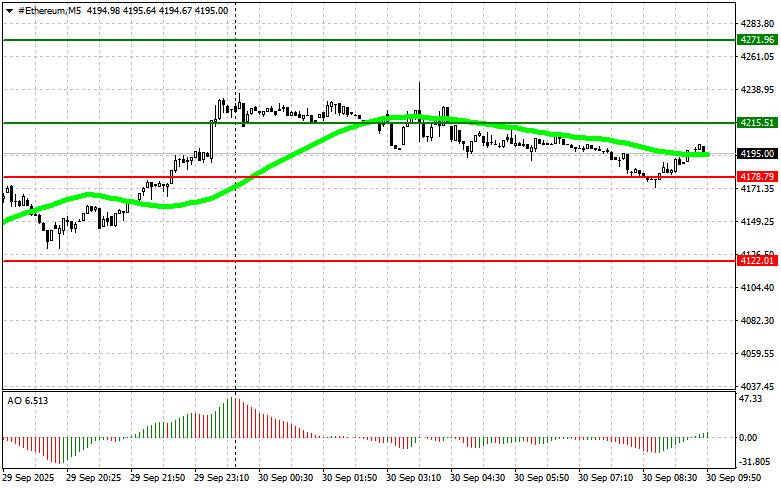

Ethereum

Buy Scenario

- Scenario 1: I plan to buy Bitcoin today at the entry point around $114,200 with a target of $115,100. Around $115,100, I will exit my long position and sell immediately on a rebound. Before buying on a breakout, it is important to confirm that the 50-day moving average is below the current price and the Awesome Oscillator is above zero.

- Scenario 2: Bitcoin can also be bought from the lower boundary at $113,700 if there is no market reaction to its breakout, with a target of $114,200 and $115,100.

Sell Scenario

- Scenario 1: I plan to sell Bitcoin today at the entry point around $113,700 with a target of $113,100. Around $113,100, I will exit shorts and buy immediately on a rebound. Before selling on a breakout, it is important to confirm that the 50-day moving average is above the current price and the Awesome Oscillator is below zero.

- Scenario 2: Bitcoin can also be sold from the upper boundary at $114,200 if there is no market reaction to its breakout, targeting $113,700 and $113,100.

Смотрите также