Cryptocurrency Market Trading Recommendations for October 14

Crypto-currencies

2025-10-14 06:47:55

Bitcoin reached the $116,000 mark yesterday but once again came under pressure. Ethereum also fell after a relatively strong recovery the day before.

The intensifying trade conflict between China and the United States continues to weigh on risk assets, including the cryptocurrency market. Traders concerned about the prospects of a global economic slowdown and rising uncertainty are being cautious and reducing their exposure to assets considered high-risk. Despite growing popularity, cryptocurrencies are still perceived by many as speculative instruments prone to significant volatility.

Amid growing trade tensions, the U.S. dollar continues to strengthen, which places additional pressure on cryptocurrencies. Traditionally, a rising dollar reduces demand for alternative assets, including digital currencies. Investors often shift capital into the dollar, considering it a safer haven during economic turbulence. However, the impact of the trade war on the cryptocurrency market is not limited to negative factors. Some analysts argue that in the long term, cryptocurrencies could benefit from the weakening of the traditional financial system caused by such conflicts. Owing to their decentralized nature, cryptocurrencies may become an attractive alternative for investors seeking diversification and protection from geopolitical risks.

The trade conflict is likely to remain a key influence on the cryptocurrency market in the near future. Further escalation could lead to continued price declines, while de-escalation may help fuel a market rebound. Traders should closely monitor developments and factor in fundamentals when making investment decisions.

As for intraday strategy, the focus remains on responding to any major dips in Bitcoin and Ethereum, with the expectation of continued medium-term bullish market conditions, which are still in place.

For short-term trading, the following strategy and conditions apply:

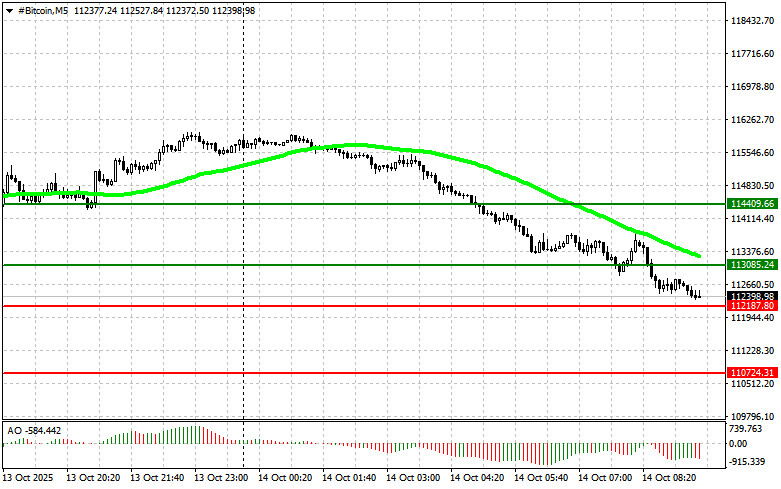

Bitcoin

Buying Scenario

Scenario 1: I will buy Bitcoin today if it reaches the entry point around $113,000 with a target at $114,400. I intend to exit long positions and sell on a bounce from $114,400. Before a breakout buy, it is necessary to confirm that the 50-day moving average is below the current price, and the Awesome Oscillator is above the zero line.

Scenario 2: A buy can also be considered from the lower boundary of $112,100, provided the market shows no reaction to a downside breakout, with targets at $113,000 and $114,400.

Selling Scenario

Scenario 1: I will sell Bitcoin today if it reaches the entry zone at $112,100 with a target at $110,700. I intend to exit short positions and buy on a bounce from $110,700. Before a breakout sell, confirm that the 50-day moving average is above the current price, and the Awesome Oscillator is below the zero line.

Scenario 2: A sell can also be considered from the upper boundary of $113,000, provided the market shows no reaction to an upside breakout, with targets at $112,100 and $110,700.

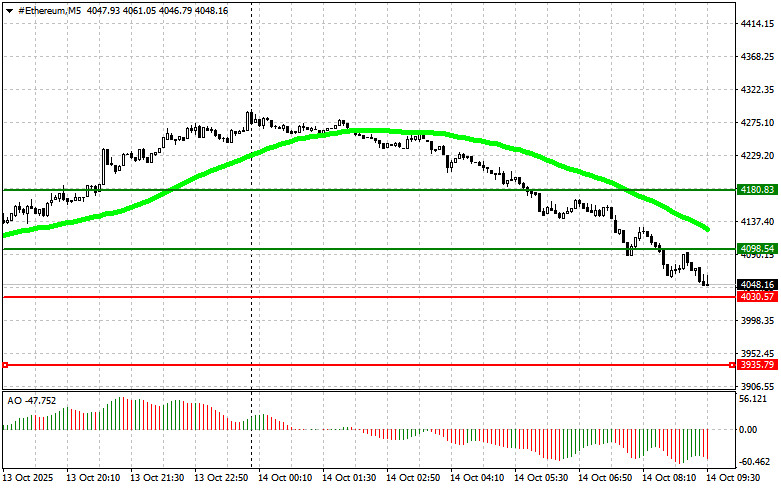

Ethereum

Buying Scenario

Scenario 1: I will buy Ethereum today at the entry point around $4098 with a target at $4180. I intend to exit long positions and sell on a bounce from $4180. Before a breakout buy, ensure that the 50-day moving average is below the price, and the Awesome Oscillator is in the positive zone.

Scenario 2: Buying can also be considered from the lower boundary of $4030 if there is no downside breakout reaction, with targets at $4098 and $4180.

Selling Scenario

Scenario 1: I will sell Ethereum today at the entry point around $4030 with a target at $3935. I intend to exit short positions and buy on a bounce from $3935. Before a breakout sell, ensure that the 50-day moving average is above the price, and the Awesome Oscillator is in the negative zone.

Scenario 2: Selling can also be considered from the upper boundary of $4098, provided there is no reaction to a breakout, with targets at $4030 and $3935.

Смотрите также