analytics1_1

EUR/USD: Simple Trading Tips for Beginner Traders on November 4. Analysis of Yesterday's Trades in Forex

EUR/USD: Simple Trading Tips for Beginner Traders on November 4. Analysis of Yesterday's Trades in Forex

Forecast

2025-11-04 06:50:49

Trade Analysis and Tips for Trading the Euro

The test of the price at 1.1528 coincided with the moment when the MACD indicator had risen significantly above the zero mark, limiting the upside potential of the pair. For this reason, I did not buy euros.

Yesterday's publication of disappointing data from the ISM manufacturing activity index in the US negatively impacted the dollar. The index remained below the 50 mark, indicating a decline in industrial activity and raising concerns about the state of the US economy. The market interpreted this as a potential signal for a softer approach from the Federal Reserve regarding interest rates. This had a noticeable effect on currency trading: dollar positions worsened against most major currencies. In particular, the EUR/USD pair demonstrated upward dynamics as investors turned their attention to the euro, considering it a more reliable option in the current situation.

Today, the first half of the day will see statements from European Central Bank President Christine Lagarde and Bundesbank President Joachim Nagel. Traders always closely monitor their own words. The market will focus on any indications regarding the ECB's further steps to combat inflation and support economic development in the current challenging environment. Special attention will be paid to analyzing the current economic situation, forecasts, and, of course, plans for upcoming measures to support the economy.

Regarding the intraday strategy, I will primarily rely on implementing Scenarios No. 1 and No. 2.

Buy Scenarios

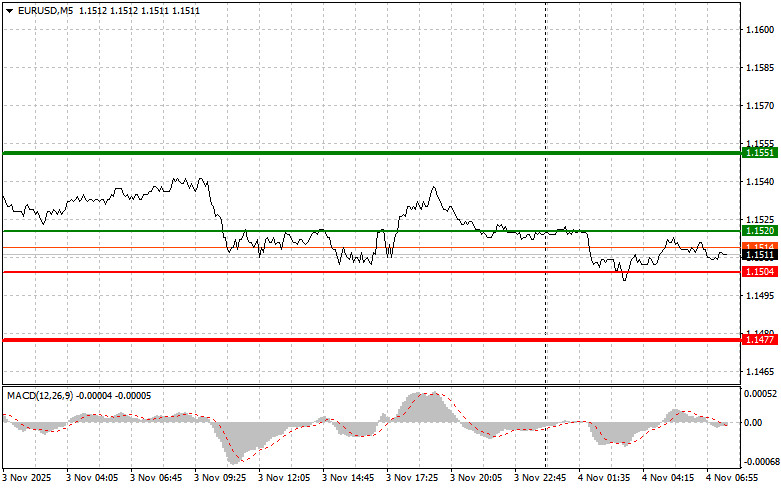

- Scenario No. 1: I plan to buy euros today when the price reaches around 1.1520 (green line on the chart), targeting a move to 1.1551. Near 1.1551, I plan to exit the market and sell euros in the opposite direction, anticipating a 30-35-pip move back from the entry point. Growth in the euro can only be anticipated within the context of a correction. Important! Before buying, ensure the MACD indicator is above the zero line and just starting an upward move.

- Scenario No. 2: I also plan to buy euros today if the price tests 1.1504 twice in a row, provided the MACD indicator is in the oversold area. This will limit the pair's downside potential and lead to an upward market reversal. Growth can be expected towards the opposite levels of 1.1520 and 1.1551.

Sell Scenarios

- Scenario No. 1: I plan to sell euros today once the 1.1504 level is reached (red line on the chart). The target will be at 1.1477, where I intend to exit my short positions and open immediate longs in the opposite direction (anticipating a 20-25-pip move back from this level). Pressure on the pair could return at any moment today. Important! Before selling, ensure the MACD indicator is below the zero line and just beginning its downward movement.

- Scenario No. 2: I also plan to sell euros today if the price tests 1.1520 twice in a row while the MACD indicator is in the overbought area. This will limit the pair's upside potential and lead to a market reversal. A decrease can be expected towards opposite levels of 1.1504 and 1.1477.

What the Chart Shows:

- Thin Green Line: Entry price at which to buy the trading instrument.

- Thick Green Line: Expected price level for setting Take Profit or manually securing profits, as further growth above this level is unlikely.

- Thin Red Line: Entry price at which to sell the trading instrument.

- Thick Red Line: Expected price level for setting Take Profit or manually securing profits, as further decline below this level is unlikely.

- MACD Indicator: When entering the market, it is important to be guided by overbought and oversold zones.

Important: Beginner traders in the Forex market must exercise great caution when making trading decisions. Before the release of significant fundamental reports, it is best to stay out of the market to avoid getting caught in sharp price fluctuations. If you choose to trade during news releases, always set stop orders to minimize losses. Without stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember, successful trading requires a clear trading plan, like the one presented above. Making spontaneous trading decisions based on the current market situation is inherently a losing strategy for intraday traders.

Смотрите также