Trading Recommendations for the Cryptocurrency Market on February 6

Crypto-currencies

2026-02-06 06:49:43

Bitcoin has plummeted to around $60,000 and then rebounded to $65,000. Ethereum dropped to $1,700, down from above $3,000 just a month ago.

Yesterday will go down in cryptocurrency history as one of the most dramatic days. The sharp $10,000 drop in Bitcoin was an unprecedented event that forced traders and investors to reassess their strategies. This volatility not only pushed the first cryptocurrency down to 14th place in the global asset ranking by market capitalization but also triggered massive liquidations in the market.

Long position holders were particularly hard hit, with losses exceeding an incredible $2.15 billion over the last 24 hours. This indicates the panic that has seized the market and the rapid change in trend direction. Many market participants note that such a sharp decline could be attributed to a complex of factors, including a lack of good news, a correction in equity markets, risk-off sentiment, regulatory uncertainty, and large sell-offs by whales amid overall panic.

The consequences of such a crash will be felt for a long time. The cryptocurrency market has once again demonstrated its unpredictability and high risk, despite much discussion last year about its viability, strengthening, and potential growth into something more substantial. It was suggested that downturns like those seen before would never occur again. However, as the saying goes, "never say never." Now, traders, especially those trading on leverage, need to conduct a thorough analysis of the current situation to determine when the bear market will end and where the bottom will eventually be found. Restoring confidence in digital assets will require time and new positive signals.

As for intraday strategies in the cryptocurrency market, I will continue to act based on any significant pullbacks in Bitcoin and Ethereum while anticipating the continuation of a long-term bull market that has not disappeared.

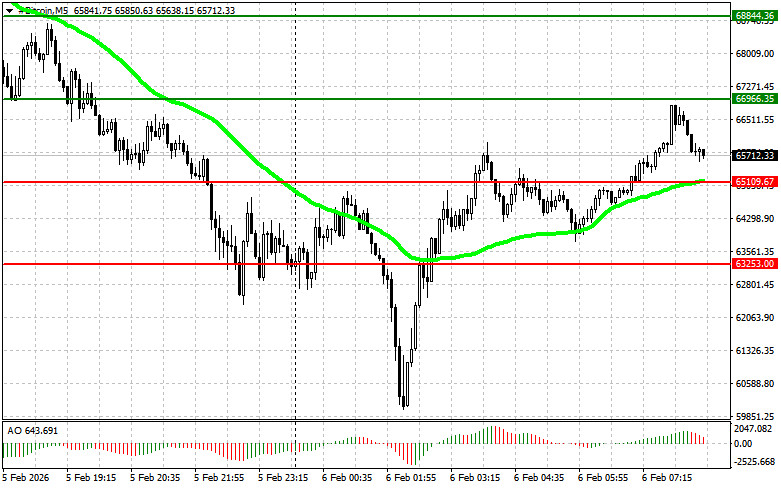

Bitcoin

Buy Scenarios

- Scenario #1: I will buy Bitcoin today at the entry point around $66,900, targeting a move to $68,800. At approximately $68,800, I will exit my positions and sell on the bounce. Before buying on a breakout, ensure the 50-day moving average is below the current price and the Awesome indicator is in the positive zone.

- Scenario #2: I can buy Bitcoin at the lower boundary at $65,100 if there is no market reaction to its breakout back up to $66,900 and $68,800.

Sell Scenarios

- Scenario #1: I will sell Bitcoin today when it reaches the entry point around $65,100, targeting a decline to $63,200. At approximately $63,200, I will exit my positions and buy immediately on the bounce. Before selling on a breakout, ensure the 50-day moving average is above the current price and the Awesome indicator is in the negative zone.

- Scenario #2: I can sell Bitcoin from the upper boundary at $66,900 if there is no market reaction to its breakout back down to levels of $65,100 and $63,200.

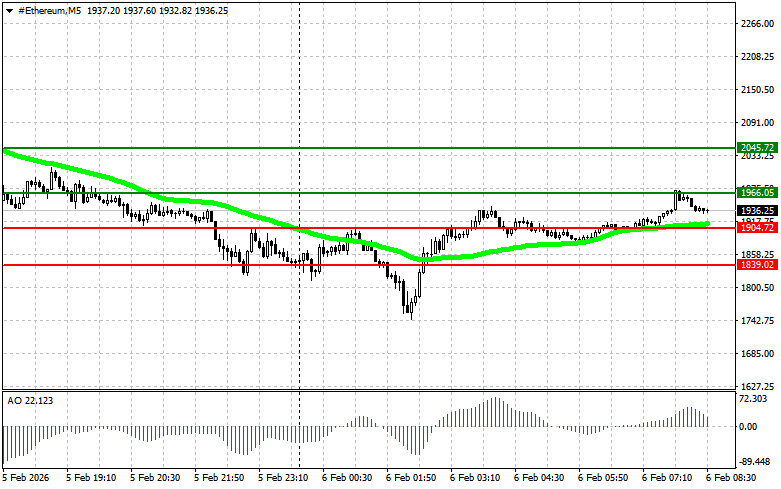

Ethereum

Buy Scenarios

- Scenario #1: I will buy Ethereum today at the entry point around $1,966, targeting a move to $2,045. At approximately $2,045, I will exit my positions and sell on the bounce. Before buying on a breakout, ensure the 50-day moving average is below the current price and the Awesome indicator is in the positive zone.

- Scenario #2: I can buy Ethereum at the lower boundary at $1,904 if there is no market reaction to its breakout back up to $1,966 and $2,045.

Sell Scenarios

- Scenario #1: I will sell Ethereum today at the entry point around $1,904, targeting a decline to $1,839. At approximately $1,839, I will exit my positions and buy immediately on the bounce. Before selling on a breakout, ensure the 50-day moving average is above the current price and the Awesome indicator is in the negative zone.

- Scenario #2: I can sell Ethereum from the upper boundary at $1,966 if there is no market reaction to its breakout back down to levels of $1,904 and $1,839.

Смотрите также