Crypto market overwhelmed by fear amid massive liquidations

Crypto-currencies

2025-11-06 13:58:45

Even though November started off with turbulence and negativity, most experts in the cryptocurrency market lean toward cautious optimism. The current pullback is indeed dramatic, but it's seen as a temporary phase and part of the overall market dynamics.

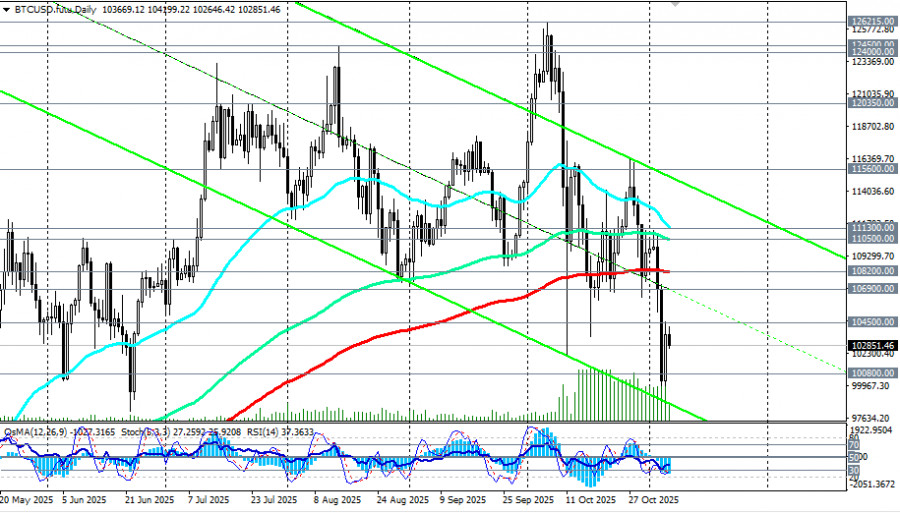

The beginning of November was marked by a substantial drop in prices of popular cryptocurrencies, leading to massive losses among investors. According to major platforms, the total number of liquidations reached billions of dollars in just a few days. Bitcoin fell below the $100,000 threshold for the first time in four months, while Ethereum dropped to approximately $3,000. This level of volatility is rare and signals serious problems within the market.

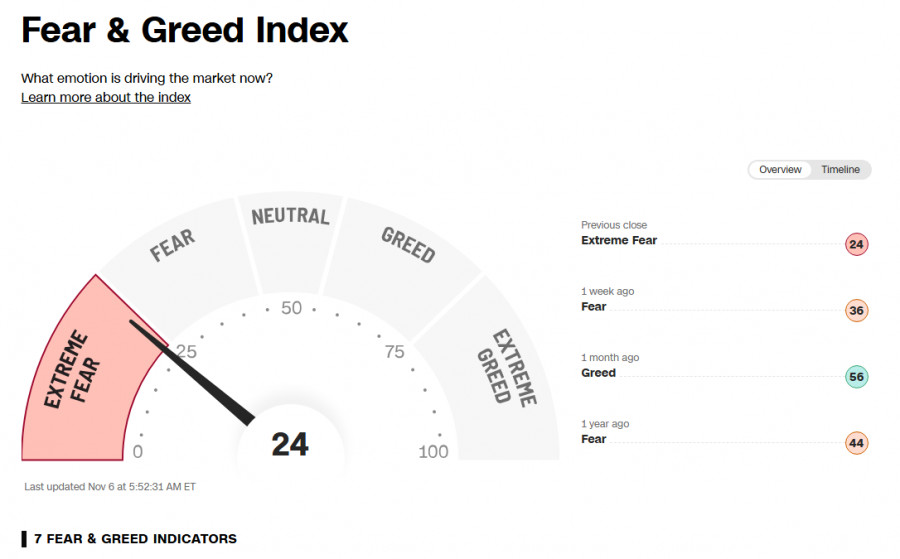

At the same time, the "fear and greed index" plummeted to a critical value of just 21 points (currently at 24) out of a possible 100. This reflects a high level of anxiety among market participants, many of whom are inclined to sell assets to minimize losses.

