Cryptocurrency market is on pause

Crypto-currencies

2025-11-28 07:30:15

After Bitcoin returned to the $92,000 level yesterday, the price failed to make an active breakout of this range. However, it is fair to note that there were also no significant selling activities from major players. This keeps the chances for further market growth alive, but likely only after the weekend. Ethereum also remains stagnant at the $3,000 mark, maintaining its potential for further correction.

While the cryptocurrency market is currently in a phase of rest, an interesting report from Syndica caught my attention. According to the data, the Solana blockchain currently dominates the market for tokenized stocks, holding over 95% market share for the past four months. In October of this year, its share even reached as high as 99%.

The explosive growth of Solana's popularity in the tokenized stock sector can be attributed to several factors. First, Solana is known for its high transaction speed and low fees, making it attractive to traders looking to quickly and efficiently trade assets. Second, the Solana ecosystem is actively developing, offering a wide range of DeFi applications and platforms that simplify the tokenization and trading of stocks.

Despite Solana's dominance, other blockchains like Ethereum and Polygon are also showing interest in the tokenized stock market. However, their shares remain insignificant compared to Solana. This disparity may be due to higher fees and slower transaction speeds on those blockchains.

Tokenized stocks are digital equivalents of traditional company shares traded on the blockchain. They allow investors access to stocks that were previously unavailable due to geographical or regulatory restrictions. Additionally, tokenization can simplify the trading process and reduce costs associated with traditional brokerage services.

Trading recommendations:

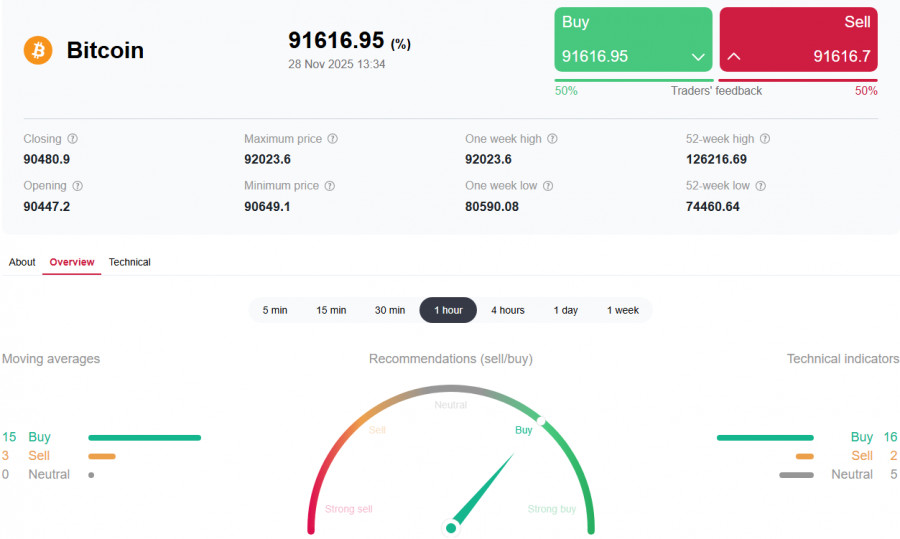

Regarding the technical picture for Bitcoin, buyers are currently targeting a return to the $92,000 level, which opens a direct path to $92,500, and from there, it is only a short distance to $99,400. The furthest objective is around $101,400; surpassing this level would indicate attempts to return to a bull market. In the event of a decline, buyers are expected at the $89,200 level. A return below this area could quickly push BTC down to around $86,500, with the most distant target at $83,900.

For Ethereum, clear consolidation above the $3,068 level opens the way to $3,193. The furthest target is around $3,317; breaking above this level would signify strengthening bullish sentiment in the market and renewed buyer interest. If Ethereum declines, buyers are expected at the $2,947 level. A drop below this area could swiftly bring ETH down to around $2,845, with the most distant support at $2,732.

What we see on the chart:

- Red lines indicate support and resistance levels where either a price slowdown or active growth is expected;

- Green lines indicate the 50-day moving average;

- Blue lines indicate the 100-day moving average;

- Light green lines indicate the 200-day moving average.

Typically, a crossover or price test of these moving averages either halts market momentum or sets a new directional impulse.

Смотрите также