analytics1_1

EUR/USD: Simple Trading Tips for Beginner Traders on September 30. Analysis of Yesterday's Forex Trades

EUR/USD: Simple Trading Tips for Beginner Traders on September 30. Analysis of Yesterday's Forex Trades

Forecast

2025-09-30 07:26:14

Trade Review and Advice on Trading the Euro

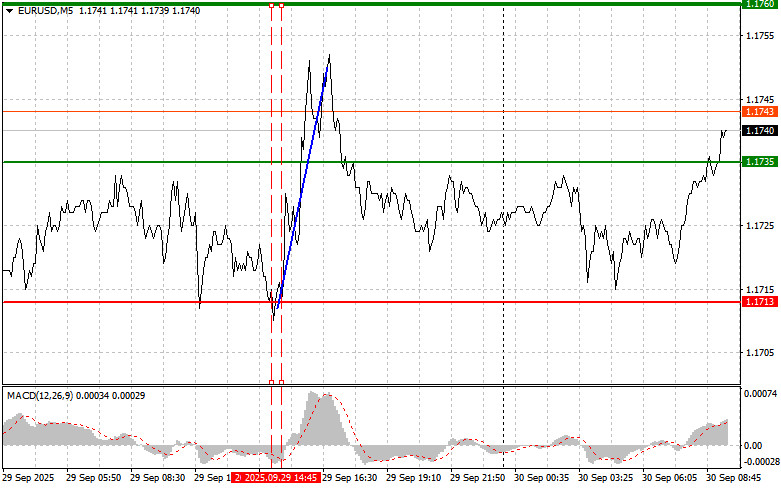

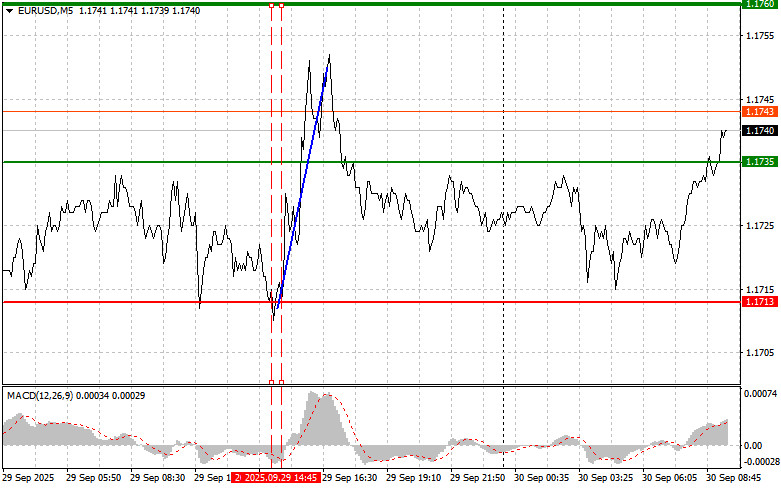

The test of 1.1713 coincided with the MACD indicator moving well below the zero line, which limited the downside potential for the pair. For this reason, I did not sell the euro. The second test of this level occurred while the MACD was in the oversold area, which allowed scenario No. 2 for buying to be realized, resulting in an increase of more than 35 pips.

The probability of a U.S. government shutdown has risen sharply following negotiations between Democratic and Republican representatives. Against this backdrop, investors are growing increasingly concerned about how political instability could impact the U.S. economy, potentially putting downward pressure on the dollar. The situation is further complicated by the approaching deadline for approving the new fiscal year's budget. If Congress fails to reach an agreement, government agencies will be forced to suspend operations temporarily. This would reduce the availability of public services, slow economic growth, and increase instability in financial markets. Analysts warn that a prolonged shutdown could have significant negative consequences for the dollar by undermining confidence in the resilience of the U.S. economy and increasing the risk of a sovereign credit rating downgrade.

