Cryptocurrency Market Trading Recommendations for October 24

Crypto-currencies

2025-10-24 06:55:15

Bitcoin has once again attempted to consolidate above the $110,000 level and, at the time of writing, is trading at $111,400. If it breaks above this range, we will likely see a swift return to $116,000. However, throughout the week, bitcoin has been quickly sold off on every rally. We'll soon find out if that pattern continues this time.

Meanwhile, Bitwise published a report suggesting that if just 4–5% of the capital currently invested in gold were reallocated to BTC, the price could at least double from its current level of $110,000. Many optimists point to growing institutional interest in cryptocurrencies, especially bitcoin, as a new asset class. They argue that bitcoin, with its limited supply and decentralized nature, presents an attractive alternative to traditional investments, particularly amid rising inflation and political uncertainty. In their view, the shift of capital from gold to bitcoin is a matter of time.

Skeptics, on the other hand, warn against excessive optimism, pointing to bitcoin's high volatility and regulatory risks. They argue that gold, as a time-tested safe-haven asset, will retain investor appeal—especially in periods of economic instability, which we are currently witnessing. Additionally, shifting such large volumes of capital from gold into bitcoin would be challenging given the scale of the gold market and the conservative nature of many investors.

As for the intraday strategy in the cryptocurrency market, I will continue to act on major pullbacks in bitcoin and ether, expecting the medium-term bull market to continue.

Regarding short-term trading, the strategy and conditions are outlined below.

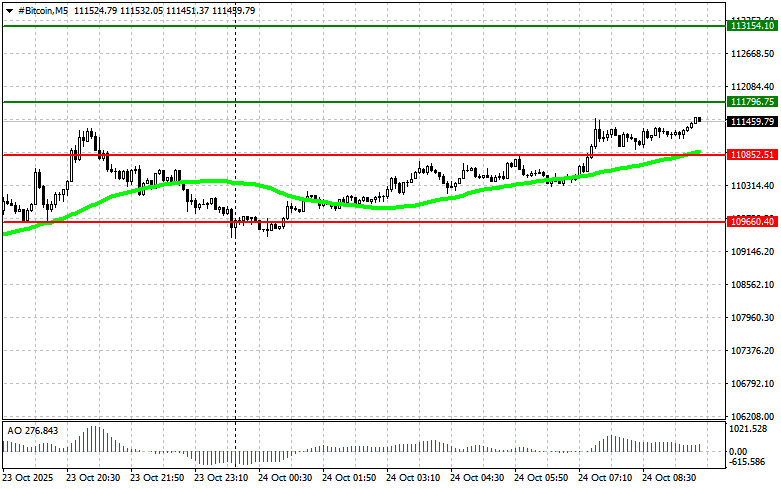

Bitcoin

Buy Scenario

Scenario 1: Buy bitcoin today at the entry point around $111,800, with a target of $113,100. Exit long positions at $113,100 and sell immediately on the rebound.

Before buying a breakout, ensure that the 50-day moving average is below the current price and the Awesome Oscillator is in the positive zone.

Scenario 2: Buy bitcoin from the lower boundary at $110,800 if there is no market reaction to a breakdown, with expected movement back to $111,800 and $113,100.

Sell Scenario

Scenario 1: Sell bitcoin today upon reaching the entry point around $110,800 with a target of $109,600. Exit short positions at $109,600 and buy immediately on the rebound.

Before selling a breakout, ensure that the 50-day moving average is above the current price and the Awesome Oscillator is in the negative zone.

Scenario 2: Sell bitcoin from the upper boundary at $111,800 if there is no market reaction to a breakout, with expected movement back to $110,800 and $109,600.

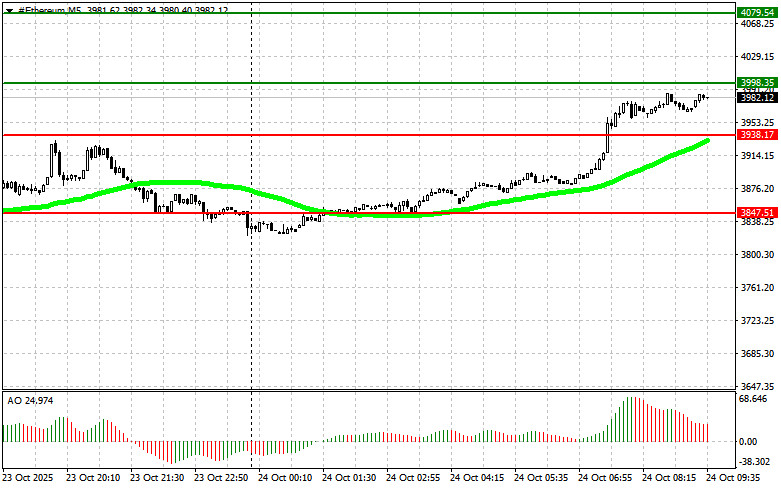

Ethereum

Buy Scenario

Scenario 1: Buy ether today at the entry point around $3998, with a target of $4079. Exit long positions at $4079 and sell immediately on the rebound.

Before buying a breakout, ensure that the 50-day moving average is below the current price and the Awesome Oscillator is in the positive zone.

Scenario 2: Buy ether from the lower boundary at $3938 if there is no market reaction to a breakdown, with expected movement back to $3998 and $4079.

Sell Scenario

Scenario 1: Sell ether today upon reaching the entry point around $3938 with a target of $3847. Exit short positions at $3847 and buy immediately on the rebound.

Before selling a breakout, ensure that the 50-day moving average is above the current price and the Awesome Oscillator is in the negative zone.

Scenario 2: Sell ether from the upper boundary at $3998 if there is no market reaction to a breakout, with expected movement back to $3938 and $3847.

Смотрите также