Trading Recommendations for the Cryptocurrency Market on November 4

Crypto-currencies

2025-11-04 06:07:01

Bitcoin continues to lose ground and, at the time of writing, is trading around $104,000, with a high likelihood of testing support at the psychological $100,000 level.

The fact that the month started with an active sell-off comes as no surprise. The question remains: when will the first major buyers step in? According to CoinShares, last week saw a net outflow of $360 million from cryptocurrency investment products managed by firms such as BlackRock, Bitwise, Fidelity, Grayscale, ProShares, and 21Shares, a significant drop from the $921 million net inflow recorded the previous week.

Despite the recent US interest rate cut, traders have been spooked by comments from Federal Reserve Chair Jerome Powell about uncertainty around further rate decreases in December. This has had an impact on the cryptocurrency market. Due to the Fed's cautious approach, investors have shown heightened risk aversion, which typically leads to capital outflows from more volatile assets such as cryptocurrencies. Bitcoin, as the flagship of the crypto market, has not escaped this trend. Altcoins, in turn, have proven even more vulnerable, with corrections exceeding Bitcoin's decline.

However, it is essential to maintain composure. Current volatility is a normal phenomenon for the crypto market, especially during periods of macroeconomic uncertainty. The long-term outlook for digital assets remains positive, given the increasing institutional acceptance and development of infrastructure.

Regarding intraday strategy in the cryptocurrency market, I will continue to focus on major pullbacks in Bitcoin and Ethereum, anticipating the ongoing development of a bullish market in the medium term.

As for short-term trading, the strategy and conditions are described below.

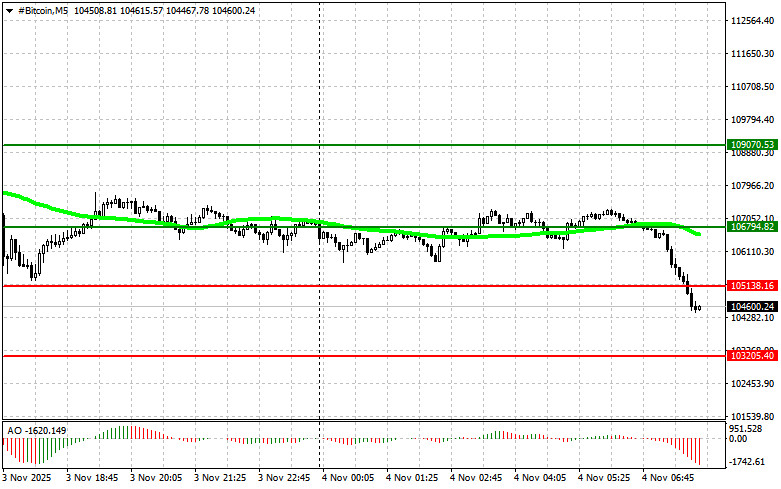

Bitcoin

Buy Scenario

- Scenario No. 1: I plan to buy Bitcoin today upon reaching the entry point around $106,700, targeting a move to $109,000. Near $109,000, I will exit my buy positions and sell immediately on the bounce. Before buying on a breakout, ensure the 50-day moving average is below the current price and the Awesome indicator is above zero.

- Scenario No. 2: I can also buy Bitcoin from the lower boundary at $105,100 if there is no market reaction to its breakout towards levels $106,700 and $109,000.

Sell Scenario

- Scenario No. 1: I plan to sell Bitcoin today upon reaching the entry point around $105,100, with a target of a decline to $103,200. Near $103,200, I will exit my sales and buy immediately on the bounce. Before selling on a breakout, make sure the 50-day moving average is above the current price and the Awesome indicator is below zero.

- Scenario No. 2: I can also sell Bitcoin from the upper boundary at $106,700 if there is no market reaction to its breakout towards levels $105,100 and $103,200.

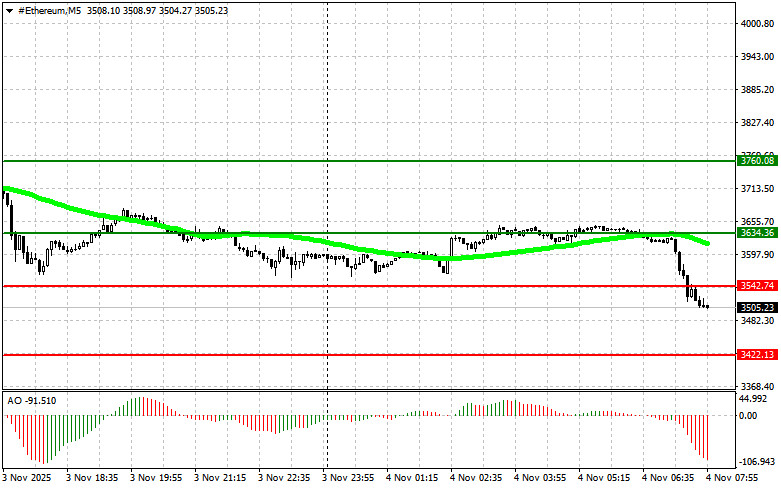

Ethereum

Buy Scenario

- Scenario No. 1: I plan to buy Ethereum today upon reaching the entry point around $3,634, targeting a move to $3,760. Near $3,760, I will exit my buy positions and sell immediately on the bounce. Before buying on a breakout, ensure the 50-day moving average is below the current price and the Awesome indicator is above zero.

- Scenario No. 2: I can also buy Ethereum from the lower boundary at $3,542 if there is no market reaction to its breakout towards levels $3,634 and $3,760.

Sell Scenario

- Scenario No. 1: I plan to sell Ethereum today upon reaching the entry point around $3,542, targeting a decline to $3,422. Near $3,422, I will exit my sales and buy immediately on the bounce. Before selling on a breakout, make sure the 50-day moving average is above the current price and the Awesome indicator is below zero.

- Scenario No. 2: I can also sell Ethereum from the upper boundary at $3,634 if there is no market reaction to its breakout towards levels $3,542 and $3,422.

Смотрите также