Trading tips for crypto market on October 14 (North American session)

Crypto-currencies

2025-10-14 14:17:51

Bitcoin climbs back to $110,000, Ethereum pulls back to $3,890

It's evident that leveraged capital continues to exit the market. Despite the significance of last week's event — when over $20 billion in leveraged long positions were liquidated — the fundamental structure of the market remains unchanged. Spot trading volumes are still strong, investment inflows into ETFs continue, and on-chain activity remains high.

It's important to understand that this type of liquidation serves as a painful but necessary cleansing process for the market. Excessive leverage has been flushed out, and speculative positions have been reduced. The market is now entering a consolidation phase, characterized by renewed caution, selective risk-taking, and a more deliberate recovery in confidence — both in the spot and derivatives markets.

For that reason, re-entry into long positions around the $110,000 area is justified, but traders should still consider the possibility of a deeper move down to $106,000. Trade with sufficient margin and avoid excessive leverage.

As for the intraday strategy, I'll continue to base my actions on significant dips in Bitcoin and Ethereum, aiming to position for a mid-term continuation of the bull market, which hasn't disappeared — just taken a pause.

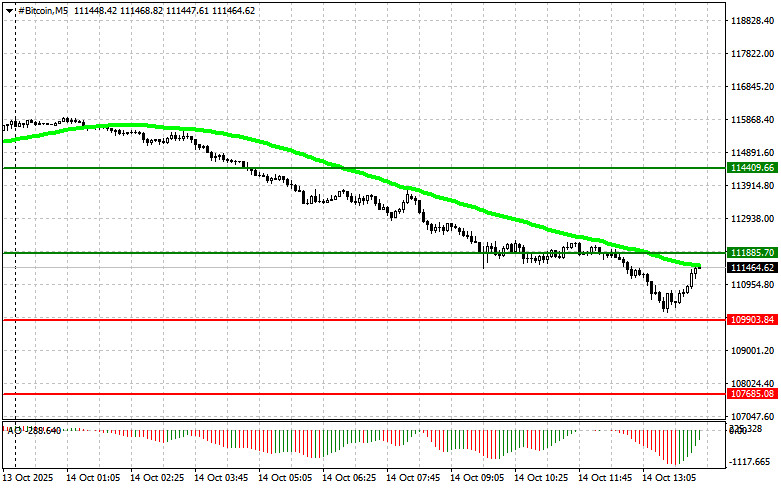

Bitcoin

Buy scenario

Scenario 1: I will buy Bitcoin today upon reaching the entry point at $111,800, with an upside target of $114,400. I plan to exit long positions around $114,400 and sell into the bounce. Before entering during a breakout, ensure that the 50-day moving average is below the current price, and the Awesome Oscillator is in positive territory.

Scenario 2: Buying is also possible from the lower border at $109,900, if there is no strong bearish reaction to that level, with a bullish target back to $111,800 and $114,400.

Sell scenario

Scenario 1: I will sell Bitcoin today upon reaching the entry point at $109,900, with a downside target of $107,600. I plan to exit short positions at $107,600 and buy during the dip. Before entering during a breakdown, ensure that the 50-day moving average is above the current price, and the Awesome Oscillator is in negative territory.

Scenario 2: Selling is also possible from the upper border at $111,800, if there is no bullish breakout, with a target back to $109,900 and $107,600.

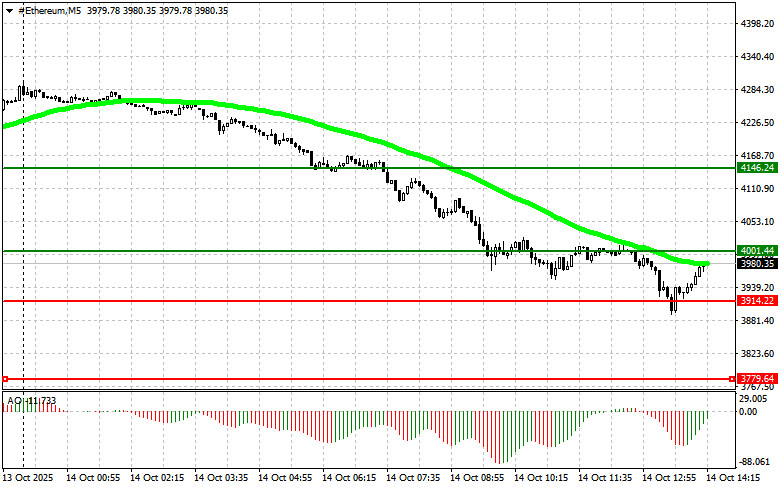

Ethereum

Buy scenario

Scenario 1: I will buy Ethereum today at the entry point of $4,000, targeting a rise to $4,146. I will exit long positions near $4,146 and sell into the bounce. Before entering on a breakout, make sure the 50-day moving average is below the current price, and the Awesome Oscillator is above zero.

Scenario 2: Buying is also possible from the lower border at $3,914, if there is no bearish confirmation, with upside targets at $4,001 and $4,146.

Sell scenario

Scenario 1: I will sell Ethereum today upon reaching the entry point at $3,914, aiming for a decline to $3,779. I will exit short positions at $3,779 and buy during the dip. Before entering during a breakdown, confirm that the 50-day moving average is above the current price, and the Awesome Oscillator is below zero.

Scenario 2: Selling is also possible from the upper border at $4,001, if there is no strong breakout, with downside targets of $3,914 and $3,779.

Смотрите также