Trading Recommendations for the Cryptocurrency Market on February 12

Crypto-currencies

2026-02-12 07:08:54

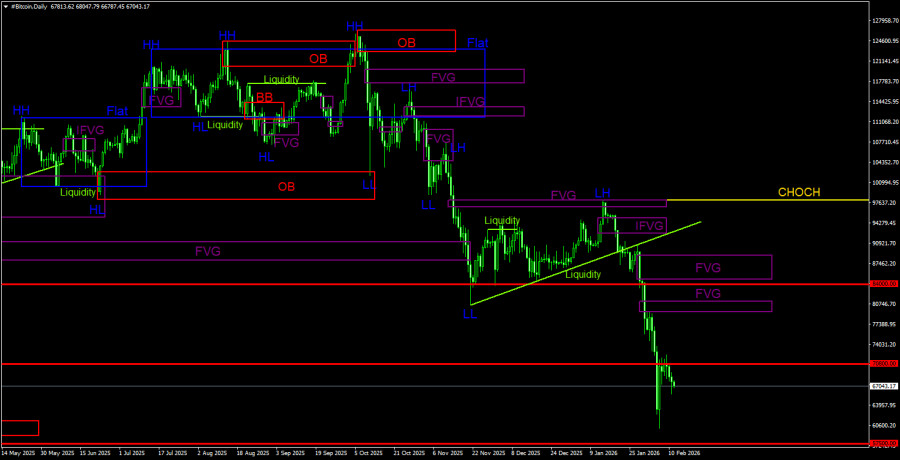

Yesterday, Bitcoin declined to around $65,700 but then recovered slightly and is now trading at $67,100. Ethereum, on the other hand, remains below $2,000, indicating sustained selling pressure.

Meanwhile, institutional recognition of Bitcoin continues. This recognition is now reinforced by actions from a reputable agency like S&P Global, which opens a new chapter in its development. The assignment of credit ratings to transactions secured by BTC indicates growing confidence among financial institutions in the stability and liquidity of this cryptocurrency. This is not just a formality; it represents a real inclusion of Bitcoin in the arsenal of tools available within the traditional financial system, potentially leading to increased use as collateral in various financial operations, from lending to financial derivatives.

The reported decrease in Bitcoin's volatility is a positive signal, bringing it closer to traditional financial assets. This trend makes cryptocurrency more attractive to institutional investors seeking to diversify their portfolios while maintaining an acceptable level of risk.

However, despite the decrease in volatility, the risk of sharp movements in the Bitcoin market remains, as evidenced by current market conditions. The excessive leverage actively used by market participants remains a potential source of instability. Any significant price movement could trigger a chain reaction of liquidations, reinforcing the initial trend and leading to significant price fluctuations. This situation requires all market participants, especially institutions, to implement diligent risk management and to understand the specifics of crypto assets.

Regarding the intraday strategy in the cryptocurrency market, I will continue to rely on significant pullbacks in Bitcoin and Ethereum, anticipating the continuation of a long-term bullish market.

As for short-term trading, the strategy and conditions are described below.

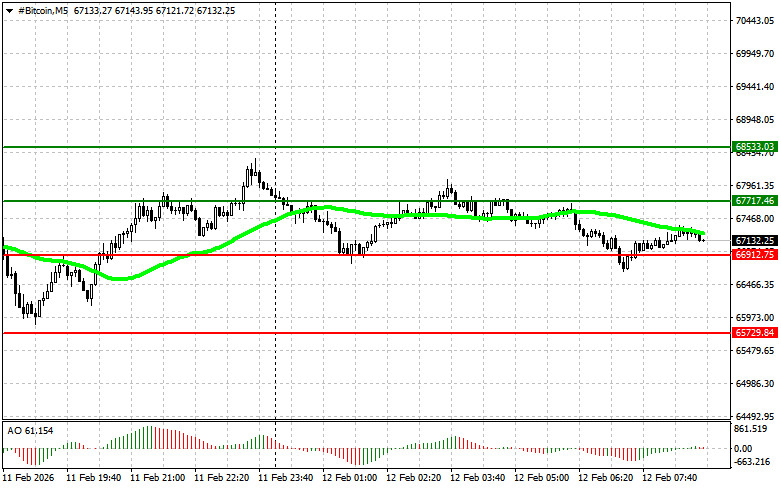

Bitcoin

Buy Scenario

- Scenario #1: I plan to buy Bitcoin today upon reaching the entry point around $67,700, targeting a move to $68,500. Near $68,500, I will exit my purchases and sell on the bounce. Before buying on a breakout, ensure the 50-day moving average is below the current price and the Awesome indicator is above zero.

- Scenario #2: Bitcoin can be bought from the lower boundary of $66,900 if there is no market reaction to its breakout in the opposite direction back to levels of $67,700 and $68,500.

Sell Scenario

- Scenario #1: I will sell Bitcoin today upon reaching the entry point around $66,900, targeting a decline to $65,900. Near $65,900, I will exit my sales and buy on the bounce. Before selling on a breakout, ensure the 50-day moving average is above the current price and the Awesome indicator is below zero.

- Scenario #2: Bitcoin can be sold from the upper boundary of $67,900 if there is no market reaction to its breakout in the opposite direction back to levels of $66,900 and $65,900.

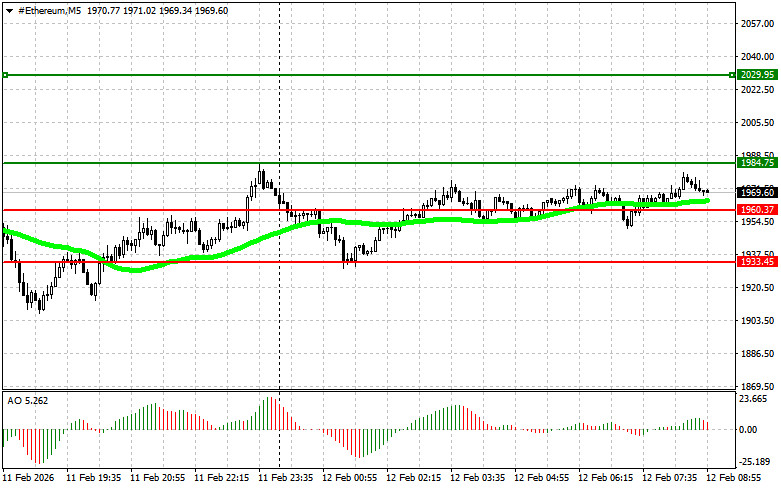

Ethereum

Buy Scenario

- Scenario #1: I plan to buy Ethereum today upon reaching the entry point around $1,984, targeting a move to $2,029. Near $2,029, I will exit my purchases and sell on the bounce. Before buying on a breakout, ensure the 50-day moving average is below the current price and the Awesome indicator is above zero.

- Scenario #2: Ethereum can be bought from the lower boundary of $1,960 if there is no market reaction to its breakout in the opposite direction back to levels of $1,984 and $2,029.

Sell Scenario

- Scenario #1: I will sell Ethereum today upon reaching the entry point around $1,960, targeting a decline to $1,933. Near $1,933, I will exit my sales and buy on the bounce. Before selling on a breakout, ensure the 50-day moving average is above the current price and the Awesome indicator is below zero.

- Scenario #2: Ethereum can be sold from the upper boundary of $1,984 if there is no market reaction to its breakout in the opposite direction back to levels of $1,960 and $1,933.

Смотрите также