analytics1_1

Overview of the EUR/USD Pair. February 6. How Will the Currency Game Between the U.S. and the EU End?

Overview of the EUR/USD Pair. February 6. How Will the Currency Game Between the U.S. and the EU End?

Fundamental analysis

2026-02-06 01:12:00

The EUR/USD currency pair traded quite calmly throughout Thursday, especially given the day's central bank meetings. However, let us remind you that the European Central bank and Bank of England meetings are not the most important events of this week. They were supposed to be, but the U.S. "shutdown" forced the Bureau of Statistics to postpone the publication of the unemployment and Nonfarm reports to next week. However, the meetings of the European and British central banks have not become more important as a result of this postponement.

Both central banks were expected to maintain the "status quo," and they did. Of course, certain points allow traders to forecast further developments, but, in our opinion, there is little sense in that. Let us explain why. A full-blown currency war is beginning between Europe and the U.S. No one is talking about it openly, but that's where things are heading. Consider this: in Europe, it is openly stated that an exchange rate above $1.20 for the euro is a blow to the economy. Export levels would decrease in this case, which could be very painful for an already weak industrial production sector. At the same time, in the U.S., Donald Trump welcomes any fall in the dollar and believes the national currency's exchange rate can be lowered even further. Trump is also concerned about export levels. It turns out that Washington and Brussels will strive to weaken their own currencies.

It is clear with Washington. Virtually every piece of news from the U.S. poses a potential threat to the dollar. Of course, we do not believe that Trump makes decisions that leave most traders in shock solely to make the dollar cheaper. But in practice, that is precisely what happens.

What is the European Union prepared to do to weaken the euro? Only lower the key rate. But to what levels? Let us remind you that the ECB is not an independent structure like the Fed. It is forced to listen to the politicians' opinions and act in the interests of the European Union. However, at the same time, the ECB is unlikely to "detach" the key rate from inflation and begin lowering it in a Trump-like manner (if he were the head of the central bank). Meanwhile, the Federal Reserve is an independent body that may lose its independence this year and does not aim to lower the dollar's exchange rate. Therefore, as long as the Fed maintains its apolitical stance, the ECB can somehow influence the euro's exchange rate. If the Fed loses control of the situation, Trump could lower rates to zero. So, the euro can maintain its current levels against the dollar only if the Fed does not lose its independence from the president.

However, Trump has a multitude of aces up his sleeve. Let us remind you that last year, the ECB actively lowered interest rates, yet the euro still rose rapidly. Monetary policy is fine and important, but Trump could carry out a couple more military operations, lay claim to some "unwanted" territory, exit NATO, impose new tariffs, and so on. And the dollar would again go down the drain regardless of what the Fed and ECB are doing. We continue to believe that the dollar remains in a blatant losing position.