Almost all major coins in the top 100 showed negative performance. The reasons included investor fears regarding an unstable economy and concerns about the sustainability of several AI-related projects. Even positive statistics from the real estate market and other sectors failed to offset negative market sentiment.

However, cryptocurrency experts believe that the market is experiencing a temporary correction following significant growth. They are confident that under favorable conditions, Bitcoin could return to an upward trajectory, especially if institutional capital continues to invest actively in digital assets.

Causes of the current crisis

Experts attribute last month's price collapse primarily to US President Donald Trump's announcement of significant tariffs on Chinese goods, which triggered serious market fluctuations. However, some observers point to additional factors, including a technical issue on the major exchange Binance, which acted as a catalyst for the crash. Specifically, trading instruments became unstable precisely when investors sought to lock in losses, creating a liquidity shortage and escalating losses.

Investors in Bitcoin were particularly hard hit, as the cryptocurrency plummeted to its lowest level since early summer at $102,000 on October 10-11. The mass liquidation of positions during that time resulted in losses amounting to approximately $19 billion, causing a genuine shock among market participants.

The further drop in prices is attributed to the growing negative sentiment among investors. Despite strong quarterly reports, the stock prices of several tech companies saw sharp declines, triggering a chain reaction across financial markets. The market has proven to be extremely sensitive to any negative news. Even positive events have had little impact on prices. Many investors have abandoned the strategy of buying on lows, preferring to realize losses and reduce risks.

Additionally, the absence of the expected traditional seasonal support characteristic of autumn has exacerbated the situation. Typically, October brings significant growth; however, this time the expectations were not met, which intensified pressure on prices.

Possible scenarios

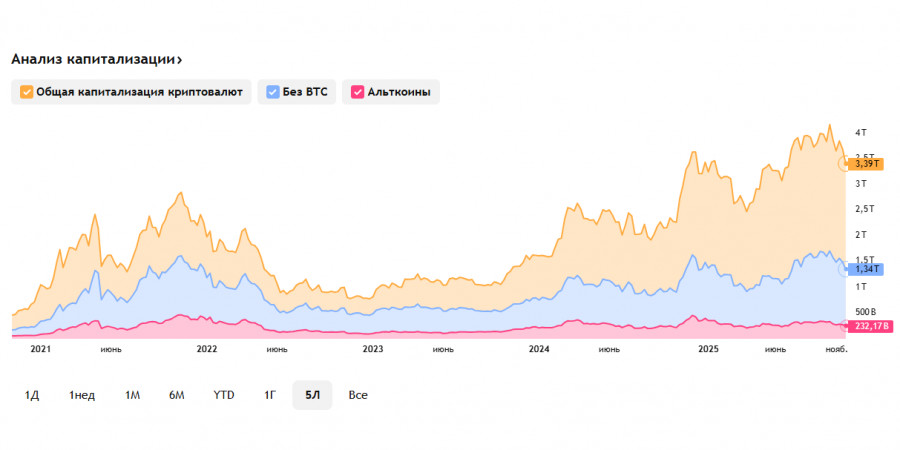

Despite the deep correction, cryptocurrency market experts believe that the current situation represents only a phase of temporary stabilization. Long-term investors see potential for continued growth, as the influx of investments from institutional players remains steady. Currently, the total market capitalization of the cryptocurrency market stands at $3.385 trillion.

Some specialists reference historical experiences from previous crises, noting that significant recoveries typically follow deep declines. For example, a similar pattern was observed in 2018 when Bitcoin lost a substantial portion of its value but later began to rise again.

In the coming days, market attention is focused on macroeconomic indicators, corporate earnings reports, and the overall state of the financial system. In particular, the dynamics of the Chinese technology sector, which is showing signs of regaining sovereignty, are of great interest.

Conclusion

All in all, even though November opened with turbulence and negative sentiment, most experts in the cryptocurrency market tend to maintain a cautious optimism. Although the current pullback is serious, it is likely a temporary condition that is part of the overall cycle of market dynamics. Investors are advised to remain calm and closely monitor the situation, considering the potential opportunities for recovery.

Смотрите также