Trading Recommendations for the Cryptocurrency Market on November 5

Crypto-currencies

2025-11-05 07:19:23

Just yesterday, I mentioned that Bitcoin was eyeing the $100,000 level, and during today's Asian trading session, the $99,000 level was breached, triggering panic in the market.

On Tuesday, the net outflow from Bitcoin and Ethereum exchange-traded funds (ETFs) in the United States amounted to $797 million, as institutional investors were spooked by the market crash. According to SoSoValue, the net outflow from spot Bitcoin ETFs reached $577.74 million, the largest daily outflow since August 1 of this year. From Fidelity's FBTC fund, $356.6 million left, $128 million flowed out from ARKB by Ark & 21Shares, and $48.9 million exited from Grayscale's GBTC. In total, seven BTC funds reported negative outflows on Tuesday. Thus, the outflow of funds from these funds has continued for five days, during which the total outflow from ETFs reached $1.9 billion.

This capital outflow marked the largest drop in recent months, highlighting the increased volatility and heightened sensitivity of institutional participants to sharp fluctuations in the cryptocurrency market. There were several reasons for the panic. First, the overall instability of the global financial system, exacerbated by statements from Federal Reserve representatives regarding a potential shift in monetary policy towards a more restrictive position, intensified the outflow from riskier assets. Second, aggressive selling in the market and a sharp lack of new buyers contributed to further panic.

As for Ethereum, the net outflow from spot Ethereum ETFs yesterday was $219.37 million, mainly from ETHA by BlackRock, which accounted for $111 million. Funds from Grayscale and Fidelity also reported outflows. Spot Solana ETFs recorded a net inflow of $14.83 million, the lowest since their launch last week.

Regarding intraday strategy in the cryptocurrency market, I will continue to act based on any significant dip in Bitcoin and Ethereum, anticipating the continuation of the bullish market in the medium term, which hasn't disappeared.

As for short-term trading, the strategy and conditions are described below.

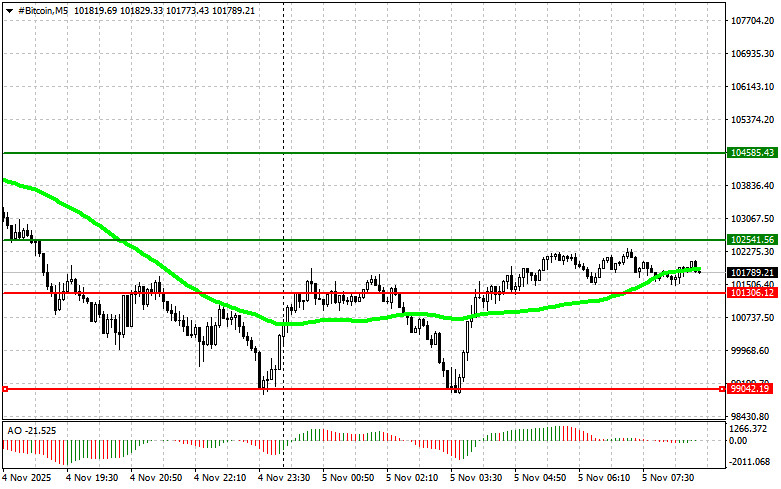

Bitcoin

Buy Scenario

- Scenario #1: I will buy Bitcoin today upon reaching an entry point around $102,500, aiming for an increase to $104,500. Around $104,500, I will exit my buys and sell immediately on the bounce. Before buying on the breakout, ensure that the 50-day moving average is below the current price and that the Awesome oscillator is above zero.

- Scenario #2: I can buy Bitcoin from the lower boundary of $101,300 if there is no market reaction to the breakout back towards levels of $102,500 and $104,500.

Sell Scenario

- Scenario #1: I will sell Bitcoin today upon reaching an entry point around $101,300, aiming for a drop to $99,000. Around $99,000, I will exit my sells and buy immediately on the bounce. Before selling on the breakout, ensure that the 50-day moving average is above the current price and that the Awesome oscillator is below zero.

- Scenario #2: I can sell Bitcoin from the upper boundary of $102,500 if there is no market reaction to the breakout back towards levels of $101,300 and $99,000.

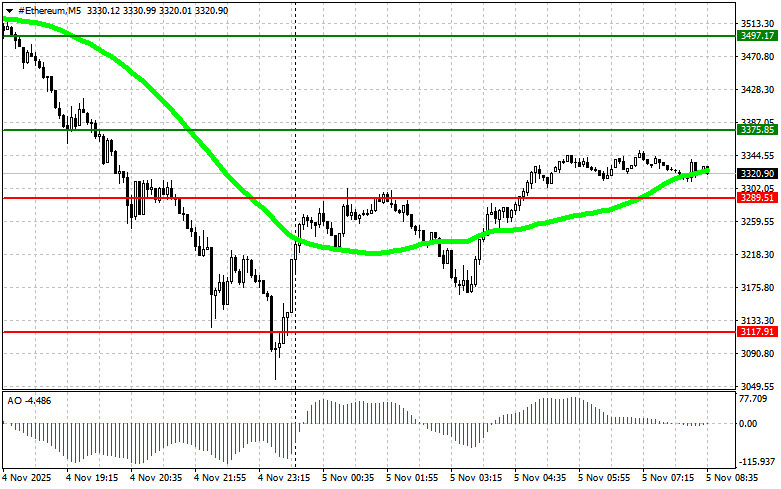

Ethereum

Buy Scenario

- Scenario #1: I will buy Ethereum today upon reaching an entry point around $3,375, aiming for an increase to $3,497. Around $3,497, I will exit my buys and sell immediately on the bounce. Before buying on the breakout, ensure that the 50-day moving average is below the current price and that the Awesome oscillator is above zero.

- Scenario #2: I can buy Ethereum from the lower boundary of $3,289 if there is no market reaction to the breakout back towards levels of $3,375 and $3,497.

Sell Scenario

- Scenario #1: I will sell Ethereum today upon reaching an entry point around $3,289, aiming for a drop to $3,117. Around $3,117, I will exit my sells and buy immediately on the bounce. Before selling on the breakout, ensure that the 50-day moving average is above the current price and that the Awesome oscillator is below zero.

- Scenario #2: I can sell Ethereum from the upper boundary of $3,375 if there is no market reaction to the breakout back towards levels of $3,289 and $3,117.

Смотрите также