Today is rich in German macroeconomic data, as reports on employment dynamics, the unemployment rate, retail trade, and inflation are scheduled for release. In addition, remarks by European Central Bank President Christine Lagarde will be in the spotlight. Market participants will pay particular attention to German labor market data. Any deviations from forecasts could trigger significant movements in the currency markets, which would directly impact the euro. Retail sales data will also be important: higher sales indicate consumer confidence and a healthy economy, while declines may signal reduced spending and potential economic headwinds. Inflation, as measured by the consumer price index, will also be closely analyzed. An acceleration of inflation could encourage tighter monetary policy, potentially strengthening the euro.

Lagarde's speech will be the day's key event. Traders will closely scrutinize her comments on the eurozone's economic situation, inflation outlook, and future monetary policy. Her statements may significantly influence sentiment and the euro's trajectory.

As for the intraday strategy, I will focus more on implementing scenarios #1 and #2.

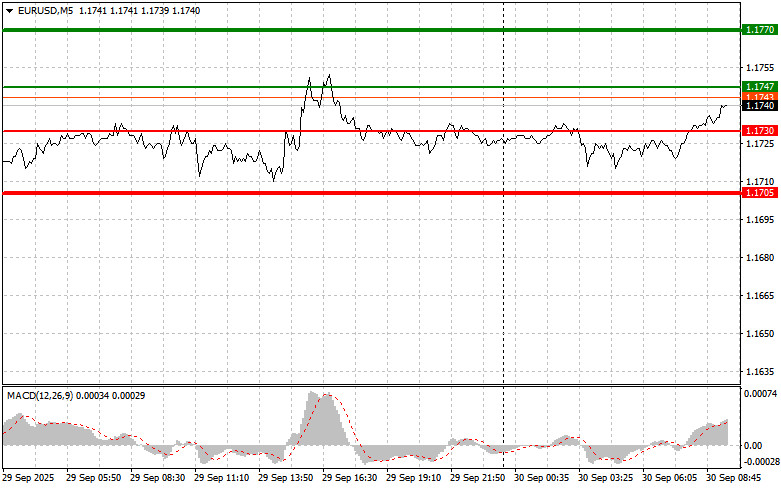

Buy Scenario

Scenario No. 1: Buy the euro today at 1.17347 (green line on the chart) with a target of 1.1770. At 1.1770, I plan to exit longs and enter short positions on a rebound, aiming for a 30–35-pip move from the entry point. Euro upside is likely only if ECB officials maintain a hawkish stance.

Important: Before buying, ensure that the MACD indicator is above the zero line and just beginning to rise from it.

Scenario No. 2: Another opportunity to buy the euro arises after two consecutive tests of 1.1730, provided the MACD is in the oversold zone. This would limit the downside potential and trigger a reversal upward. Growth to 1.1747 and 1.1770 can then be expected.

Sell Scenario

Scenario No. 1: Sell the euro after it moves to 1.1730 (red line on the chart), with a target at 1.1705, where I plan to exit shorts and buy immediately on a rebound, targeting a 20–25-pip move in the opposite direction. Pressure on the pair may return if the data disappoints.

Important: Before selling, ensure that the MACD indicator is below the zero line and just beginning to decline from it.

Scenario No. 2: Another opportunity to sell the euro will arise after two consecutive tests of 1.1747, while the MACD remains in the overbought zone. This would cap the pair's upside potential and trigger a downward reversal, with expected targets at 1.1730 and 1.1705.

What's on the Chart:

Thin green line – entry price at which the instrument can be bought.

Thick green line – suggested price for taking profit or manually securing profits, as further growth above this level is unlikely.

Thin red line – entry price at which the instrument can be sold.

Thick red line – suggested price for taking profit or manually securing profits, as further decline below this level is unlikely.

MACD indicator: When entering the market, it is important to refer to overbought and oversold areas.

Important. Beginner forex traders should exercise extreme caution when making entry decisions. Before important fundamental reports, it is best to stay out of the market to avoid sharp price swings. If you decide to trade during the release of news, always use stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit, especially if you don't use money management and trade large volumes. And remember: for successful trading, you need a clear trading plan, as I described above. Making spontaneous trading decisions based on the current market situation from moment to moment is a losing strategy for an intraday trader.

Смотрите также