Cryptocurrency Market Trading Recommendations for October 21

Crypto-currencies

2025-10-21 06:20:12

Bitcoin and Ethereum resumed their decline. After breaking the $109,500 support level during the Asian session, Bitcoin faced heavy selling pressure. Ethereum also dropped back below the $4,000 mark, raising concerns about a potential extended sell-off.

Adding to bearish sentiment, a report from Glassnode revealed that long-term holders (LTHs) are still actively selling BTC. This exerts additional downward pressure on the price, signaling waning long-term confidence from experienced investors—traditionally viewed as more resilient to market volatility. The increased supply could trigger a chain reaction of further sell-offs, accelerating the bearish trend. The only factor that could stop the drop is renewed institutional buying through spot ETFs, but these buyers remain on the sidelines for now.

The influence of long-term holders on the crypto market is difficult to overstate. Their activity often reflects broader community sentiment, and their exit from the asset may indicate a prolonged period of stagnation—or even deeper decline. Still, it's important to note that their selling may not be solely due to fear or uncertainty. Reasons may include profit-taking after the recent bull run, portfolio diversification, or the need to meet financial obligations.

From an intraday trading perspective, the approach remains the same: look for significant pullbacks in BTC and ETH as opportunities to enter in anticipation of a continued medium-term bull market, which remains intact for now.

As for short-term trading, the strategy and conditions are described below.

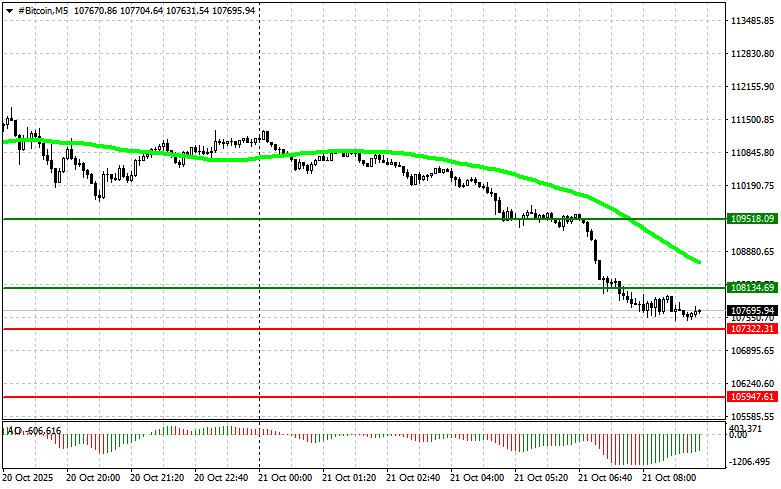

Bitcoin (BTC)

Buy Scenarios:

- Scenario 1: Buy BTC at the entry point around $108,100 with a target of $109,500. Exit long positions near $109,500 and consider selling on a retracement.

- Prerequisite: The 50-day moving average must be below the current price, and the Awesome Oscillator should be in positive territory.

- Scenario 2: Buy BTC from the lower boundary at $107,300 if the market shows no reaction to a breakdown, with targets at $108,100 and $109,500.

Sell Scenarios:

- Scenario 1: Sell BTC at the entry point of $107,300 with a target of $105,900. Exit short positions near $105,900 and consider buying on a bounce.

- Prerequisite: The 50-day moving average must be above the current price, and the Awesome Oscillator should be in negative territory.

- Scenario 2: Sell BTC from the upper boundary at $108,100 if there's no breakout reaction, targeting $107,300 and $105,900.

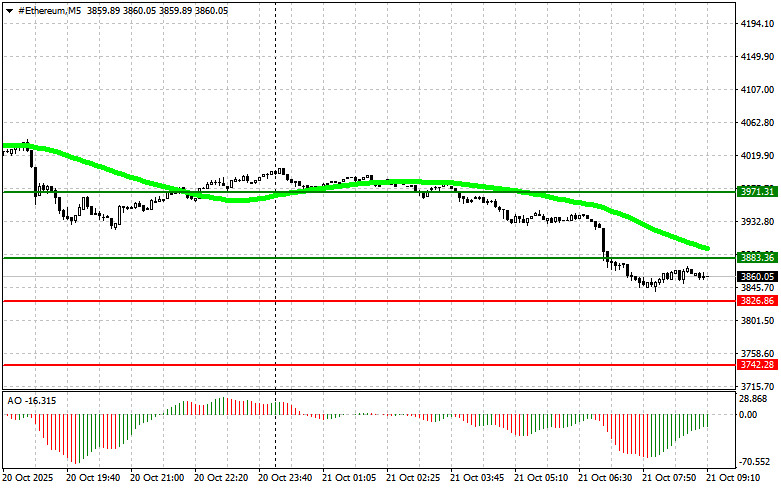

Ethereum (ETH)

Buy Scenarios:

- Scenario 1: Buy ETH at the entry point around $3,883 with a target of $3,971. Exit long positions near $3,971 and consider shorting on a pullback.

- Prerequisite: The 50-day moving average must be below the current price, and the Awesome Oscillator should be in positive territory.

- Scenario 2: Buy ETH from the lower boundary at $3,826 if there is no reaction to a breakdown, with targets at $3,883 and $3,971.

Sell Scenarios:

- Scenario 1: Sell ETH at the entry point around $3,826 with a target of $3,742. Exit short trades near $3,742 and consider buying on the rebound.

- Prerequisite: The 50-day moving average must be above the current price, and the Awesome Oscillator should be in negative territory.

- Scenario 2: Sell ETH from the upper boundary at $3,883 if there is no reaction to a breakout, with targets at $3,826 and $3,742.

Смотрите также