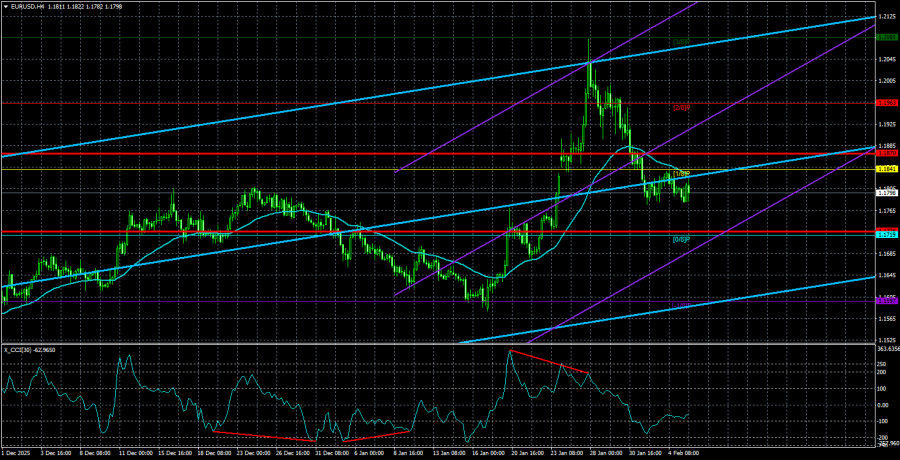

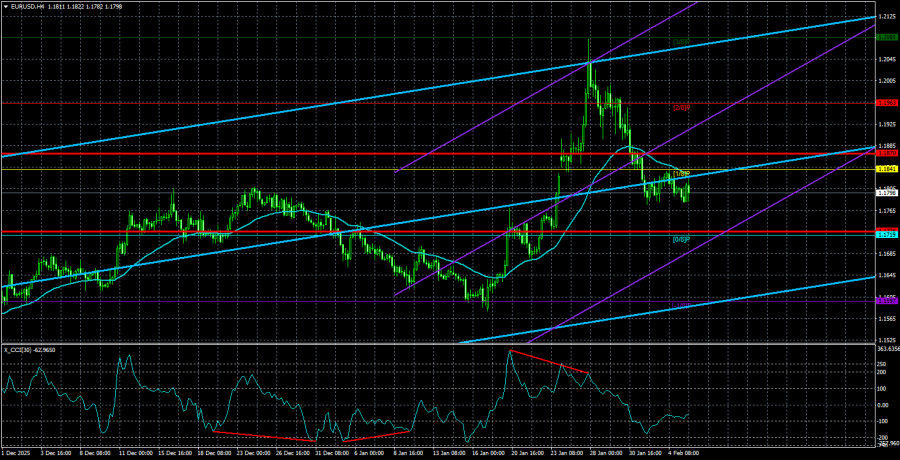

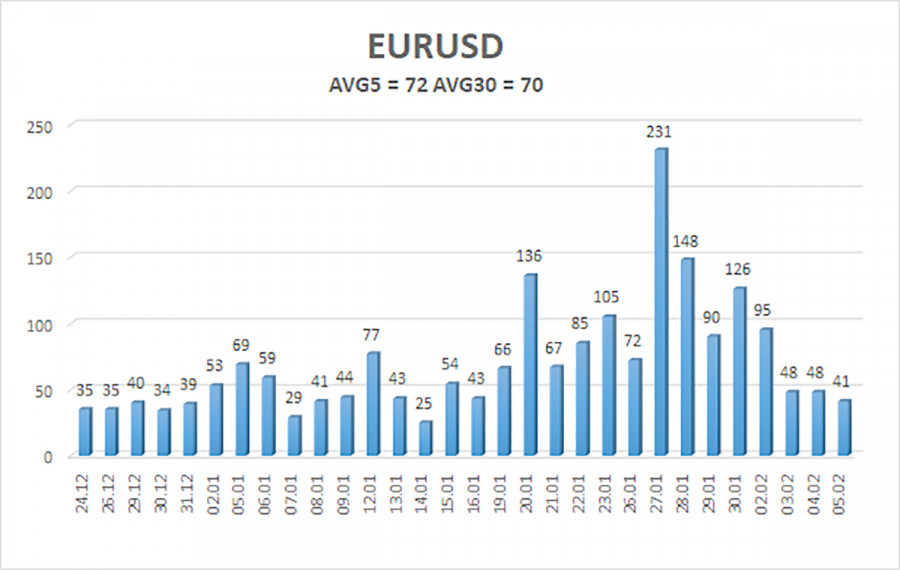

The average volatility of the EUR/USD currency pair over the last five trading days as of February 6 is 72 pips, which is classified as "average." We expect the pair to trade between 1.1726 and 1.1870 on Friday. The upper linear regression channel is pointing upwards, indicating further euro growth. The CCI indicator has entered overbought territory, forming two "bearish" divergences that signal an impending pullback.

The nearest support levels:

S1 – 1.1719

S2 – 1.1597

S3 – 1.1475

The nearest resistance levels:

R1 – 1.1841

R2 – 1.1963

R3 – 1.2085

Trading Recommendations:

The EUR/USD pair continues a fairly strong correction within an upward trend. The overall global fundamental backdrop remains extremely negative for the dollar. The pair spent seven months in a sideways channel, and now it is likely time to resume the global trend of 2025. The dollar has no fundamental basis for long-term growth. When the price is below the moving average, small shorts can be considered with a target of 1.1726 on purely technical grounds. Above the moving average line, long positions remain relevant with targets of 1.1963 and 1.2085.

Explanations for Illustrations:

- Linear regression channels help to determine the current trend. If both are directed the same way, it indicates a strong trend;

- The moving average line (settings 20,0, smoothed) defines the short-term trend and the direction that trading should currently take;

- Murray levels are target levels for movements and corrections;

- Volatility levels (red lines) are the probable price channel within which the pair will stay in the coming days based on current volatility indicators;

- The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) indicates that a trend reversal in the opposite direction is approaching.

Смотрите также