Recommendations for Trading on the Cryptocurrency Market for December 31

Crypto-currencies

2025-12-31 10:48:44

The Bitcoin price returned to around $89,000, but then pulled back slightly. Given the end of the year, significant changes in the cryptocurrency market are unlikely in the coming days. Ether also remains below $3,000.

Among the positive factors at the beginning of the next year are whales accumulating BTC on the spot market and the fact that long-term holders stopped selling Bitcoin in December. The futures market is the only concern, as it has become the arena for speculative retail activity, the so-called crowd. Obviously, until the majority of speculators are liquidated, the market is unlikely to rise significantly.

The situation is exacerbated by high leverage on futures, which tempts inexperienced traders with the possibility of quick enrichment. This creates fertile ground for sharp fluctuations and so-called "liquidation cascades," in which mass position closures from margin calls trigger further price declines, sweeping everyone along. The history of the crypto market is full of examples. Large players will likely use this volatility to their advantage, knocking out weak hands and accumulating assets at more favorable prices.

In the current circumstances, the most reasonable strategy for long-term investors may be to wait patiently and gradually increase positions on the spot market during corrections. A focus on accumulating assets rather than speculative trading will help avoid significant losses and capitalize on future market growth.

As for the intraday strategy in the crypto market, I will continue to act on large Bitcoin and Ether drawdowns, assuming the long-term bull market continues.

As for short-term trading, the strategy and conditions are described below.

Bitcoin

Scenario for buying

Scenario No. 1: I will buy Bitcoin today upon reaching an entry point around $88,800 with a target to rise to $89,800. Around $89,800, I will exit purchases and sell immediately on the rebound. Before buying on a breakout, make sure that the 50-day moving average is below the current price and that the Awesome Oscillator is in the zone above zero.

Scenario No. 2: Bitcoin can be bought at the lower boundary of $88,100 if there is no market reaction to its downside breakout, targeting levels of $88,800 and $89,800.

Scenario for selling

Scenario No. 1: I will sell Bitcoin today upon reaching an entry point around $88,100, with a target price of $87,200. Around $87,200, I will exit sales and buy immediately on the rebound. Before selling on a breakout, make sure that the 50-day moving average is above the current price and that the Awesome Oscillator is in the zone below zero.

Scenario No. 2: Bitcoin can be sold from the upper boundary of $88,800 if there is no market reaction to its breakout to the upside, targeting levels of $88,100 and $87,200.

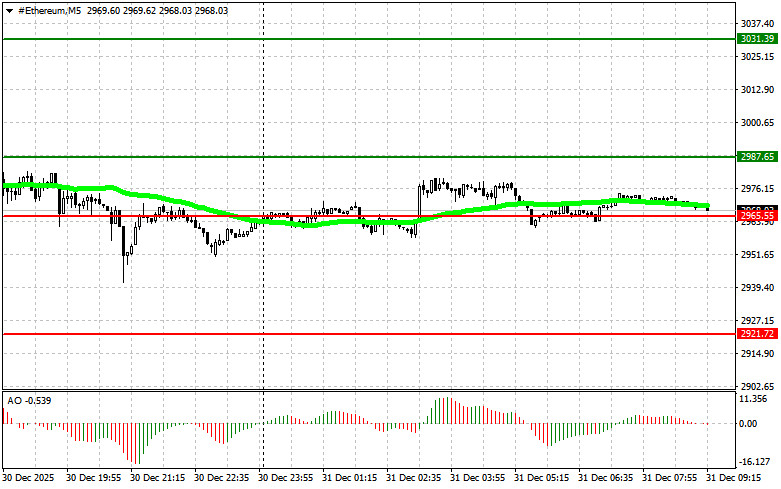

Ethereum

Scenario for buying

Scenario No. 1: I will buy Ether today upon reaching an entry point around $2,987 with a target to rise to $3,031. Around $3,031, I will exit purchases and sell immediately on the rebound. Before buying on a breakout, make sure that the 50-day moving average is below the current price and that the Awesome Oscillator is in the zone above zero.

Scenario No. 2: Ether can be bought at the lower boundary of $2,965 if there is no market reaction to its downside breakout, targeting levels of $2,987 and $3,031.

Scenario for selling

Scenario No. 1: I will sell Ether today upon reaching an entry point around $2,965 with a target fall to $2,921. Around $2,921 I will exit sales and buy immediately on the rebound. Before selling on a breakout, make sure that the 50-day moving average is above the current price and that the Awesome Oscillator is in the zone below zero.

Scenario No. 2: Ether can be sold from the upper boundary of $2,987 if there is no market reaction to its breakout to the upside, targeting levels of $2,965 and $2,921.

Смотрите также