Trading Recommendations for the Cryptocurrency Market on March 11

Crypto-currencies

2025-03-11 08:03:09

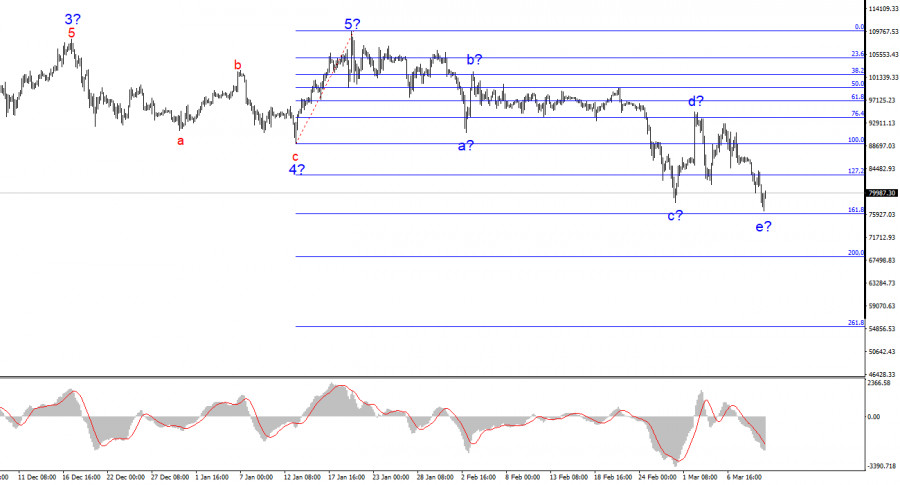

Bitcoin and Ethereum have both reached new annual lows, mirroring a decline in the U.S. stock market, which has now fallen for the fourth consecutive week. Yesterday, the crypto market experienced a significant sell-off, with major assets losing between 7% and 10%.

Bitcoin dropped to around $76,500 but is now trading at approximately $79,600. Similarly, Ethereum fell to about $1,750 during Asian trading but rebounded to roughly $1,850 due to buying activity.

Ongoing macroeconomic uncertainty in the U.S. and stricter trade policies are continuing to put pressure on risk assets, including cryptocurrencies. In this cautious environment, investors are increasingly opting to sell volatile instruments in favor of more stable assets. The recent decline in Bitcoin and Ethereum is also related to technical factors. After Bitcoin failed to reclaim the $90,000 level, it became evident that the recent correction was insufficient to sustain the bull market or reach new yearly highs.

Despite the negative trends, this correction may present long-term investors with an opportunity to purchase cryptocurrencies at more appealing prices. However, for this to occur, we need to see signs of macroeconomic stabilization and renewed confidence in the crypto market.

As for the intraday trading strategy, I will focus on significant dips in Bitcoin and Ethereum, anticipating continuing the bullish trend in the medium term.

For short-term trading, the strategy and conditions are outlined below.

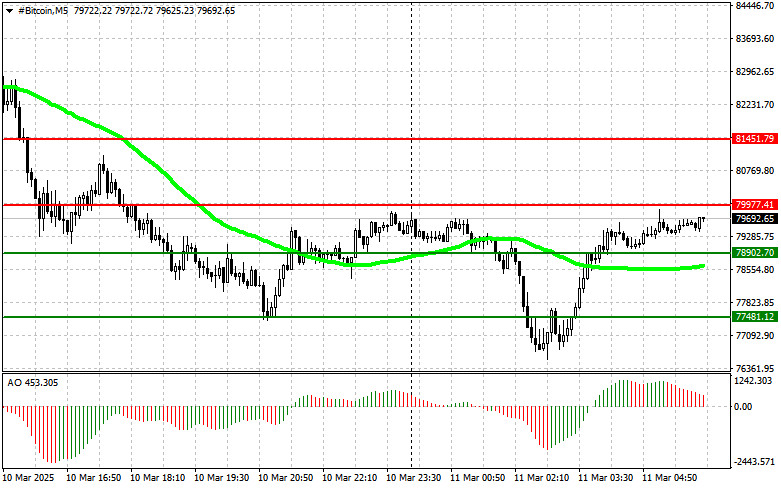

Bitcoin

Buy Scenario

Scenario #1: I will buy Bitcoin today at the entry point around $80,000, aiming for a rise to $81,400. Around $81,400, I will exit purchases and sell immediately on a pullback. Before buying on a breakout, I need to confirm that the 50-day moving average is below the current price and that the Awesome indicator is in the positive zone.

Scenario #2: Bitcoin can also be bought from the lower boundary of $78,900 if there is no market reaction to a breakout in the opposite direction, with targets at $80,000 and $81,400.

Sell Scenario

Scenario #1: I will sell Bitcoin today at the entry point around $78,900, aiming for a drop to $77,400. Around $77,400, I will exit sales and buy immediately on a pullback. Before selling on a breakout, I need to confirm that the 50-day moving average is above the current price and that the Awesome indicator is in the negative zone.

Scenario #2: Bitcoin can also be sold from the upper boundary of $80,000 if there is no market reaction to a breakout in the opposite direction, with targets at $78,800 and $77,400.

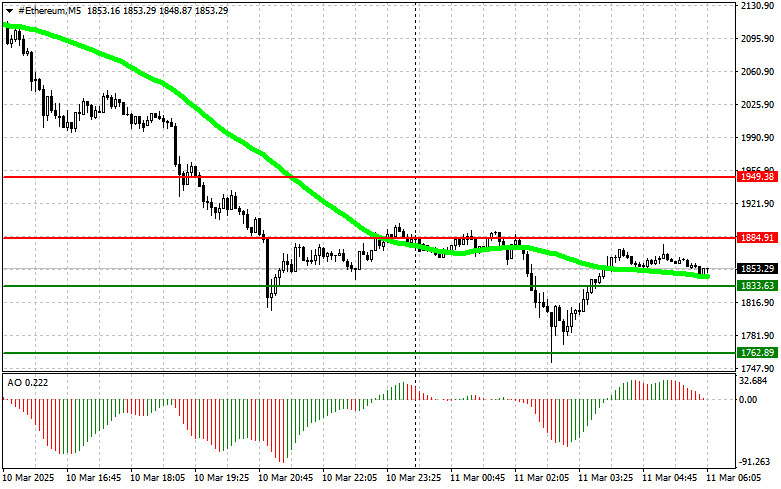

Ethereum

Buy Scenario

Scenario #1: I will buy Ethereum today at the entry point around $1,884, aiming for a rise to $1,949. Around $1,949, I will exit purchases and sell immediately on a pullback. Before buying on a breakout, I need to confirm that the 50-day moving average is below the current price and that the Awesome indicator is in the positive zone.

Scenario #2: Ethereum can also be bought from the lower boundary of $1,833 if there is no market reaction to a breakout in the opposite direction, with targets at $1,884 and $1,949.

Sell Scenario

Scenario #1: I will sell Ethereum today at the entry point around $1,833, aiming for a drop to $1,762. Around $1,762, I will exit sales and buy immediately on a pullback. Before selling on a breakout, I need to confirm that the 50-day moving average is above the current price and that the Awesome indicator is in the negative zone.

Scenario #2: Ethereum can also be sold from the upper boundary of $1,884 if there is no market reaction to a breakout in the opposite direction, with targets at $1,833 and $1,762.

Смотрите также