Cryptocurrency Trading Recommendations for October 20

Crypto-currencies

2025-10-20 07:44:50

Bitcoin and Ethereum have shown a notable rebound over the past day. Bitcoin, for example, rose from $106,000 to $111,300, indicating a renewed appetite for risk assets.

One of the catalysts for renewed buying was the softening of Donald Trump's rhetoric toward China and ongoing trade tensions—the very issue that triggered last week's widespread sell-off. However, it's important to note that the recovery of the cryptocurrency market is taking place amid persistent global economic uncertainty. Much will depend on the outcome of upcoming trade negotiations between the United States and China, as well as the actions of central banks regarding monetary policy. It is worth recalling that the U.S. Federal Reserve is expected to lower interest rates at the end of this month, which could further support the cryptocurrency market.

Lower interest rates typically lead to a weaker U.S. dollar, making alternative assets like cryptocurrencies more attractive to investors. Additionally, lower rates stimulate economic activity and investment, which may increase demand for cryptocurrencies as portfolio diversification tools and inflation hedges. However, it's important to recognize that the cryptocurrency market is influenced by a wide range of factors, and the Fed's decision is only one of them. Geopolitical risks, regulatory developments, technological breakthroughs, spot ETF inflows, and investor sentiment all play significant roles in shaping cryptocurrency prices. Therefore, while a rate cut from the Fed could positively impact the market, investors should exercise caution and consider all relevant factors when making investment decisions.

As for intraday strategy in the cryptocurrency market, I plan to continue relying on strong intraday pullbacks in Bitcoin and Ethereum with the expectation that the medium-term bull market remains intact.

Details of the short-term trading strategy are outlined below:

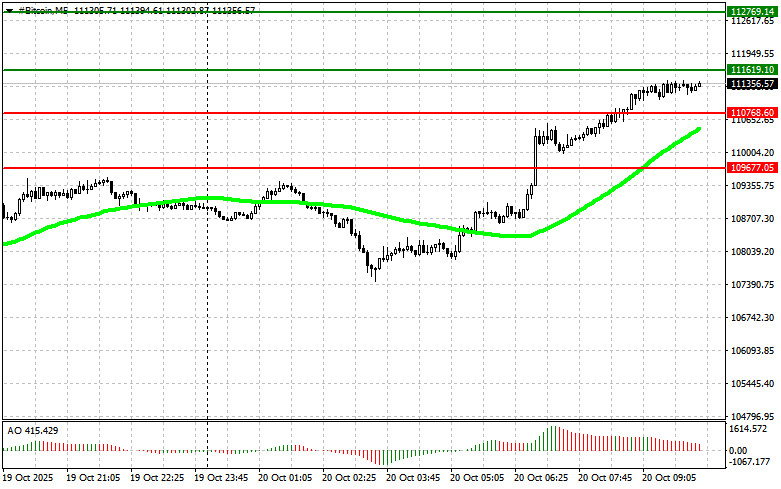

Bitcoin

Buy Scenarios

- Scenario 1: I plan to buy Bitcoin today upon reaching the entry point near $111,600 with a target at $112,700. Around $112,700, I'll exit the buy trade and immediately open a short position on the pullback.Before buying the breakout, make sure the 50-day moving average is below the current price and the Awesome Oscillator is in positive territory.

- Scenario 2: Bitcoin can also be bought from the lower boundary at $110,700 if there is no sustained market reaction to a breakout, with an upside target of $111,600 and $112,700.

Sell Scenarios

- Scenario 1: I plan to sell Bitcoin today from the entry point at $110,700 with a target of $109,600. Around $109,600, I'll exit the short position and open a buy on the bounce.Before selling the breakout, ensure that the 50-day moving average is above the current price and the Awesome Oscillator is in negative territory.

- Scenario 2: Bitcoin can also be sold from the upper boundary at $111,600 if there is no sustained market reaction to the breakout, with targets at $110,700 and $109,600.

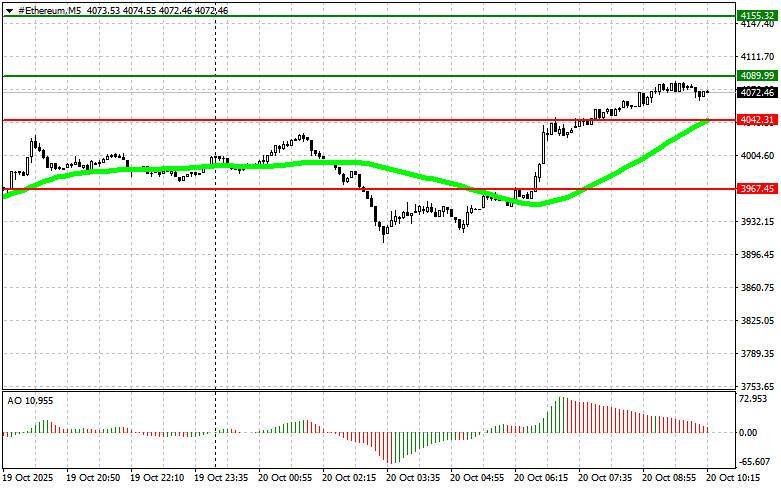

Ethereum

Buy Scenarios

- Scenario 1: I plan to buy Ethereum today upon reaching the entry point near $4,089 with a target at $4,155. Around $4,155, I'll exit the buy trade and immediately short on the pullback.Before buying the breakout, confirm that the 50-day moving average is below the current price and the Awesome Oscillator is in positive territory.

- Scenario 2: Ethereum can also be bought from the lower boundary at $4,042 if there is no reaction to a breakdown, with upside targets at $4,089 and $4,155.

Sell Scenarios

- Scenario 1: I plan to sell Ethereum today from the entry point at $4,042 with a target of $3,967. Around $3,967, I'll exit the short trade and open a buy on the bounce.Before selling the breakout, confirm that the 50-day moving average is above the current price and the Awesome Oscillator is in negative territory.

- Scenario 2: Ethereum can also be sold from the upper boundary at $4,089 if there is no reaction to the breakout, with downside targets at $4,042 and $3,967.

Смотрите также